AI Sparkler Detection: How Insurers Spot Indoor Fire Risks Before Claims

By The Visualping Team

Updated January 2, 2026

How Insurers Are Using AI to Spot Sparkler Risks Before They Become Claims

Published January 2, 2026 Analysis by Editorial Staff

Note: Visualping offers AI monitoring tools for insurers to identify and action on online content published publicly by insured bars and restaraunts. The specific capabilities and accuracy rates of these systems vary by provider, and the technology is still maturing. Insurers considering these tools should evaluate them carefully.

Indoor sparklers look great on Instagram. Champagne bottles blazing with light, held aloft in crowded venues, capturing that perfect moment of celebration.

They're also a serious fire hazard, one that has now contributed to a catastrophic loss of life.

This week's tragedy in Crans-Montana, Switzerland, where sparklers on champagne bottles likely ignited an acoustic ceiling and killed 40 people, is a stark reminder of how quickly celebration can turn to catastrophe. Swiss prosecutor Beatrice Pilloud stated at a January 2 press conference that "everything leads us to believe that the fire was started from sparkling candles or sparklers that were put on bottles of champagne that were moved too close to the ceiling."

The Crans-Montana fire echoes another New Year's tragedy. In 2001, sparklers ignited dry Christmas decorations on the ceiling of a café in Volendam, Netherlands, killing 14 young people and injuring over 200. That incident led to sweeping fire safety reforms for Dutch hospitality venues.

The pattern is consistent: sparklers held near flammable ceiling materials in crowded indoor spaces can trigger fires that spread with terrifying speed.

Commercial insurers have taken notice. And increasingly, some are turning to AI-powered monitoring tools to identify sparkler use in their insured venues. The goal is not to punish operators, but to educate them before celebration turns to catastrophe.

The Challenge: What Happens Between Inspections

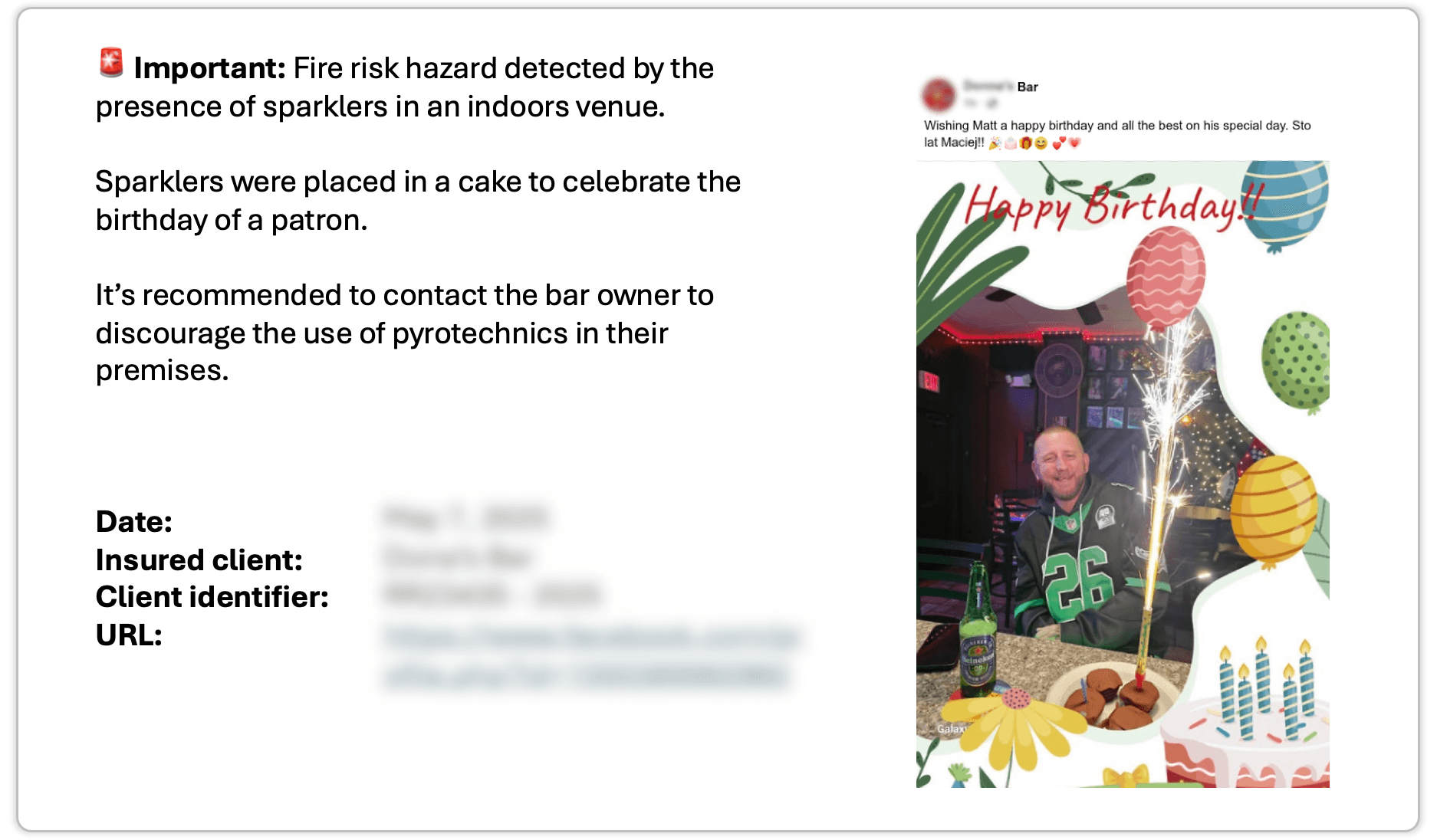

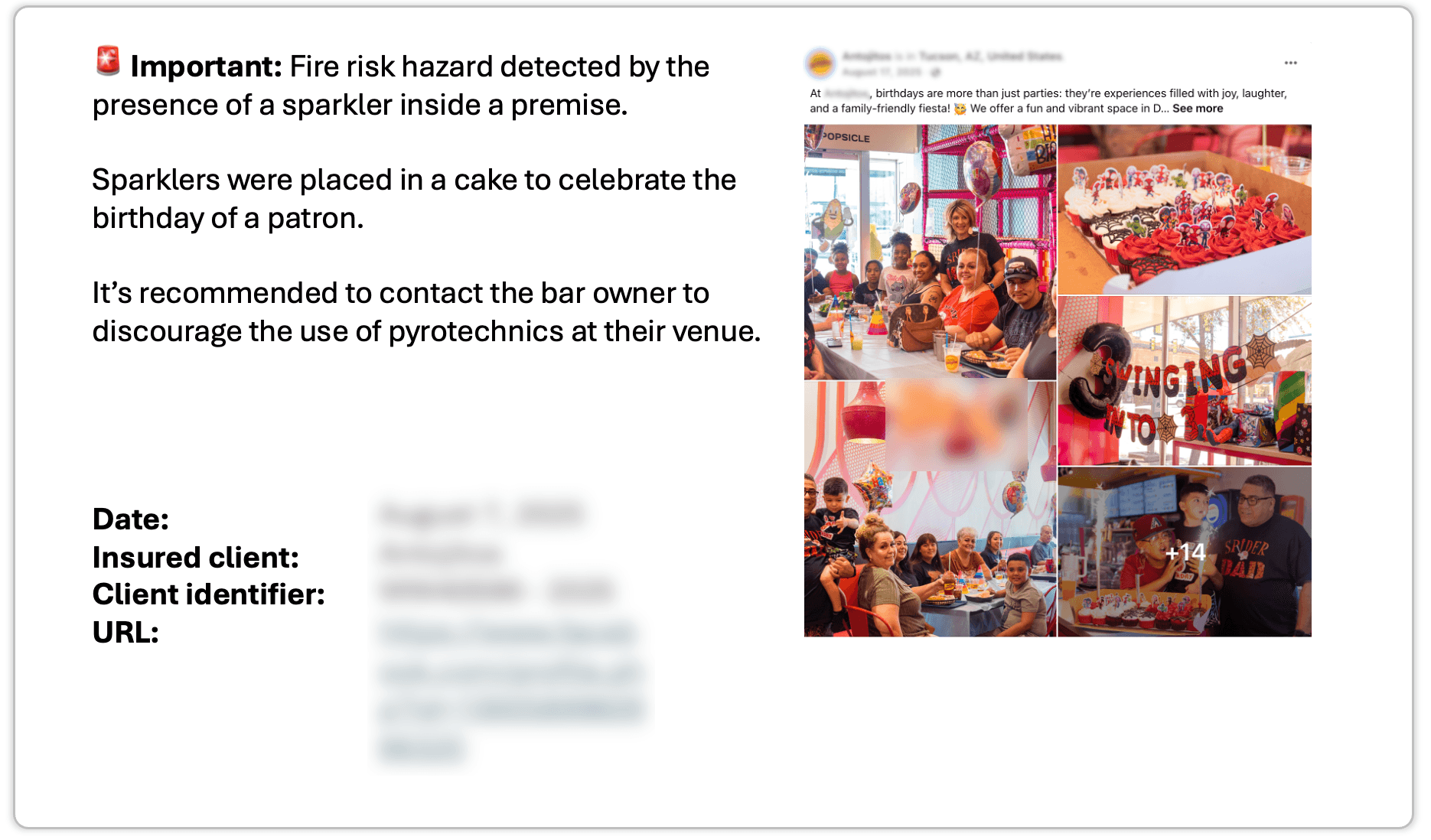

A real world example of use of sparklers that would be detected by AI and may require insurer action or customer education

A real world example of use of sparklers that would be detected by AI and may require insurer action or customer education

A loss control inspector might visit a bar or restaurant once a year. In between, the venue operates largely unsupervised from an insurance perspective. Menus change. Events get added. New practices emerge.

Sparkler service on champagne bottles is a perfect example. A venue might adopt the practice six months after their last inspection, promote it heavily on social media, and never think to mention it to their insurance carrier. From the operator's perspective, it's just good showmanship. From an underwriting perspective, it's a material change in risk profile that could affect coverage terms.

The traditional insurance model often only surfaces these gaps after something goes wrong, typically when a claim is filed. By then, it's too late for prevention.

How AI Monitoring Works

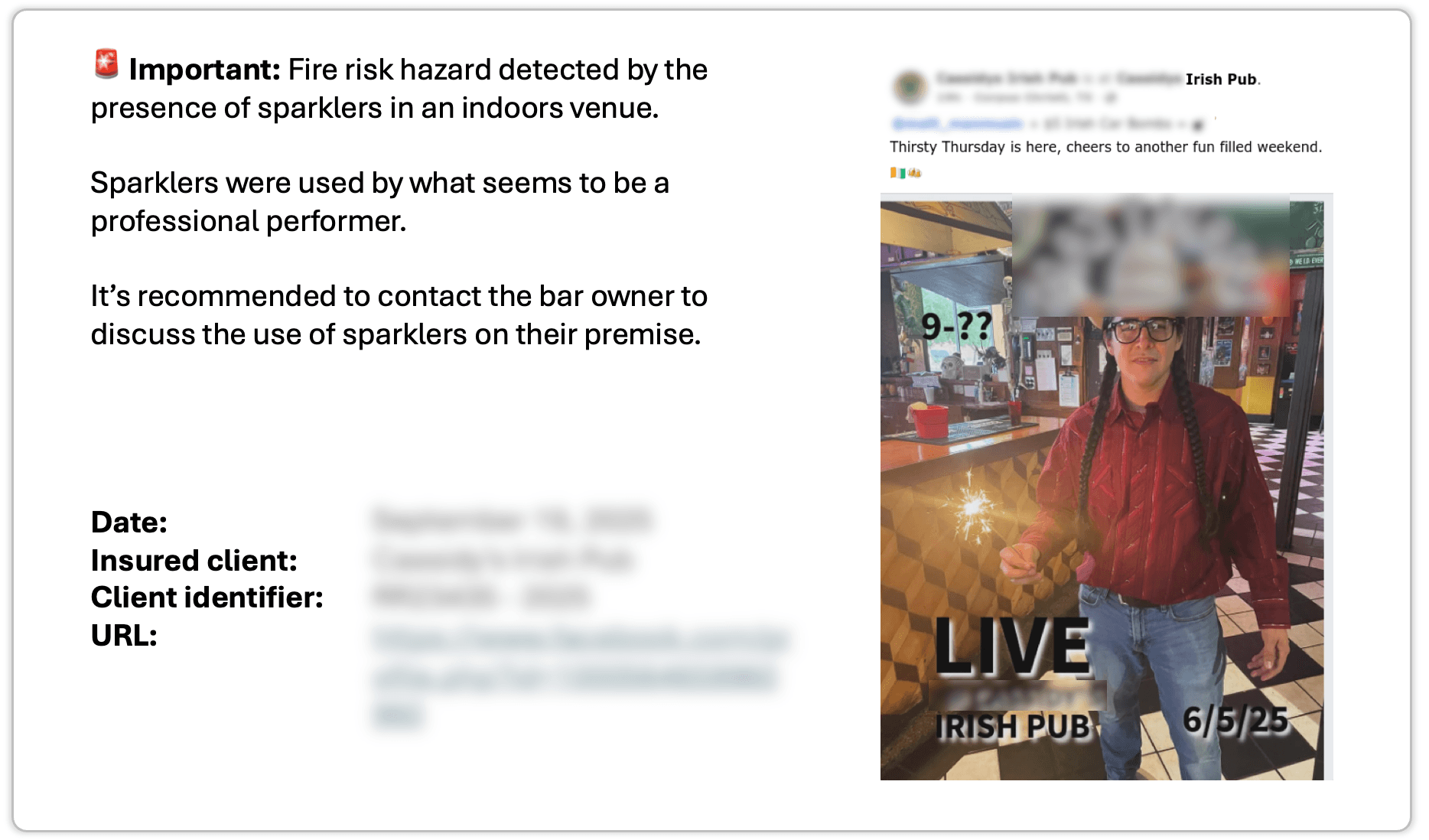

Another real world example of a promotional piece of content utilizing sparklers that may require discussion

Another real world example of a promotional piece of content utilizing sparklers that may require discussion

A growing number of risk intelligence platforms now offer insurers the ability to monitor their policyholders' public digital presence. These tools scan websites, social media accounts, and business profiles for changes that may signal elevated risk.

For sparkler detection specifically, the general approach includes:

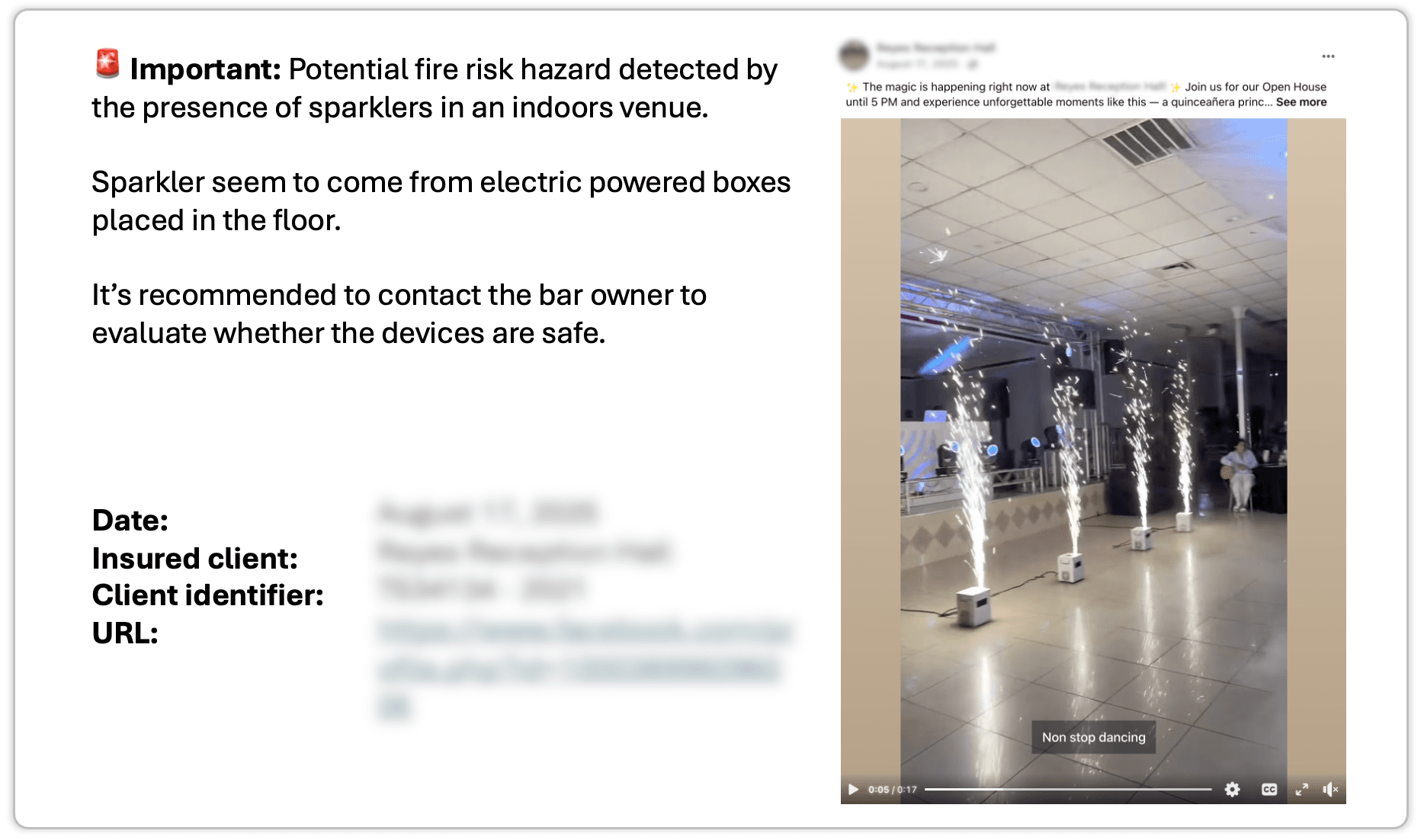

Image analysis. AI systems scan promotional photos and videos for visual indicators of indoor sparkler use: lit sparklers, champagne bottles with attached flares, staff holding sparking items near ceilings.

Text monitoring. Menus, event announcements, and social posts are scanned for keywords like "sparkler service," "bottle presentation," "VIP bottle service," or similar terms that indicate sparkler use.

Pattern recognition. Systems can flag when a venue that previously showed no sparkler content suddenly begins promoting sparkler-topped bottles.

When a flag is raised, the insurer receives an alert with timestamped evidence and context explaining why the change matters from a risk perspective.

Education Over Enforcement

The most effective approach isn't using these tools to catch policyholders doing something wrong. It's using them to start conversations.

When monitoring surfaces sparkler use at an insured venue, a constructive response might include:

Direct outreach. A loss control representative contacts the operator to discuss the practice and its associated risks.

Educational materials. The insurer provides resources on fire code regulations and safer alternatives for creating celebratory atmosphere. The National Fire Protection Association (NFPA) provides guidance on assembly occupancy fire safety through NFPA 101 (Life Safety Code) that can inform these conversations.

Risk consultation. If the operator wants to continue sparkler service, the insurer can help them understand what modifications might reduce risk: ceiling height requirements, fire suppression systems, staff training, crowd density limits, and ensuring ceiling materials meet fire resistance standards.

Policy review. In some cases, the insurer may need to adjust coverage terms or premiums to reflect the changed risk profile. Transparency here benefits both parties.

This approach can transform the insurer from a distant underwriter to an active risk management partner. Operators often don't realize the hazard they've introduced. When informed, most are willing to make changes, especially when the alternative is watching their business burn.

The Public Information Question

A real world example of use of pyrotechnical devices that would be detected by AI and may require insurer action or customer education

A real world example of use of pyrotechnical devices that would be detected by AI and may require insurer action or customer education

Some operators may be uncomfortable with the idea of insurers monitoring their social media. It can feel invasive, even when the information being tracked is entirely public.

This concern deserves acknowledgment. A few principles help draw appropriate boundaries:

Public means public. If content is posted to a public website, Facebook page, or Instagram account, it's visible to anyone, including insurers. Monitoring public information isn't surveillance in any meaningful legal sense, though businesses should understand this is occurring.

Transparency matters. Policyholders should understand that their public digital presence may be reviewed as part of the underwriting and loss control process. This should be clearly communicated in policy documentation.

Focus on genuine hazards. Monitoring should target practices that represent documented fire risks, not minor aesthetic choices.

Education first. The response to a flag should be conversation, not cancellation. Operators deserve the opportunity to address risks before facing coverage consequences.

When implemented this way, monitoring becomes a value-add for policyholders: an early warning system that helps them avoid practices that could destroy their business and endanger their customers.

What Operators Should Know

A real world example of use of pyrotechnical devices from a public post created by a patron that may provide insight into the use of sparklers at this establishment

A real world example of use of pyrotechnical devices from a public post created by a patron that may provide insight into the use of sparklers at this establishment

If you run a bar, nightclub, or restaurant, here's the practical reality: your insurer may be monitoring your public content, or may begin doing so. This isn't necessarily cause for alarm. It's an opportunity.

Review your own practices. Look at your promotional materials through a risk lens. Are you advertising sparkler service or similar fire hazards in indoor spaces? Consider how these would appear to a loss control professional.

Understand your policy. Many commercial policies have exclusions or specific requirements around pyrotechnics and open flames. Know what your coverage actually says. If you're unsure, ask your broker or agent.

Engage proactively. If you want to offer sparkler service, talk to your insurer first. They may be able to help you do it more safely, or explain why it's not worth the risk given your venue's characteristics.

Consider alternatives. LED sparklers and cold spark machines with proper safety certifications (which use metal granules rather than gunpowder and produce sparks that are cool to the touch) can create similar visual effects without the same fire hazard. However, even these alternatives require proper installation and evaluation for your specific venue.

Check your ceiling materials. The Crans-Montana fire, like the Volendam fire before it, involved ceiling materials that ignited rapidly. If your venue has acoustic foam, fabric decorations, or other potentially flammable materials overhead, verify they meet current fire resistance standards. Otherwise, reconsider any practice that brings open flames near them.

The venues that get burned (sometimes literally) are usually the ones that adopted risky practices without thinking through the implications. A little proactive engagement goes a long way.

The Bigger Picture

Indoor sparklers are one example of how insurers are exploring AI-powered monitoring to improve risk management. The underlying shift is from reactive to proactive loss control. Instead of waiting for claims to reveal problems, insurers can potentially identify emerging risks across their portfolio and intervene before losses occur.

For the hospitality industry specifically, this may mean closer partnership with insurers: more touchpoints, more education, more accountability. Some operators will find this intrusive. Others will recognize it as exactly the kind of risk management support they need.

What no one wants is another satisfying Instagram post that ends in tragedy.

Resources

For operators and insurers seeking more information on indoor fire safety:

- NFPA Free Access to Codes and Standards: NFPA makes its codes and standards available online to the public for free, including NFPA 101 (Life Safety Code) which establishes requirements for assembly occupancies.

- NFPA 101 Life Safety Code: The specific standard covering fire safety requirements for nightclubs, bars, and other assembly occupancies.

- Local Fire Marshal: Contact your local fire marshal's office for guidance on fire codes applicable to your venue. In the US, you can typically find contact information through your city or county government website.

- Insurance Broker/Agent: Discuss your current practices and coverage with your insurance professional to understand how sparkler use or other pyrotechnics may affect your policy.

This article represents analysis and commentary on emerging industry trends. Specific insurance coverage questions should be directed to licensed insurance professionals. Fire safety compliance questions should be directed to local fire authorities.

Want to monitor the web with AI?

Sign up with Visualping to track web changes with AI and save time, while staying in the know.

The Visualping Team

This article is published by Visualping's editorial staff, based on our experience working with commercial insurers in the bars & restaurants niche. Visualping is responsible for monitoring thousands of publicly posted pieces of content across North America for our commercial insurance partners and continues to iterate on our AI monitoring commercial insurance offering hand in hand with these partners.