How Currencycloud Ensures Marketing Compliance with Visualping

By Emily Fenton

Updated June 23, 2023

Summary: Currencycloud, a cloud-based B2B payment platform, needed a compliance monitoring tool to efficiently monitor their clients’ websites and make sure their product was being marketed according to strict regulatory requirements.

Currencycloud’s regulatory team uses Visualping to automatically track hundreds of client websites for prohibited language in communicating their product to end users. Visualping enables Currencycloud to stay on top of potentially noncompliant marketing language, saving time for the regulatory team and reducing the risk of noncompliance.

Visualping ultimately makes it easier for Currencycloud to help work towards a safer marketing environment.

Industry: Financial services

Currencycloud’s Story

Currencycloud is a cloud-based B2B payment platform that collects, pays, manages, and transfers various currencies, giving businesses the ability to efficiently move money across borders and transact on a global scale.

Currencycloud sells its platform to organizations that leverage Currencycloud’s API building blocks to construct their own custom payment solutions – whether they are embedding Currencycloud’s infrastructure into their own products or services, or building on top of it. Currencycloud also handles the regulatory requirements associated with cross-border payments, as well as on-boarding the end users – providing them with regulated services, and making it easier for organizations to do business globally.

Having processed more than $100bn USD across 180 countries since 2012, Currencycloud’s customers consist of banks, financial institutions and Fintechs across the globe. Acquired by Visa in 2021, the financial services company has offices in New York, Amsterdam, Cardiff, and Singapore.

Situation

In some of the jurisdictions where it operates, Currencycloud sells its cross-border payment infrastructure solutions to other businesses. These businesses can then, through Currencycloud, provide services, such as payments, to end users – which they wouldn’t have been able to do with their own regulatory license.

As such, the language Currencycloud’s clients use in their marketing messages must reflect this. They’re also subject to various other strict regulatory requirements. In the event a clients’ marketing messages are noncompliant, Currencycloud is held responsible – even if its own marketing language is compliant.

“There are very tight rules in the financial services industry. In the UK, you generally shouldn’t describe something as “the best” or “the cheapest” because, if someone else offers a cheaper product, that’s then a misleading statement. That’s not allowed.”

Other language concerns revolve around the fact Currencycloud is not a bank. If the marketing language isn’t careful, Electronic Money Institutions, like Currencycloud, may be mistaken as providing the same services as that of a bank – they can, after all, hold balances for you, as well as perform payments services.

To prevent misleading consumers, regulators make it very clear Electronic Money Institutions cannot present themselves as banks. It is Currencycloud’s responsibility to ensure that not only their own marketing, but also that of their third-party clients, is not falling foul of this.

If one of Currencycloud’s clients do misrepresent the nature of the product, this would be considered a serious breach of trust (and of our regulators’ requirements). Currencycloud would be held liable.

{{<blockquote "“If you’re a financial services company, how you market your products, and, by extension, how the entities you work with market the products – it’s high stakes if you get it wrong.”">}}

Staying compliant is very important for Currencycloud. If found non-compliant, the financial services company could face all kinds of potential consequences – including reputational damage, imposed restrictions on its operations, hefty fines, and having its license taken away.

Manually Scanning for Prohibited Language on Third-Party Websites

Currencycloud needs to continuously monitor how its clients market its cross-border payment infrastructure on their websites. To do so, Currencycloud trained employees internally to recognize the language clients are permitted to use, and the language that is prohibited – such as saying they have “the best” product, or claiming their service is a “bank.”

Next, employees would take Currencycloud’s client list – they have over 200 clients – and comb through each web page on each website, scanning through all their content to ensure there are no issues with howCurrencycloud’s product is being communicated.

{{<blockquote "“We would perform manual reviews, across hundreds of web pages, across hundreds of websites, across hundreds of individual URLs.”">}}

Issues

Time-Consuming and Susceptible to Human Error

Manually rechecking websites and scanning the content for certain words and phrases takes time. Besides being an inefficient use of internal resources, this process also meant Currencycloud was vulnerable to slow responses and human error, increasing the risk of non-compliance.

The approach required employees, for example, to remember to go back and check, not accidentally overlook something on the website, and to chase non-compliant clients.

Manually checking also meant the data would end up disorganized, depending on how employees manually recorded their findings in a spreadsheet. Currencycloud had no automated reporting solution for the results of the testing, either.

“It was incredibly time-consuming to check whether the changes had been made or not. The frequency we could do the reviews also left us open to risks. We recognized a need to improve and automate that process – enter Visualping.”

{{<blockquote "“It was incredibly time-consuming to check whether the changes had been made. The frequency we could do the reviews also left us open to risks. We recognized a need to improve and automate that process – enter Visualping.”">}}

The Solution: Visualping

Currencycloud now leverages Visualping as a compliance monitoring tool.

{{<blockquote "“Visualping, very clearly and early on, was a clear positive choice for us.”">}}

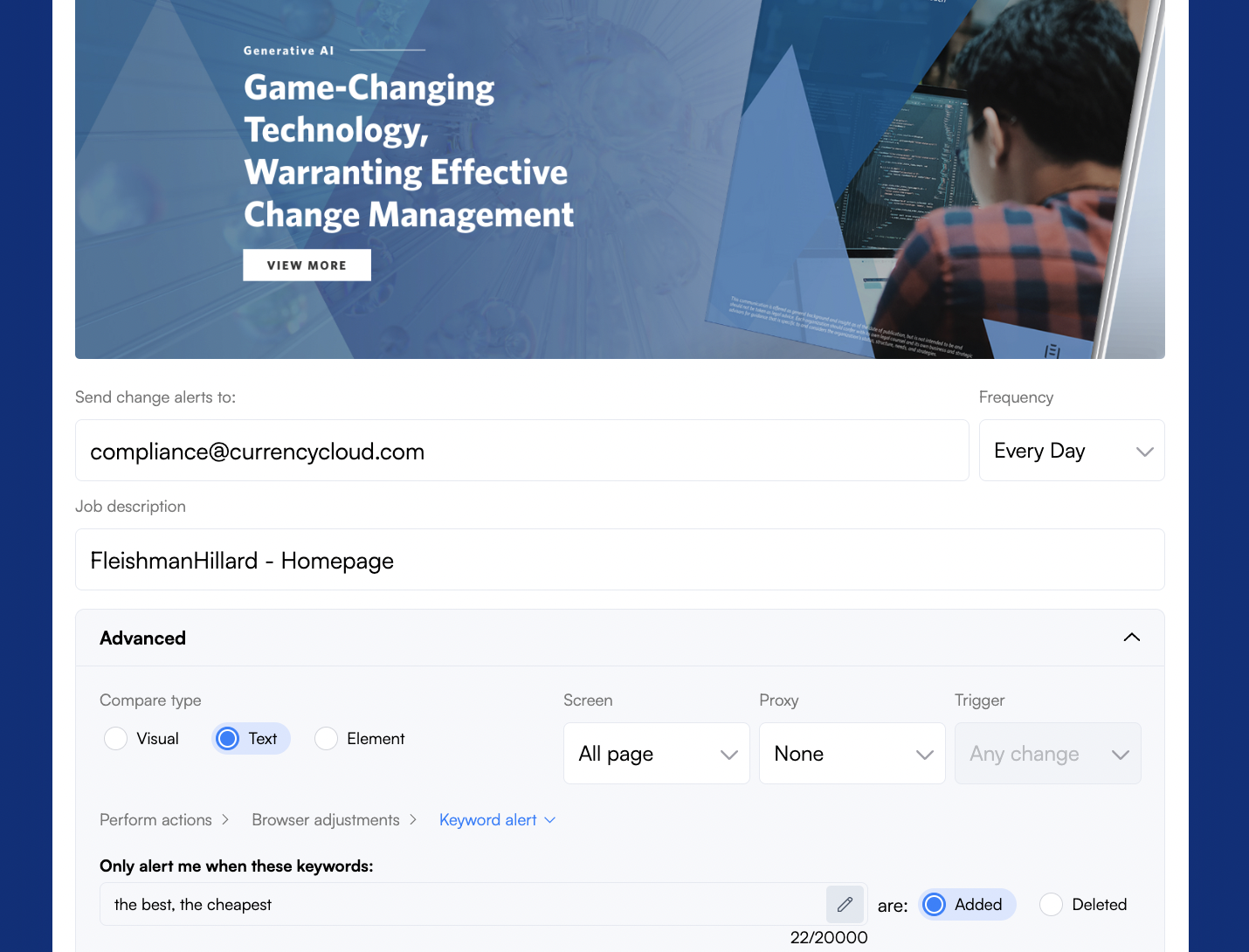

<center>Example of Visualping being set up for Currencycloud’s use case, not an actual Currencycloud client</center>

<center>Example of Visualping being set up for Currencycloud’s use case, not an actual Currencycloud client</center>

Before choosing Visualping, Currencycloud experimented with a few other tools but, due to their lack of customizable features, they weren’t fit for purpose.

{{<blockquote "“There wasn’t the same level of customizability with the other options. Especially with the keyword feature – this stood out as a huge benefit when I was doing the business case.”">}}

With Visualping, on a monthly basis, Currencycloud is able to automatically scan each third-party website to check for prohibited words and phrases. When Visualping detects a change on a website that matches the prohibited language, Currencycloud’s regulatory team gets automatically notified of the update, via email.

{{<blockquote "“We take the terminology and phrases we consider to be against what our regulators allow us to say, and we use Visualping to scan our client’s websites for those terms.”">}}

The email alert includes a screenshot of the client’s web page, with the changes highlighted, so it’s quick and easy for the regulatory team to understand the change.

{{<marketingcta "Start monitoring pages for regulatory compliance" "Visualping makes it easy to stay in top of your partners, clients and any third-party websites to ensure compliance.">}}

Feature Spotlight: Keyword Alerts and Reports in Action

With Visualping’s keyword alert feature, Currencycloud is able to monitor its clients’ websites for the emergence of prohibited words and phrases. When the language is detected, Visualping automatically notifies the team, sparing employees from having to perform this tedious monitoring task themselves, as well as reducing the chance of an issue getting accidentally overlooked.

<center>Example of Visualping being set up for Currencycloud’s use case, not an actual Currencycloud client</center>

<center>Example of Visualping being set up for Currencycloud’s use case, not an actual Currencycloud client</center>

On top of keyword alerts, Currencycloud also leverages Visualping’s new keyword reports feature – an exported report that shows the exact keywords triggered in the new alert.

The keyword reports help add more structure and organization to the regulatory team’s reporting process, as well as reducing the chance of human error. Currencycloud has to monitor many words and phrases that make up the prohibited language, and so the reports also help save time by laying out the impacted keywords in the change alert.

“The new keyword report feature is absolutely massive for us. I can input it into Tableau, and make some really cool graphs of what frequency certain keywords are getting. That’s really useful.”

Faster Reaction Times

With Visualping automatically performing the monthly checks for Currencycloud, and notifying the regulatory team of prohibited language, the regulatory team is able to respond to compliance concerns much faster than before. Training is provided to the clients on what is and isn’t allowed on the websites, and when permission should be sought, but occasionally something will slip through the net.

“If a client changes their website to something that we don’t allow, Visualping notifies us within the month. Whereas, before, that statement could be on the clients’ website, potentially misleading customers, and we wouldn’t have caught it until our next review.”

Efficiency Gains

The website review process has also become much more efficient.

“Essentially what Visualping has done is automate our process… with those efficiency savings, we can perform the checks much more holistically, and much more frequently.”

Mitigated Compliance Risk

As a result of the automated checks, the regulatory team is able to reduce a substantial amount of risk – thanks to improved response times. The chance of human error is also significantly reduced.

{{<blockquote "“Visualping removes a large element of human error from our website scanning. It's easy-to-use, very intuitive. It’s really helped us mitigate the risk that can arise from mis-marketing our product.”">}}

"Overall, we’ve been able to improve the frequency and consistency of checks - meaning we’re more likely to catch things that we need to, quicker.”

Want to be sure a web page is always compliant?

"Sign up with Visualping to detect issues from any web page – before your business is on the line.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats