Competitive Intelligence in Pharma: Strategies for Success

By Eric Do Couto

Updated June 14, 2024

Competitive Intelligence in Pharma: Strategies for Success

In the pharmaceutical industry, competitive intelligence (CI) is a pivotal tool for gaining a strategic edge over rivals. Businesses use CI to gather actionable insights on competitors’ pipelines, clinical trials, and market trends, enabling informed decision-making and innovation. By leveraging technology-driven CI programs, companies can anticipate competitor actions and adjust strategies accordingly.

Incorporating Competitive Intelligence and Monitoring into their strategic planning helps businesses build actionable insights. This helps accelerate time-to-market for new drugs, ensuring companies stay ahead in a dynamic and competitive marketplace.

Foundations of Competitive Intelligence in Pharma

Competitive Intelligence (CI) in the pharmaceutical industry is critical for maintaining an edge. It involves systematically gathering and analyzing data about competitors, market conditions, and regulatory environments.

Pharmaceutical companies rely on CI to make informed decisions. This includes insights into rivals' products, strategic moves, and technological advancements.

Key Components of Pharma Competitive Intelligence:

- Data Gathering: Collecting both proprietary and non-proprietary information about competitors and market trends.

- Analysis: Transforming raw data into actionable insights through various analytical methods.

- Knowledge Management: Storing, organizing, and retrieving data efficiently to support decision-making processes.

Regulatory and Licensing Insights:

Regulations and licensing are pivotal in pharma CI. Companies must navigate complex regulatory landscapes when bringing new drugs to market. Regulatory intelligence aids in understanding current and upcoming regulations, ensuring compliance, and anticipating challenges.

Role of Technology and AI:

Advancements in AI and technology have transformed CI in pharma. AI and machine learning enable real-time data analysis, predictive modeling, and enhanced forecasting. For instance, WNS Global Services highlights how CI can accelerate drug development timelines with AI-backed platforms.

Key Benefits:

- Speed: Faster drug development cycles.

- Accuracy: Improved decision-making with real-time insights.

- Efficiency: Better utilization of resources.

Pharma companies that integrate CI effectively gain significant competitive advantages, including faster market entry and improved regulatory compliance. These foundations underpin successful strategies in the highly competitive pharmaceutical sector.

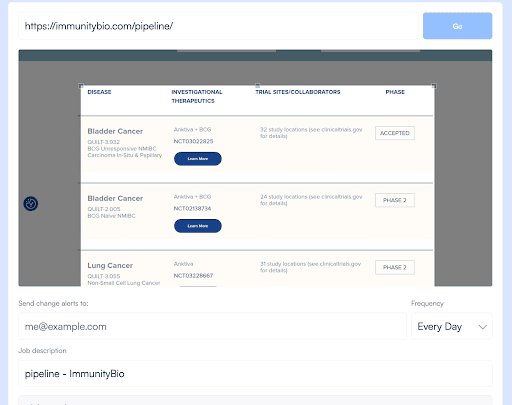

Using Visualping for Competitive Intelligence

Visualping, an AI-powered web monitoring tool, can be highly effective for gathering competitive intelligence in the pharmaceutical industry.

You can monitor any web sources, on the internet, for the regulatory updates you need to be aware of. When a change is detected, you receive an email alert with an AI-generated summary of the page change, so you can quickly understand the developement. It also includes an screenshot of the page, with the changes highlight, so you can visually see the change, too.

Step-by-Step Instructions:

1. Set Up Alerts:

- Visit the Visualping website and create an account.

- Identify key competitor websites and specific pages to monitor, such as product launches, new leadership hires, whitepapers, pipeline updates, press releases, or regulatory announcements.

- Configure Visualping to track these pages for changes.

2. Specify Monitoring Frequency:

- Determine how often you need updates.

- Visualping allows you to choose monitoring frequencies from every 5 minutes to daily checks.

- For fast-moving competitors or time-sensitive notifications, more frequent intervals are advisable.

3. Customize Alerts:

- Use keyword alerts to monitor specific terms related to new drug developments or market entries.

- Set thresholds for when alerts should be triggered to avoid information overload.

4. Receive Notifications:

- Visualping sends notifications via email or SMS when changes are detected.

- Enable detailed change reports for a clearer understanding of the updates.

5. Analyze Data:

- Compile the collected data in an organized manner.

- Use visualizations and tables within Visualping to highlight significant changes and trends.

- Compare this data against your internal metrics to measure impact.

Example CI Configuration in Visualping:

| Competitor | Page Monitored | Frequency | Change Type | Keywords |

|---|---|---|---|---|

| Competitor A | New product announcements | Daily | Content | "FDA approval", "launch" |

| Competitor B | Regulatory updates | Weekly | Legal | "regulation", "policy" |

| Competitor C | Press releases | Hourly | Marketing | "new drug", "partnership" |

<br>Effective use of Visualping can provide real-time insights into competitor activities. This supports informed decision-making and helps maintain a competitive edge in the pharmaceutical market.

Regulatory Environment and Compliance

Understanding and adapting to the dynamic regulatory environment is vital for ensuring compliance and maintaining the quality of drug development in the pharmaceutical industry. This section explores the intricacies of navigating global regulations and the direct impact of regulatory decisions on the industry.

Navigating Global Regulations

Adapting to international regulations requires comprehensive monitoring and analysis. Regulatory intelligence teams need to stay updated on changes across different regions. This is essential due to the diverse regulatory frameworks, such as those of the FDA in the United States and the EMA in Europe.

Companies often leverage a three-step strategy: monitoring regulatory changes, analyzing the potential impact, and implementing compliance measures. The regulatory intelligence function in pharma helps businesses remain compliant and mitigate risks, ensuring they are not blindsided by unexpected legislative changes.

Resources and expertise are crucial in this effort. Larger companies may have dedicated teams, while smaller organizations might rely on external consultants to keep track of evolving regulations. Consistent communication across global branches is necessary to maintain a unified approach toward compliance.

Impact of Regulatory Decisions

Regulatory decisions have significant ramifications on drug development and the overall strategy of pharmaceutical companies. The approval or rejection of FDA applications, for example, can dictate the timeline and feasibility of bringing new drugs to market.

Changes in compliance requirements can lead to shifts in quality control processes, necessitating updates in documentation, procedures, and training programs. These decisions also impact financial planning, as unexpected regulatory hurdles can increase costs and delay product launches.

Moreover, regulatory bodies frequently update guidelines to reflect new scientific findings and technologies. Staying ahead in such an environment requires agility and a proactive approach. Through diligent monitoring and swift adaptation, pharma companies can turn regulatory challenges into innovation and quality improvement opportunities.

For further information, the value of regulatory intelligence in pharma and insights on pharmaceutical regulatory intelligence offer additional context on these critical functions.

Innovation and R&D Focus

Pharmaceutical companies are placing significant emphasis on innovation within their R&D pipelines. This is driven by emerging therapeutic areas, evolving research patterns, and increased investment in research technologies.

Emerging Therapeutic Areas

Pharma companies are redirecting their R&D efforts towards novel therapeutic areas like gene therapy, immuno-oncology, and rare diseases. These areas offer the potential for high-impact treatments and significant market opportunities.

For example, gene therapy is transformative, addressing the root causes of genetic disorders. Immuno-oncology harnesses the body's immune system to fight cancer, focusing on personalized treatments. Targeting rare diseases, often neglected, represents a growing segment as advancements in genomics provide new avenues for treatment.

Research Patterns and Breakthrough Therapies

Pharmaceutical R&D is increasingly characterized by collaborative efforts and advanced analytics to identify and develop breakthrough therapies. Integrating artificial intelligence (AI) and machine learning enables real-time insights and accelerates drug discovery.

For instance, API integration in clinical trials enhances efficiency and reduces time-to-market by leveraging big data and predictive analytics. Collaborative research, involving partnerships with academic institutions and biotech firms, fosters an innovative environment and pushes the boundaries of traditional drug development.

Investment in Research Technologies

Investment in cutting-edge research technologies is central to enhancing R&D productivity. AI-powered platforms, advanced data analytics, and automated lab systems significantly boost drug development processes.

AI and machine learning optimize decision-making and streamline drug pipelines by predicting outcomes faster and more accurately. In addition, implementing automated laboratory systems reduces human error and speeds up repetitive tasks, freeing researchers to focus on high-value activities.

To summarize, focusing on emerging therapeutic areas, evolving research patterns, and investment in advanced technologies fundamentally shifts the landscape of pharmaceutical innovation and R&D efforts.

Competitive Landscape Analysis

In the pharmaceutical industry, understanding the competitive landscape is crucial for gaining a competitive advantage. Key factors include identifying major players, scrutinizing competitor pipelines, and benchmarking performance against rivals.

Key Players and Market Share

Identifying key players in the pharmaceutical market involves analyzing major companies such as Pfizer, Novartis, and Roche. These firms dominate substantial market shares due to their extensive research and development (R&D) capabilities. Market intelligence reports often detail the market share distribution, allowing companies to pinpoint where they stand relative to their competitors. This analysis helps recognize potential threats and opportunities. For more detailed insights, companies use tools like Cortellis Competitive Intelligence to monitor the competitive landscape and validate strategic decisions.

Analyzing Competitor Pipelines

Examining competitor pipelines is essential for understanding the future direction of market trends and innovations. Companies like BiopharmaVantage offer insights into competing firms' ongoing research and development projects. This includes reviewing clinical trial statuses, new drug applications, and potential market entries. Staying informed about pipeline assets helps companies anticipate shifts in the market and adjust their strategies accordingly. For instance, advancements in gene therapies and GLP-1 drugs have reshaped competitive dynamics, making it imperative to stay updated through platforms like PDF Transforming Pharma Competitive Intelligence.

Benchmarking and Positioning

Benchmarking involves comparing a company’s performance metrics against its competitors to identify strengths and weaknesses. Key performance indicators (KPIs) such as market share growth, R&D spending, and approval rates of new drugs are critical in this process. Companies use competitive intelligence tools to ensure they are well-positioned in the market. This strategic positioning helps achieve sustainable growth and maintain a competitive edge. Monitoring and adapting market trends is vital for staying relevant and competitive, as the BiopharmaVantage Ultimate Guide highlights.

Market Intelligence and Business Strategies

Market intelligence and business strategies enable pharmaceutical companies to identify opportunities and craft effective growth and expansion plans. These strategies are designed to maximize commercial success and leverage competitive advantages.

Assessing Market Opportunities

Assessing market opportunities involves comprehensively analyzing industry trends, competitor activities, and customer needs. Market intelligence tools collect data on drug pipelines, clinical trial outcomes, and regulatory environments. This data helps companies gauge the potential success of new products and identify unmet medical needs.

Pharmaceutical firms utilize business development teams to explore new markets and partnerships. These teams can identify lucrative expansion opportunities by understanding the competitive landscape and predicting market shifts. Analytical tools and insights from primary research enable strategic decision-making that aligns with long-term business goals.

Strategies for Growth and Expansion

Growth and expansion strategies in the pharmaceutical sector focus on fostering innovation, entering new markets, and forming strategic partnerships. Companies prioritize marketing strategies highlighting their products' unique benefits to attract and retain customers. Firms can use market intelligence to tailor their messaging and distribution plans to market dynamics.

Partnerships with research institutions, biotech firms, and competitors can accelerate drug development and enhance market reach. Effective strategic decision-making ensures that these collaborations align with corporate objectives, driving commercial success. Additionally, monitoring market trends and competitor actions allows companies to adapt and remain competitive in an evolving landscape.

Clinical Trials and Pipeline Analysis

Pharmaceutical companies use sophisticated methods to design and execute clinical trials alongside robust data analytics to assess trial outcomes. These efforts help identify effective treatments and advance drug development pipelines efficiently while addressing unmet therapeutic area needs.

Clinical Trial Design and Execution

Effective clinical trial design is crucial to the success of drug development. Considerations include selecting the right patient populations, defining clear endpoints, and choosing appropriate control groups.

Randomized controlled trials (RCTs) are often the gold standard. These trials ensure reliability and minimize bias by randomly allocating patients to treatment and placebo groups.

Adaptive trial designs can adjust protocols mid-study based on interim results. This flexibility improves efficiency and responses to emerging data. Real-world evidence (RWE) is also increasingly used to complement clinical trial data, providing insights from broader patient populations.

Data Analytics in Trial Outcomes

Advanced data analytics plays an essential role in interpreting clinical trial outcomes. Machine learning algorithms and predictive analytics help identify patterns and predict trial success rates.

Statistical modeling methodologies such as Drug Timelines & Success Rates (DTSR) are instrumental in forecasting drug launch timelines and success probabilities.

Companies leverage such analytics to inform business and portfolio decisions, ensuring that they focus on promising pipeline candidates. In addition, these insights guide strategic decisions to address unmet needs in specific therapeutic areas, optimizing resource allocation and accelerating the development of effective treatments.

Commercialization and Product Lifecycle

A successful pharmaceutical product lifecycle involves strategic commercialization and ongoing post-market surveillance. These components maximize the drug's commercial success and beneficial patient outcomes across various therapeutic areas.

Route to Market Strategies

Route-to-market strategies ensure that a new pharmaceutical product effectively reaches its intended audience. Companies must identify the right distribution channels, including partnerships with healthcare providers and pharmacies. A robust market access plan considers pricing, reimbursement, and regulatory compliance, significantly affecting the drug's commercial success.

Portfolio management aligns the drug's launch strategy with the broader business goals, optimizing resource allocation and market penetration. Early engagement with stakeholders, including payers and regulatory bodies, can streamline the approval and distribution process, accelerating time-to-market. Leveraging digital tools and data analytics is also pivotal in tailoring marketing strategies to therapeutic areas and patient demographics.

Post-Market Surveillance and Evolution

Post-market surveillance encompasses monitoring a drug's safety and efficacy after its launch. This phase is critical for maintaining product viability and ensuring ongoing patient safety. Pharmacovigilance activities, such as adverse event reporting and periodic safety updates, help identify potential risks that arise during widespread usage.

The ability to adapt to new data and market conditions is essential. Companies must be ready to update labeling, issue recalls, or reformulate products in response to safety findings. Continuous improvement strategies, guided by competitive intelligence insights, allow companies to refine their products and maintain their competitive edge. For detailed guidance on pharma competitive intelligence, refer to BiopharmaVantage's guide.

Technological Advancements and AI Integration

The pharmaceutical industry has seen significant advancements with the integration of artificial intelligence. These developments have transformed drug discovery processes and made research and development (R&D) more efficient.

Impact of AI on Pharmaceutical Development

AI algorithms have revolutionized pharmaceutical development. They expedite the drug discovery process by analyzing vast datasets to identify potential compounds quickly.

Pharmaceutical companies leverage big data analytics to understand disease mechanisms and target biomolecules. This data-driven approach enables precise and effective drug designs.

Cloud-based platforms enhance collaboration by providing researchers worldwide with real-time data access. This accelerates decision-making and problem-solving in drug development projects.

Generative AI creates novel compounds by predicting how molecules will behave. This helps researchers prioritize the most promising candidates for further testing, ultimately reducing time to market.

Advancing R&D with Machine Learning

Machine learning (ML) is transforming R&D processes in pharma. ML models analyze experimental data to predict outcomes, optimize processes, and improve efficiency.

Researchers gain insights into complex biological systems by integrating ML with big data. This approach aids in understanding disease progression and identifying new therapeutic targets.

Cloud-based technology facilitates the storage and analysis of large datasets. Researchers can run simulations and predictive models more efficiently, fostering innovation.

ML accelerates the drug testing phase by identifying potential side effects and drug interactions early in development. This proactive approach helps in designing safer, more effective drugs.

AI and ML continue to evolve, enhancing R&D capabilities and driving forward pharmaceutical innovation.

Stakeholder Engagement and Knowledge Sharing

Effective stakeholder engagement and robust knowledge sharing are fundamental to driving innovation and maintaining a competitive edge in the pharmaceutical industry.

Collaborations and Synergies

Stakeholders in the pharmaceutical sector, including Key Opinion Leaders (KOLs), play a vital role in knowledge sharing. Engaging with KOLs during trade shows and conferences allows companies to gather critical insights that shape R&D efforts.

Collaborating with external partners is another key element. Organizations often form alliances to share knowledge and resources, enhancing innovation capabilities. For example, around 40% of Pfizer's portfolio has been externally sourced, illustrating the importance of external collaborations (source).

Knowledge-sharing mechanisms reduce duplication and enhance efficiency. Addressing gaps in knowledge sharing can mitigate issues related to productivity and quality. For instance, larger organizations often face challenges with siloed information, which can be overcome through strategic stakeholder engagement (source).

Monitoring and Assessing External Factors

Understanding the external environment is crucial for gaining a competitive edge in the pharmaceutical industry. This includes tracking global health trends and the impact of digital disruption on the market landscape.

Global Health Trends and Impacts

Tracking global health trends helps pharma companies identify emerging threats and opportunities. Seasonal diseases, demographic changes, and shifting health priorities can determine market needs. Monitoring these factors supports strategic decisions for portfolio management and drug development.

For example, developing regions might experience rising infectious diseases, creating demand for new vaccines. Conversely, aging populations in developed countries elevate the need for chronic disease treatments. This vigilance ensures companies remain responsive to evolving health challenges.

Technology and Digital Disruption

Technology and digital disruption are transforming the pharmaceutical industry. Innovations in artificial intelligence, big data, and cloud-based platforms enhance competitive intelligence by delivering real-time insights.

Automatically aggregating and analyzing data from multiple sources allows for timely responses to market changes. Monitoring patent expiries and recent innovations can inform decision-making and strategic adjustments. This proactive approach enables companies to adapt and incorporate new medtech advancements into their strategic plans.

Digital tools also streamline processes, reducing time-to-market for new drugs. Keeping abreast of technological trends can thus significantly enhance a company's market position in the healthcare industry.

Strategic Partnerships and Business Alliances

Strategic partnerships and business alliances are crucial in enhancing innovation and ensuring mutual benefits for all parties involved. Key aspects include leveraging partnerships for innovation and aligning strategies for mutual benefits.

Leveraging Partnerships for Innovation

Companies in the pharmaceutical sector often form alliances to drive innovation. Collaborations with Contract Development and Manufacturing Organizations (CDMOs) allow pharmaceutical companies to enhance quality and efficiency. These partnerships are critical in incorporating advanced technologies like Generative AI, which streamline processes and fill expertise gaps.

Pharma firms must evaluate potential alliances based on the partner's cultural fit, quality standards, and reputation to ensure successful joint ventures. The shared resources and knowledge reduce research timelines and operational costs, fostering industry-wide innovation.

Aligning Strategies for Mutual Benefits

Aligning strategies is essential to maximize the benefits of strategic alliances. Successful partnerships are built on transparency, trust, and a shared vision. Entities involved in such agreements should regularly assess the alliance's potential to contribute significantly to their business objectives.

Competitive intelligence is crucial in guiding these strategic decisions in the pharmaceutical industry. By understanding their partners' capabilities and market actions, firms can better align their goals and prioritize initiatives. This alignment helps both parties to progress and evolve efficiently, ensuring that the partnership remains beneficial and integral to each organization's success.

Strategic alliances often involve considerable portions of each organization's operations, making it imperative to maintain strong, synchronized strategies.

Metrics for Performance and Decision-Making

Analyzing metrics in competitive intelligence (CI) helps pharmaceutical companies optimize operations and make strategic decisions based on actionable insights. Key areas include Key Performance Indicators (KPIs) and using CI to extract meaningful data.

Key Performance Indicators (KPIs)

Key Performance Indicators are essential metrics for monitoring performance and efficiency in pharmaceutical operations. They include metrics such as time-to-market, which tracks the duration from drug development to market release, and revenue growth, which measures financial progress. Resource utilization metrics gauge the efficiency of resource deployment, while cost-per-trial scrutinizes the budget efficiency of clinical trials.

Additional KPIs may focus on patient recruitment rates and clinical trial success rates. Accurate data on these metrics enables firms to streamline processes and improve pharmaceutical outcomes.

Using CI for Actionable Insights

Competitive Intelligence is pivotal in transforming data into actionable insights. Through thorough analytics, companies can forecast competitor actions, identify market trends, and refine their strategic approaches. Actionable insights derived from CI contribute to informed decision-making processes by highlighting potential risks and opportunities in the market.

These insights can lead to operations optimizations, enhance efficiencies, and ensure a quicker time to market. By leveraging data analytics, pharmaceutical companies can improve resource utilization and boost revenue through targeted strategies that align with market demands and competitor behavior.

Implementing these methods ensures that companies remain adaptable and responsive to changes within the competitive landscape, fostering sustained growth and innovation.

Want to monitor web changes that impact your business?

Sign up with Visualping to get alerted of important updates, from anywhere online.

Eric Do Couto

Eric is the Senior Partnerships Manager at Visualping. Eric has over 10+ years of experience in Marketing and Growth Leadership roles across various industries.