AI in Insurance Underwriting: Top Use Cases

By Emily Fenton

Updated April 11, 2025

Introduction: AI Ramping Up in Insurance

The integration of artificial intelligence (AI) in insurance underwriting is revolutionizing how insurers assess risk and make decisions. As technology evolves, traditional underwriting practices are becoming outdated, with AI and machine learning taking center stage in commercial insurance loss control strategies.

According to Gartner’s CIO surveys the last few years, AI is consistently ranked as the top game-changing technology – including in the insurance industry. And, with insurance companies starting the see the value of AI, AI is set to ramp up: while less than half of claims executives (44%) report their organizations are advanced in use of automation and AI, 80% say it can bring more value. 65% say they plan to invest more.

AI in insurance underwriting uses machine learning to automate tasks, analyze data, and improve risk assessment, resulting in more efficient, and accurate, underwriting processes. This technology helps insurers reduce underwriting decision time, improve risk assessment accuracy, and ultimately, enhance profitability.

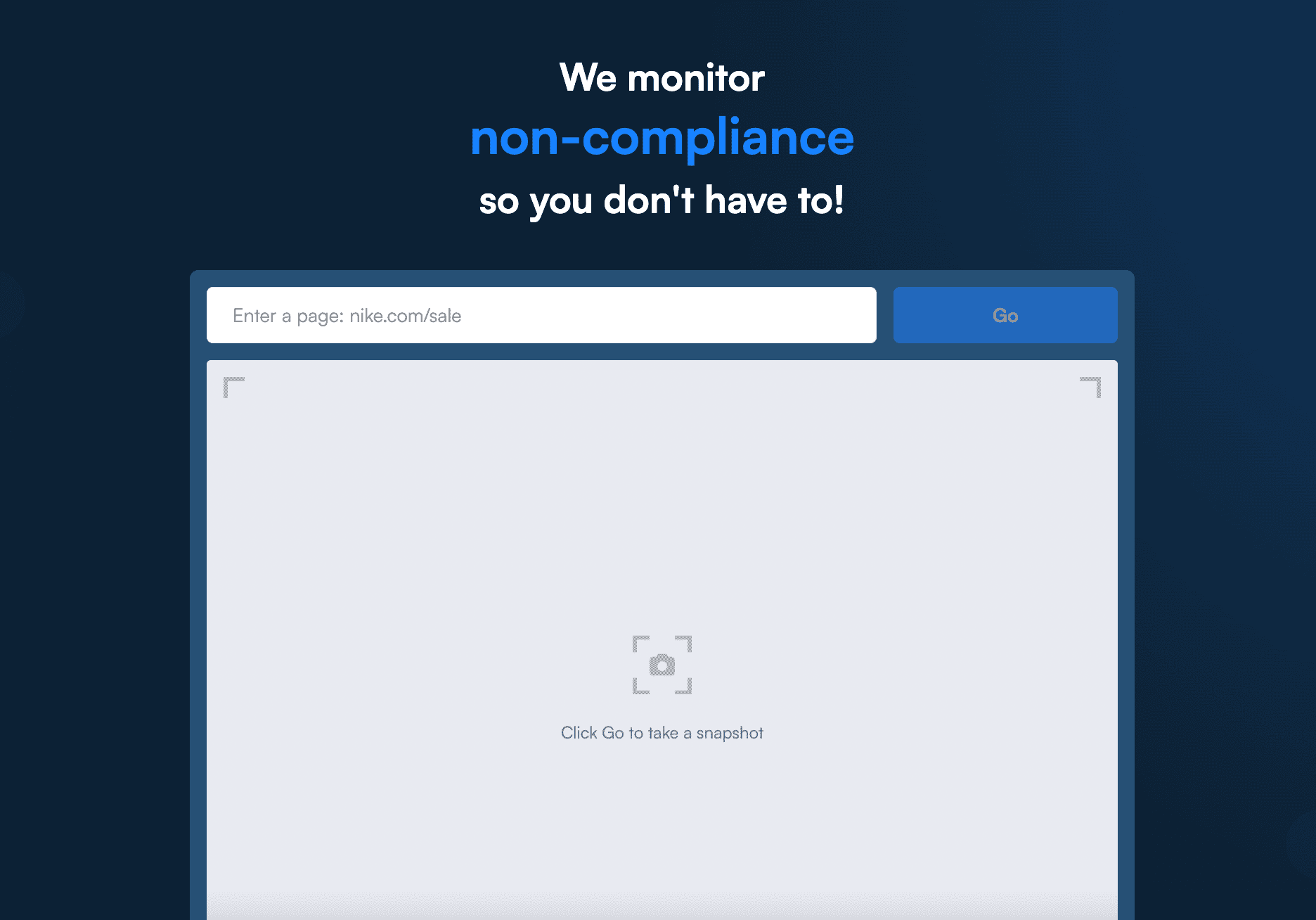

Visualping, for example, is an AI website monitoring tool that’s gaining traction in the sector. It automatically monitors policyholders’ digital footprint, capturing critical updates from their websites and social media that signal potential risk. It also detects shifts in business practices, helping insurers identify new business opportunities.

Whether you're a seasoned industry player or new to the game, understanding these advancements can be a game-changer.

Top Reasons to Integrate AI in Insurance Underwriting

Increased Automation and Efficiency

According to a recent underwriter employee survey, up to 40% of underwriters’ time is spent on non-core and administrative activities, representing an approximate industry loss of up to $160 billion in the next five years. Incorporating AI into underwriters’ workflows can reduce time spent on administrative tasks, manual processes, and redundant data inputs.

Additional recent studies show that firms adopting AI have reported up to a 30% decrease in fraud rates and improved quote accuracy. In fact, predictive analytics is making it possible to assess risks and make data-driven decisions in real time – a far cry from the days of guesswork and slow processing.

Identify Business Opportunities

But the benefits go beyond insurance risk control. Without integrating automation in underwriting tasks, opportunities are inherently being missed to sell clients additional insurance products compatible with their profile. Insurance companies aim for 5-15% upsell rate, across a large client base, these opportunities can be worth millions in revenue.

Rising Affordability of AI

AI is becoming increasingly more affordable, making it a more cost-effective solution to adopt at scale. For instance, the cost to train an image classifier, like ResNet-50, on a public cloud platform, dropped from approximately $1,000 to $10 between 2017 and 2019.

AI also enables insurers to reduce labour costs from paying employees to execute repetitive, mundane tasks that can otherwise be allocated to automation. AI investments can even be leveraged across insurance functions, compounding the cost benefits across the value chain (e.g., Claims, policy service, and contact centers).

AI Use Cases in Insurance Underwriting

Automated Risk Assessment

A significant component in insurance risk management is monitoring and assessing clients for potential risk and fraudulent activity. AI can automatically monitor and analyze policyholder data from various sources, including historical claims, ongoing client behavior, such as their online content, and external factors, to assess risk more accurately and efficiently.

Risk and Fraud Detection

AI can identify suspicious patterns and behaviors in applications and claims. It can also detect risk exposures and potentially fraudulent activity from monitoring clients’ websites and social media, helping reduce fraud – and overall claims.

Personalized Pricing

AI can help insurers create customized insurance policies based on individual risk profiles and preferences, leading to better customer satisfaction and retention.

Streamlined Application Processing

AI can automate tasks like data entry, application review, and document summarization, reducing manual effort and improving efficiency.

Improved Decision-Making

AI can provide underwriters with data-driven insights and recommendations, helping them make more informed decisions.

Elevate Your Insurance Underwriting with Visualping

Visualping assists with underwriting processes and insurance risk control by automating the client monitoring process. The tool scans clients’ web content and social media at regular intervals, at a set frequency you choose. When an update occurs that matches your custom criteria of risk, hazardous activity, and/or a policy violation, you and your team get notified immediately.

The notification, via email, includes a screenshot of the web page, with an AI-generated summary of the change. It also includes a screenshot of the page, with the changes highlighted.

By leveraging online monitoring tools, insurance companies can enhance their commercial insurance loss control services by better staying on top of their client base, and providing more accurate risk assessments. This proactive approach helps insurers manage their portfolios more effectively, and assists businesses in creating safer work environments and reducing their insurance premiums.

Tutorial: How to Get Setup with Visualping

Step 1: Input the Website URL into the Designated Field on Visualping’s Main Page

Begin by accessing a specific web page using your browser and copy the URL found in the address bar. After that, head over to the Visualping homepage, and paste the URL into the provided field to display the tracking interface, where you can choose the exact segment of the page to observe.

Step 2: Identify the Portion of the Page You Wish to Track

To enable alerts, select the specific portion of the page that captures your interest. For enhanced monitoring, you may leverage features that notify you when certain terms relevant to your interest appear on the page.

Step 3: Set the Frequency for Visualping to Inspect the Page

Next, indicate how frequently you want Visualping to monitor the page for any updates. You have the option to specify a checking interval ranging from as short as five minutes to as long as one month. This flexibility lets you receive updates at the most suitable times for you.

Step 4: Provide an Email Address to Receive Alerts Related to Changes

Visualping needs a valid email address to send you alerts, so ensure you enter an email account that you access frequently, ensuring you will not miss any important notifications.

Conclusion

The integration of AI technologies, especially tools like Visualping, is a game-changer for the insurance underwriting landscape. Insurers can enhance efficiency, better detect risk exposure and potentially fraudulent activity, while identifying business opportunities and maximizing profit. Now's the time to consider how Visualping can fit into your underwriting strategy.

As the industry pivots toward a more digital approach, the need to adopt these technologies isn't just smart—it's essential. For more information on how your team can integrate Visualping into your insurance underwriting processes, get in touch with our team today. The future of insurance is here—make sure you’re ready!

Monitor Your Policyholders Online

Identify, document, and act on the first sign of risk exposures, hazardous behavior and policy exclusions, by monitoring clients web content.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.