A Comprehensive Guide to Financial Services Compliance

By Emily Fenton

Updated April 14, 2025

Financial Services Compliance: A Comprehensive Guide

Financial services compliance is an inevitable part of working in the financial sector.

Here’s a comprehensive guide to what financial services compliance is and how you can use tools like Visualping to stay up to date on regulatory compliance for financial institutions. The tools, techniques, and compliance systems will help protect not only your financial institution but your customers as well.

What Is Financial Regulatory Compliance?

Financial services regulatory compliance is an umbrella term that covers the need to comply with the laws and regulations that impact a financial institution. These regulations and laws are specific to and and implemented by the government in the geographic location where the financial institution operates.

For example, a bank that has branches, employees, and/or customers in both the United States and Canada will have to maintain compliance with different laws and regulations in both countries. What is viewed as sufficient data compliance in the U.S. may not meet standards in Canada, and vice versa.

These regulations exist for a reason. They are in place protect financial services consumers (and providers), and helps establish both fairness and efficiency within financial markets.

Non-compliance with financial services regulations can result in detrimental consequences, including severe fines.

Financial Services Compliance Is a Constantly Changing and Evolving Landscape

Although financial regulations are critical for the fairness and safety of those participating in the financial markets, they can nonetheless be frustrating to navigate and stay compliant with. This is because laws and regulations are constantly changing and evolving.

For example, in 2018, the original California Consumer Protect Act was passed. This was a statute within the state of California designed to enhance privacy rights among consumers.

In the last five years, the Act has been amended twice. If you were operating your business in California, you would have had to adjust your systems and become compliant with new regulations three times in less than five years.

Since these laws are constantly evolving, it is critical for businesses to stay up to date on their local laws to maintain compliance. Some of the most crucial types of regulations that financial services organization must pay attention to include:

- Data localization (storing regulated data within the borders of the country)

- Cross-border data transfers (when sensitive data is transferred abroad)

- The process of client consent (like the recent GDPR in the EU)

- Possible penalties for non-compliance (such as fines)

So how are you to stay updated on these ever-changing regulations?

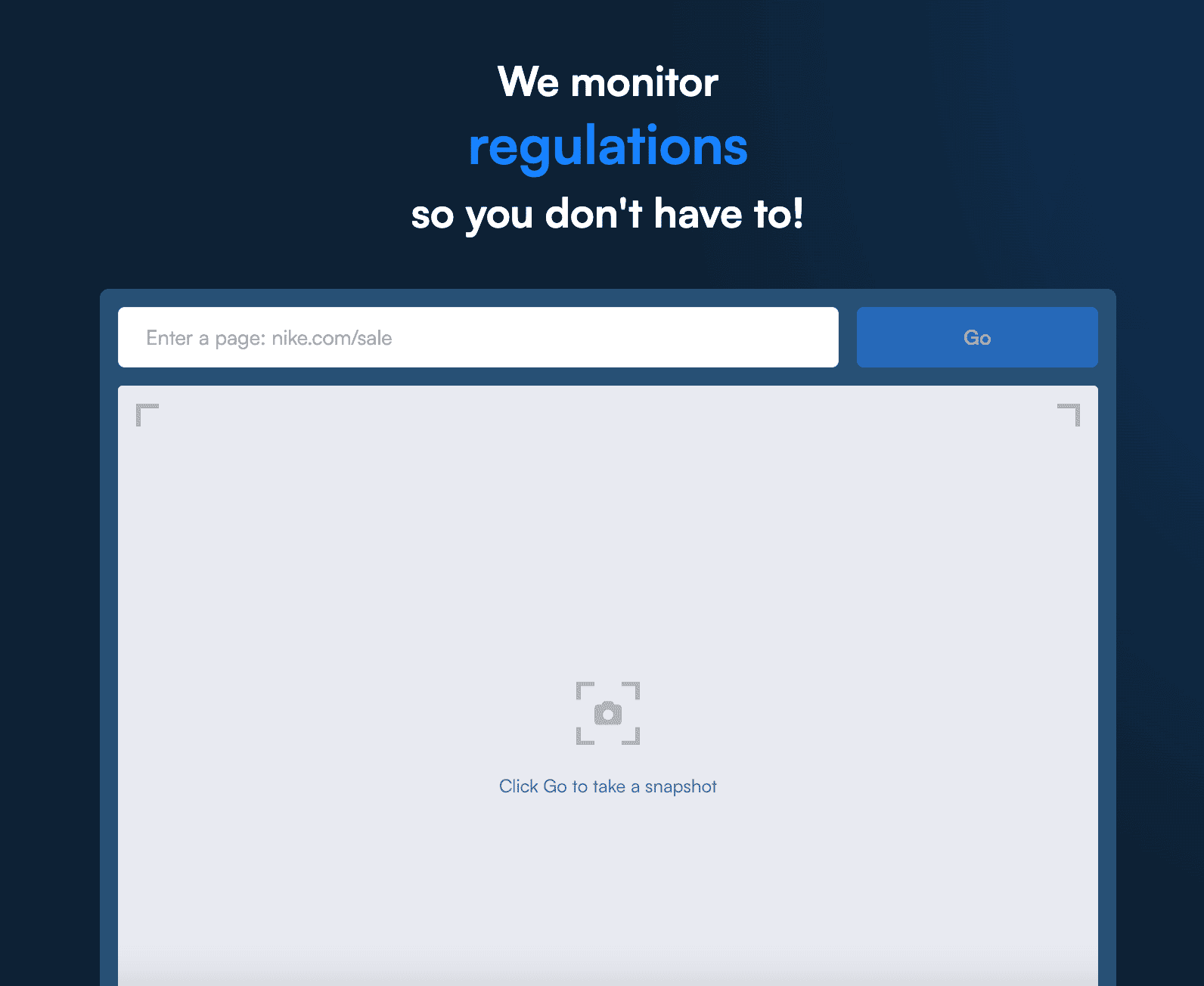

One option is to use Visualping, a tool that can help you track any changes in regulations or legislation as long as those changes are published online.

With Visualping, you input the website you want to monitor. Then, instead of you manually checking the website every so often, Visualping checks the web pages on your behalf and notifies you if there are any changes. This not only frees up your time and mental capacity but also brings you peace of mind.

Major Issues and Concerns Within Financial Industry Compliance

Some of these issues have already been mentioned, such as data localization and client consent. This section digs a little deeper into some of the major types regulationss you should monitor to stay in compliance with the financial industry’s regulations.

Data Privacy Rules

Data privacy is designed to regulate how companies collect information. In today’s world, information is critical for business operations such as online advertising, company branding, and business strategy.

Within the financial industry, data privacy dictates not only how financial institutions are allowed to collect their customers’ personal financial information but also how they can disclose that information.

Cybersecurity Standards

Cybersecurity in the financial industry is important because it sets the bare minimum standard for data security. The goal of cybersecurity, especially within the field of banking, is to safeguard the assets of clients, whether data or cash.

Cybersecurity is becoming more relevant as society shifts to cashless, digital transactions. As quickly as technology evolves, so do hacking methods. Just as technological advancements to increase ease and convenience within the financial sector become more sophisticated, so do the methods criminals use to hack systems.

Consumer Legislation and Regulations

Consumer legislation includes statutes, acts, laws, and regulations that are designed to protect consumers. Protection includes giving consumers more control over their online data and privacy, as well as protecting them from any potential deceptive or abusive actions on behalf of companies.

Employee Misconduct Definitions

Employee misconduct within the financial industry comes with a variety of risks and negative consequences, from losing customer trust to weakening the institution itself. Misconduct also contributes to the public perspective on the banking center, potentially leading to instability in the system itself. Laws governing the conduct of employees in the financial sector must be

Financial Crime Regulations

Crime is sadly present in every industry, and the financial industry is no exception. Crimes such as forgery, counterfeiting, tax evasion, embezzlement, and money laundering have all resulted in regulations that are intended to prevent these crimes from occuring.

Corporate Governance Rules

Without strong corporate governance, an institution is at risk for a variety of problems and issues. Strong corporate governance, usually through the oversight of an executive board, helps maintain not only thorough risk management but also institutional stability.

How Financial Institutions Can Improve Regulatory Compliance

There are ways for you to improve and stay in compliance with financial services, and you can get started now.

Putting Preventative Measures into Place

One of the best ways to decrease financial crime, data breaches, hacks, and employee misconduct is to put preventative measures in place. The Financial Stability Board offers a toolkit to help provide suggestions on measures you can take to strengthen corporate governance frameworks while reducing risks of misconduct.

Effective Compliance Monitoring Strategies

Staying updated on changes in regulatory laws is critical to improving compliance. Again, simple tools like Visualping can do this for you so you don’t have to worry about whether you’re missing a critical update.

Structured Oversight Within the Organization

Financial industry compliance should include how operating under rigorous oversight can help minimize problems before they begin. A competent board that is able to provide oversight to your organization is a valuable tool.

Integration Between General Risk Management and Compliance Solutions

Every business should have general risk management systems in place to help better the outcomes of their work. Integrating general principles of risk management with specific financial compliance solutions can help keep your company stable and secure.

Tutorial: How to Use Visualping to Get Notified of Regulatory Changes

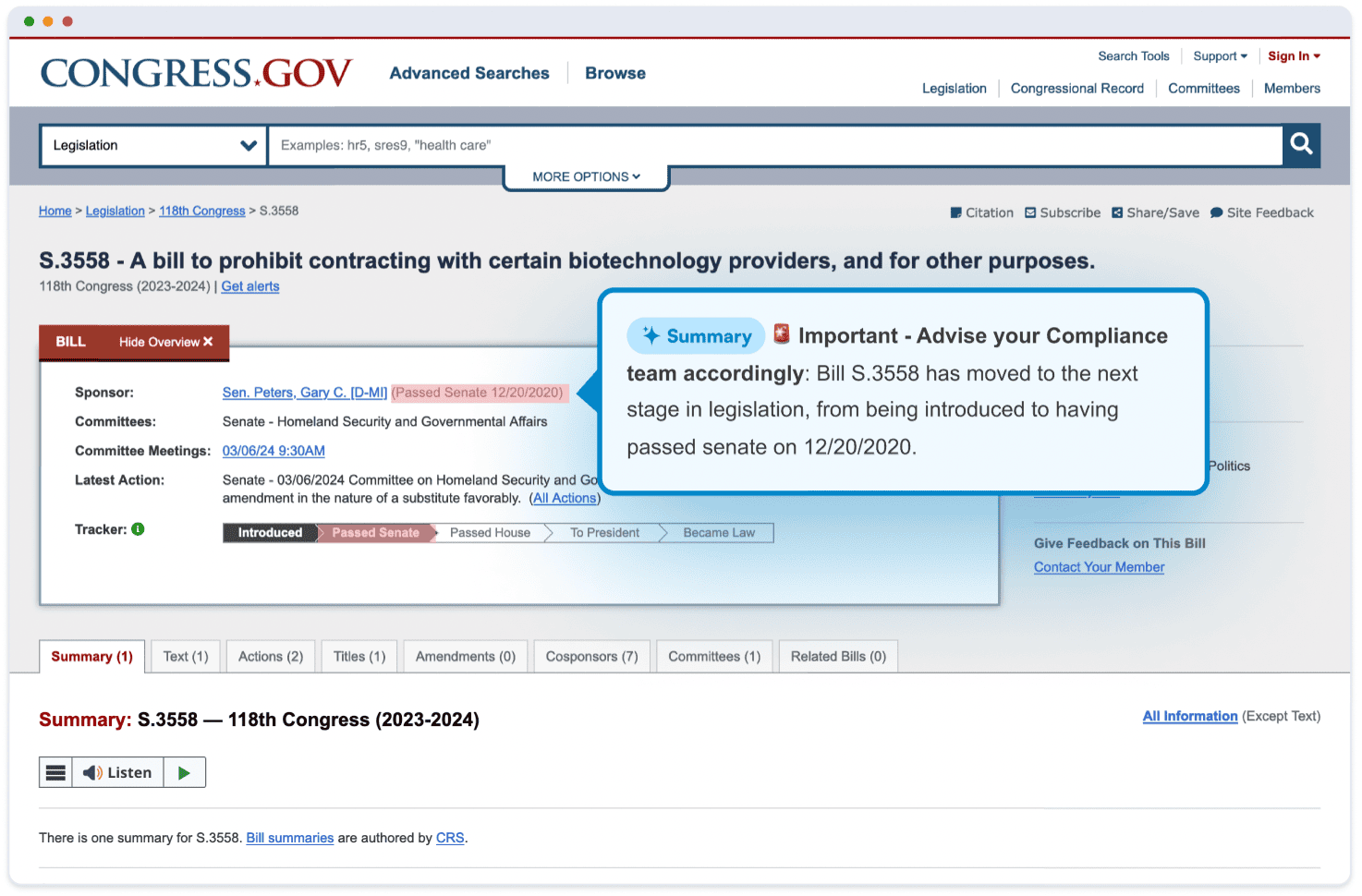

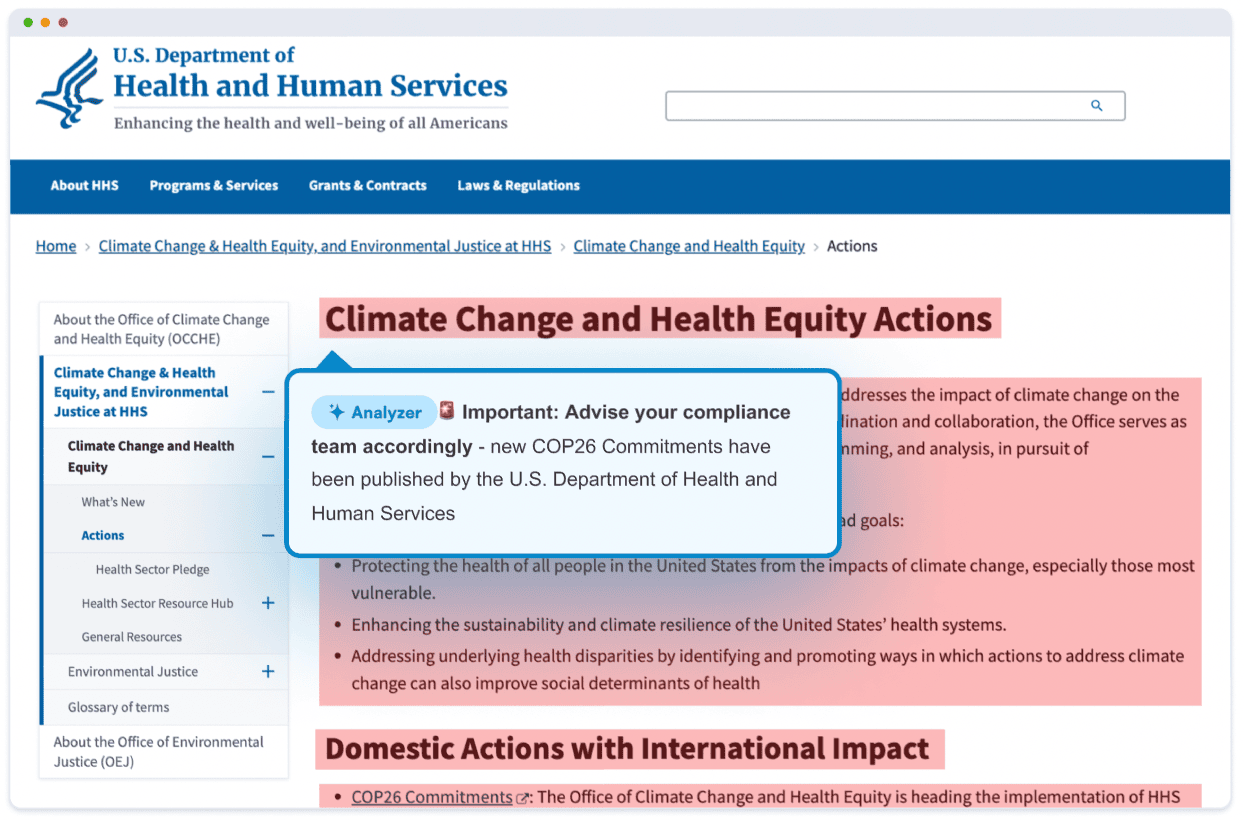

Visualping is a versatile tool used to monitor website changes. Visualping not only monitors updates to regulations and legislation posted online, but can also help you compare current regulation language with previous versions so you can get a clear understanding of compliance changes.

Here’s how you can use Visualping to monitor financial regulatory compliance changes:

Step 1: Copy the URL Where the Legislation or Regulations Are Published Online, Then Paste Them into Visualping’s “Search” Field on the Homepage

Locate the URL of the page you want to monitor and paste it into the search field on Visualping.

Step 2: Select the Part of the Page That You Want to Monitor

You can monitor an entire webpage or just a section of text.

Step 3: Decide How Often You Want Visualping to Check the Page for New Changes

Determine how often you want Visualping to run a scan of the page to check for any changes.

Step 4: Enter Your Email Address

Enter your email address into Visualping’s system to initiate the sign-up process.

Step 5: Check Your Email to Complete the Sign-up Process

Confirm your email, and done!

Stay Protected with Visualping

Staying in compliance with finance regulations is critical. Compliance helps protect you and your business from dreadful disasters. Visit Visualping today to get started.

Get regulatory updates -- straight from the source.

Sign up with Visualping to get alerted of regulatory changes from anywhere online.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.