How to Monitor Tax Codes with Visualping

By Emily Fenton

Updated September 13, 2023

Keeping track of tax codes and guidelines is essential for both individuals and businesses to ensure financial and legal compliance. However, staying up-to-date with tax code changes can be a daunting task, considering the frequent updates and complex regulations involved. This is where Visualping comes in as a reliable solution for efficient tax code monitoring.

In this article, we will discuss the significance of monitoring tax codes, the challenges associated with staying informed, and the benefits of using Visualping as a tool for effective tax code tracking. Let's dive in!

The Importance of Monitoring Tax Codes

Watching tax codes and other guidelines plays a crucial role in maintaining financial and legal compliance. The ever-evolving tax landscape makes it vital for individuals and businesses to monitor updates to codes, deadlines, and processes regularly. Outdated or incorrect tax information can result in penalties, legal issues, financial losses, and reputational damage.

Accurate and timely tax monitoring is essential to avoid costly mistakes. By staying informed about the latest changes and regulations, individuals and businesses can proactively adjust their financial strategies, ensure compliance, and seize potential opportunities.

Visualping offers a comprehensive tax code monitoring system that provides real-time alerts on updates and changes. With Visualping, users can stay ahead of the curve, leveraging their monitoring capabilities to maintain compliance and mitigate risks effectively.

How to monitor tax code web pages with Visualping

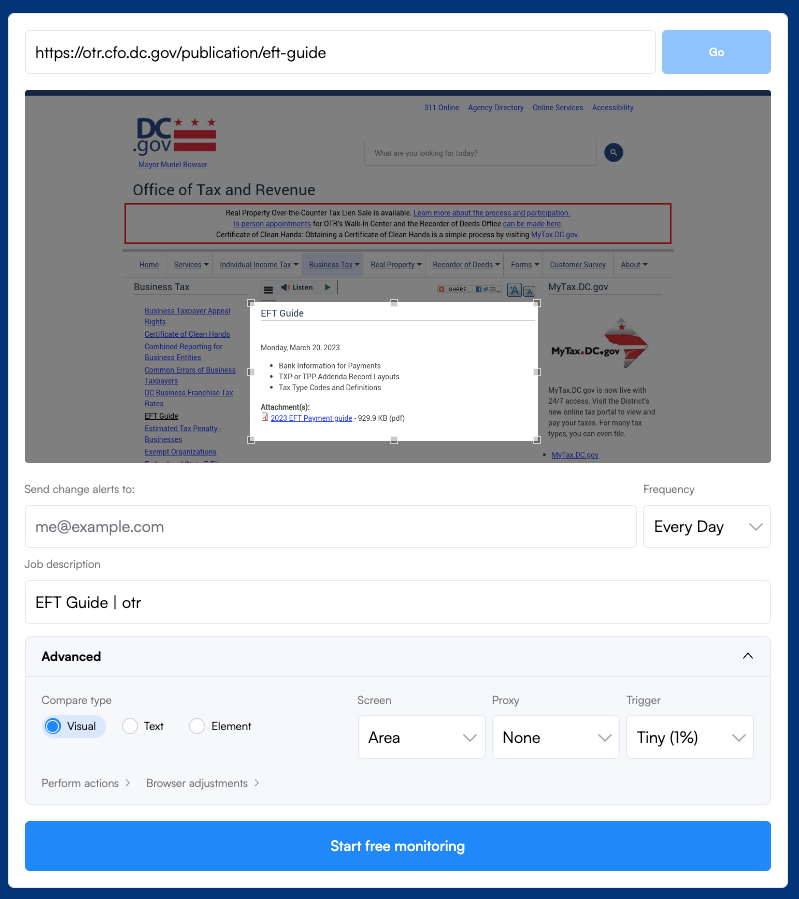

Step 1: Access Visualping's Homepage and Input the Tax Code URL in the Search Field

Open your web browser and visit the Visualping homepage. From the web page that contains the tax codes or other guidelines you want to monitor, copy the URL from the address bar. Paste this URL into the provided search field on the Visualping homepage to display the viewfinder which allows you to select the specific section you want to track.

Step 2: Select the Section of the Page to be Monitored

Choose the specific area of the webpage that you are interested in monitoring for any tax code changes. You can also utilize advanced settings to receive alerts when specific keywords appear on the page.

Step 3: Determine the Monitoring Frequency

Indicate the frequency at which Visualping should check the page for tax code updates. You can set the interval anywhere between five minutes and one month, depending on your preferences. This enables you to receive notifications at your desired convenience.

Step 4: Provide your Email for Notification Delivery

To receive notifications regarding any changes on the monitored page, you need to provide Visualping with an email address. Input an active email address that you frequently check to ensure timely receipt of each notification.

Limitations of Current Approaches to Tax Code Monitoring

Traditional methods of monitoring tax code updates, such as manual research and email subscriptions, often fall short in terms of efficiency and accuracy. Manual monitoring is time-consuming, prone to human errors, and easily leads to missed updates. Relying solely on email subscriptions also presents challenges, with overwhelming inbox clutter and limited customization options.

Visualping addresses these limitations. With its easy setup and customization features, users can tailor their monitoring according to their specific tax needs. Visualping eliminates manual efforts, ensures real-time updates, and reduces the chances of overlooking important tax code changes. It empowers individuals and businesses to take a proactive approach to tax code compliance.

Conclusion

Monitoring tax codes is crucial for financial and legal compliance. By using Visualping's tax code monitoring solutions, individuals and businesses can efficiently stay updated, avoid penalties, and navigate the complex tax landscape with ease. Don't wait for compliance issues to arise – explore Visualping's features today and simplify your tax code monitoring process.

Want to monitor web changes that impact your business?

Sign up with Visualping to get alerted of important updates, from anywhere online.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats