What Is Regulatory Compliance in Banking? - Visualping

By Emily Fenton

Updated February 1, 2023

How to Stay Updated on New Laws and Regulations

Regulatory compliance is like a suit of armor that helps protect your financial institution from vulnerabilities that put you at risk of hefty fines or irrevocable damage.

One challenge of maintaining compliance is that it can be difficult to stay on top of the constant change in regulations. Tools like Visualping are designed to help those in the banking industry avoid this issue.

The Basics of Banking Compliance

Banking regulatory compliance describes the set of standards and practices banking institutions must adopt to remain in compliance with industry regulations and other relevant legislation.

Regulatory compliance in banking applies to a range of industry factors, including:

- Security and infosec

- Risk management

- Information processing

- Data reliability

- Ethical conduct

The purpose of regulatory compliance in banking is to prevent deviations or illegalities and address these and other issues within the company's operations.

Regulatory compliance in the banking sector is constantly evolving, which is a reflection of the financial industry itself. New technology has emerged within the last several years, and with it have come new processes.

The Role of Banking Compliance Departments

Since the banking industry is considered high risk for criminal activity, compliance measures are critical for protecting not only banking clients but banking organizations themselves.

That’s why most banks have an entire department dedicated solely to compliance — to ensure that each bank operates according to the law and industry regulations.

These departments are responsible for any potential security concerns, such as flagging and freezing accounts at risk of possible fraud. Such actions serve to help avoid or minimize both financial and administrative losses.

Compliance departments also work to prevent illicit activities like tax evasion, money laundering, and other actions that are out of compliance with the ethical and legal obligations of the bank.

Challenges of Banking Regulatory Compliance

As tightly run as these departments tend to be, banks still face many challenges when implementing and maintaining compliance with regulations, including the following.

Governance, Risk, and Compliance (GRC) Functions Are Generally Centralized and Often Narrow in Focus

GRC is a framework that offers organizations a sense of confidence by giving them the tools they need to properly operate their businesses while staying compliant.

GRC frameworks tend to be centralized. Since every department or unit within the business is focused on its own goals, there can be a lack of alignment between GRC processes and the organization's overall goals.

GRC Departments’ Interpretations of Compliance Risks May Be Siloed from the Bank’s Overall Risk Management Process

Another challenge with regulatory compliance in banking occurs when the compliance department and the bank’s own risk management process are at odds. Disconnection between these two areas can result in dysfunction and gaps in risk management.

Some departments struggle with GRC because their documentation process is archaic and not streamlined, requiring phone calls, emails, spreadsheets, and other outdated means of communication. When processes and systems are so spread out, it can be hard to keep up with everything.

One way banks can combat this is by defining systems strategies that allow them to bring together all relevant data, enabling the prioritization of critical tasks such as audit activities.

Lack of Preventive Defense Strategies

Too often, compliance departments react to crisis control with band-aid solutions that can be implemented quickly.

Moving away from reactive models and tactical fixes and instead developing a comprehensive framework strategy can improve compliance department efficiency and overall effectiveness in addressing regulatory issues or responding to expectations from management.

Haphazard or Poorly Coordinated Management and Implementation

Haphazard management is a symptom of a scattered system. The combination of all the above issues lays the groundwork for haphazard or poorly coordinated compliance management.

From reactive tactical fixes to siloed data information, if GRC isn’t implemented comprehensively with all units taken into account, the result can be disastrous.

Compliance Staff Often Serve in an Advisory Role but Are Not Involved in Actively Identifying Risks

As mentioned, compliance staff often have an advisory role that becomes reactive once a risk arises.

If compliance personnel can start taking active roles in identifying potential risks and threats according to current relevant laws and regulations, GRC may be more successful.

Banking Regulatory Compliance Is a Field in Which There’s an Ongoing Talent Scarcity, Making It Difficult to Find and Recruit Good Candidates

Those who make up risk and compliance departments are critical members of an organization, especially in the banking sector. Unfortunately, the field of regulatory compliance is plagued by an ongoing talent scarcity that makes it difficult to find desirable candidates in the first place.

What’s even more elusive is exceptional candidates. Prospective hires with the right attitude, skill set, and expertise can help protect banking institutions from non-compliance issues.

Banking Regulations Change all The Time

With all the potential for crossed wires in a bank's compliance operations, one thing that adds complexity is the pace of change of regulatory standards. Staying on top of the rules and procedures required in every region a bank does business is extremely difficult.

Using Visualping to Stay on Top of Regulatory Changes Affecting the Banking Industry

With all the uncertainties and issues surrounding banking regulatory compliance, what are you to do?

One simple solution is to start using software that monitors changes in compliance regulations so you never miss an update. Visualping is one such tool. It’s a powerful software that can monitor ongoing changes to legislation and regulations published online.

Visualping can also compare older versions of a webpage with its new versions to give you a side-by-side comparison of key language.

Here’s a brief guide to getting started with Visualping.

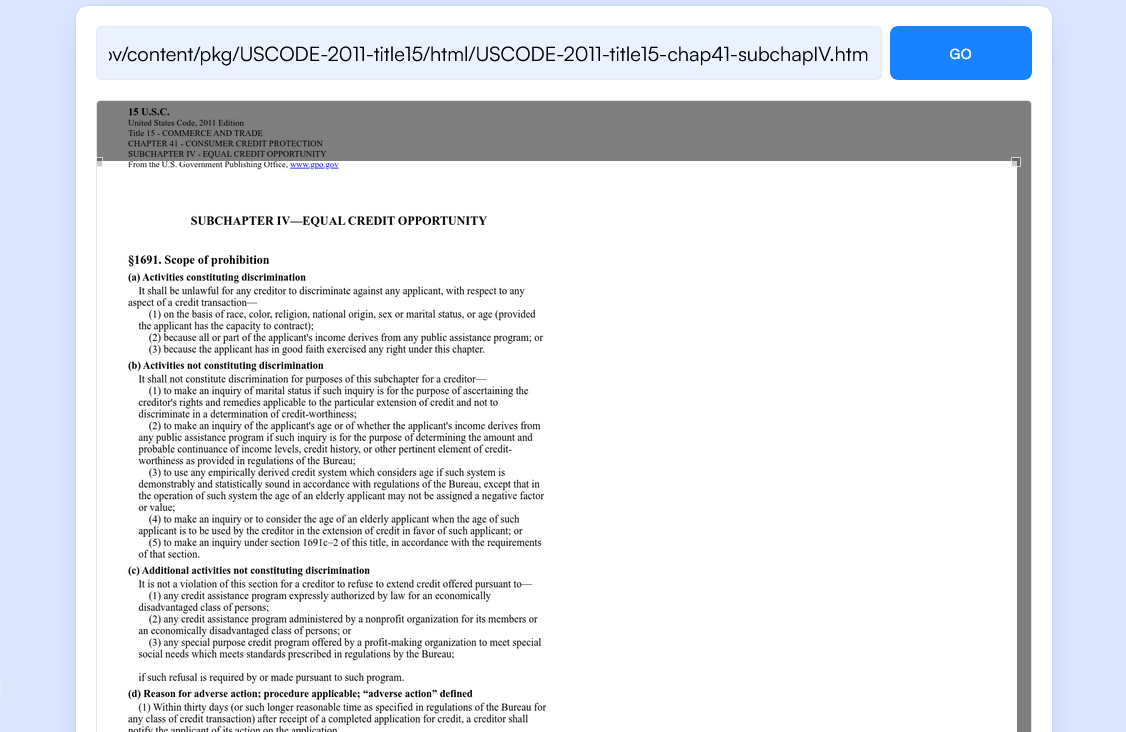

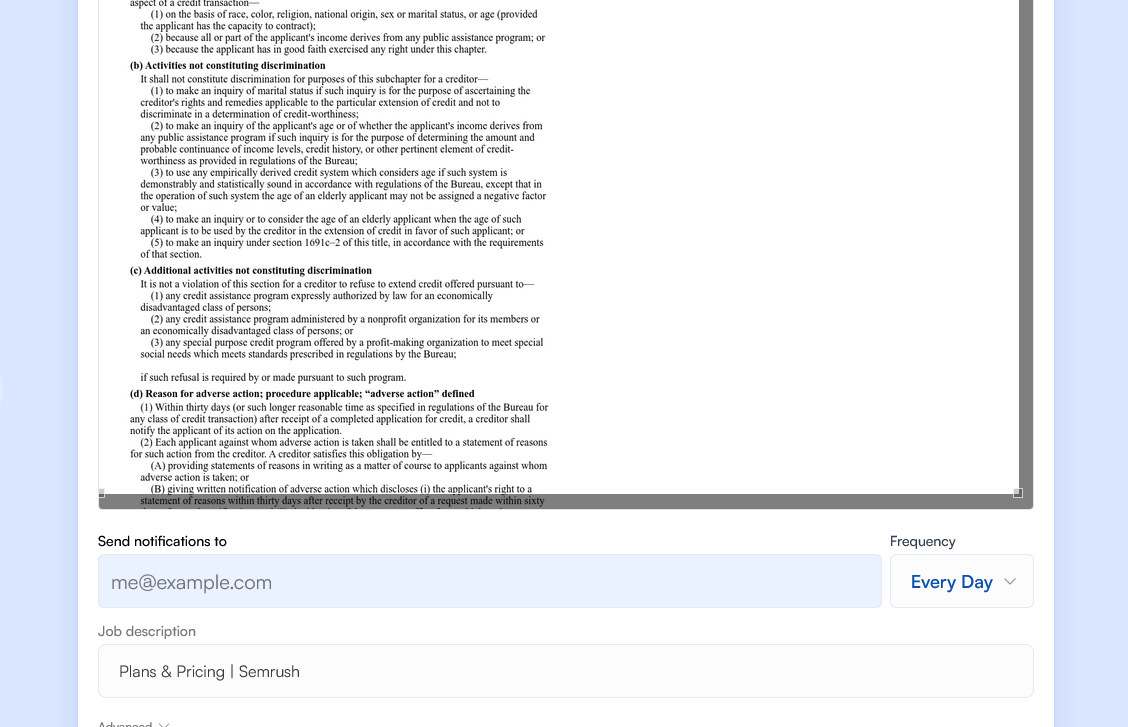

Step 1: Copy the URL Where the Legislation or Regulations Are Published Online, Then Paste Them into Visualping’s “Search” Field on the Homepage

Copy the URL from the webpage you frequently visit to check compliance regulations. Paste the URL into the search field on Visualping, which is located on its homepage.

Step 2: Select the Part of the Page that You Want to Monitor

You can set up alerts to monitor the entire webpage or choose a specific portion of the text you want to receive alerts about.

Step 3: Decide How Often You Want Visualping to Check the Page for New Changes

Select an interval for Visualping to scan the webpage and send you notifications. You have many options here, so choose the one that will give your team the most up-to-date information without being a distraction.

Step 4: Enter Your Email Address

Initiate the sign-up process by entering your email when prompted. Use an email you check regularly to avoid missing important notifications.

Step 5: Check Your Email to Complete the Signup Process

Confirm your email address to complete the sign-up process and activate Visualping. It’s that simple.

Use New Tech to Stay in Compliance

Banking institutions must adhere to regulatory compliance to protect their financial interests. But despite stringent regulations, non-compliance issues are rampant for many reasons.

Fortunately, there are tools tools to help compliance departments streamline their information systems and make compliance updates easier to follow.

With Visualping, it has never been easier to stay up to date with banking regulatory compliance. Sign up today to get started.

Want to monitor web changes that impact your business?

Sign up with Visualping to get alerted of important updates, from anywhere online.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats