Coinbase New Coin Alerts: How to Get Alerted when Coins Go Live

By Eric Do Couto

Updated November 15, 2024

Cryptocurrency enthusiasts and investors are constantly on the lookout for new opportunities in the digital asset space. Coinbase, one of the leading cryptocurrency exchanges, regularly adds new coins to its platform. Staying informed about these additions can be crucial for making timely investment decisions.

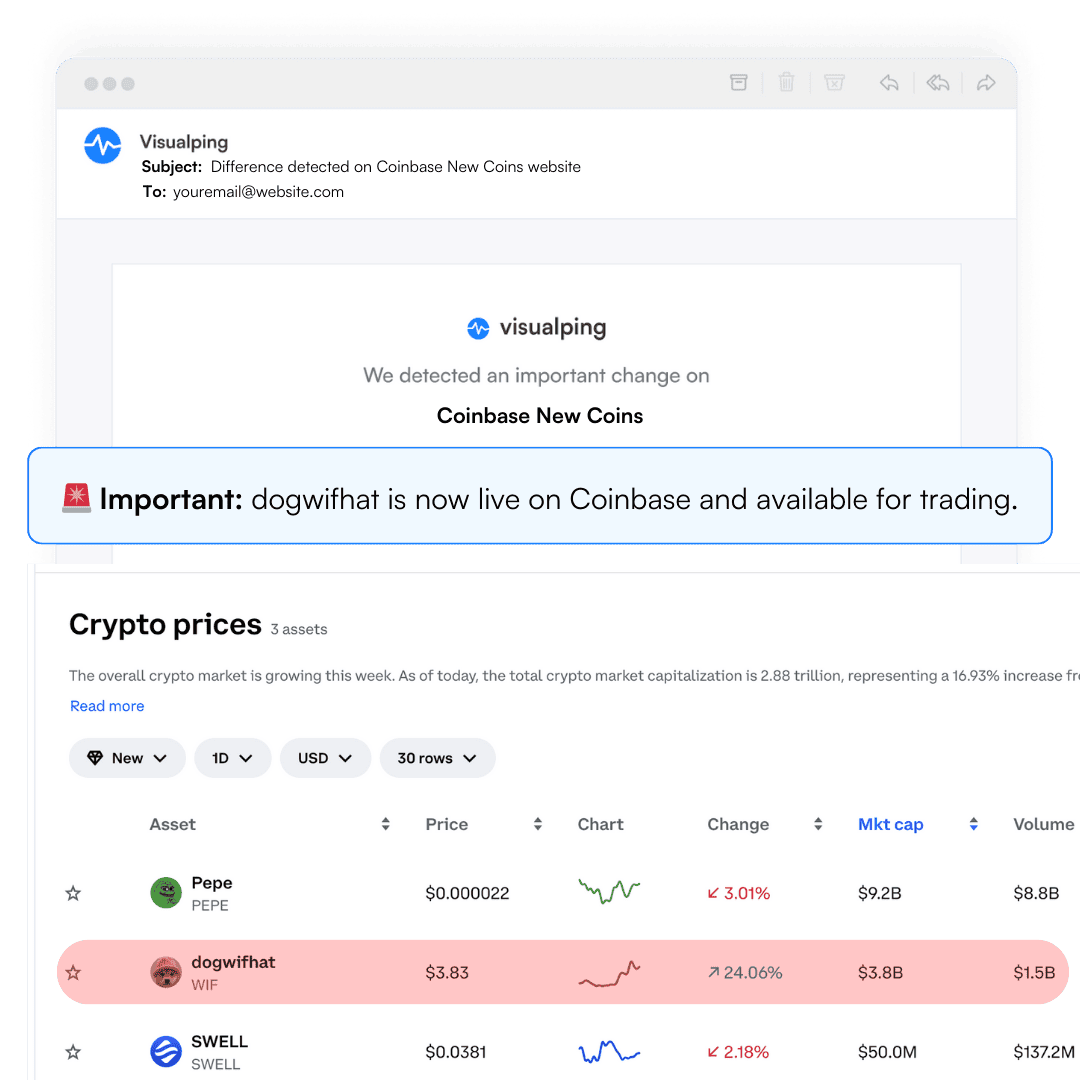

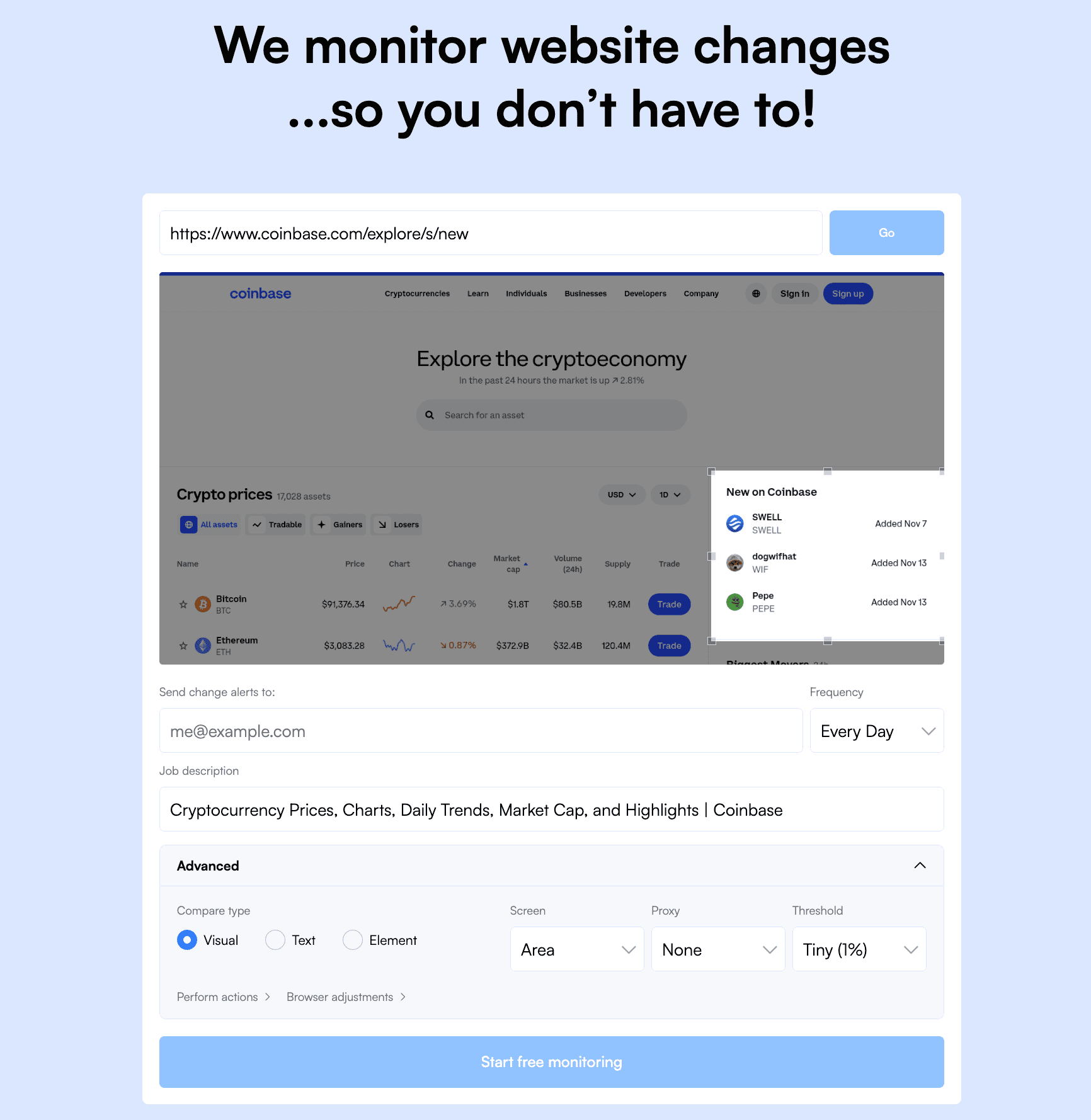

Instead of bookmarking the Coinbase web page and remembering to manually recheck it for new crypto coins everyday, it’s become the norm for traders to leverage online services, like Visualping, to get automatic alerts of new crypto coin releases.

Setting up new crypto coin alerts using Visualping can help users track Coinbase listings efficiently.

Visualping monitors the Coinbase website for changes, notifying users when new coins are added. By utilizing this service, investors can react quickly to emerging opportunities in the cryptocurrency market.

Understanding Visualping

Visualping is a service that monitors web pages and sends you an alert when there's an update, including an AI summary of what's changed. It's a great tool for all kinds of things, and it's a top pick of cryptocurrency traders for monitoring new listings.

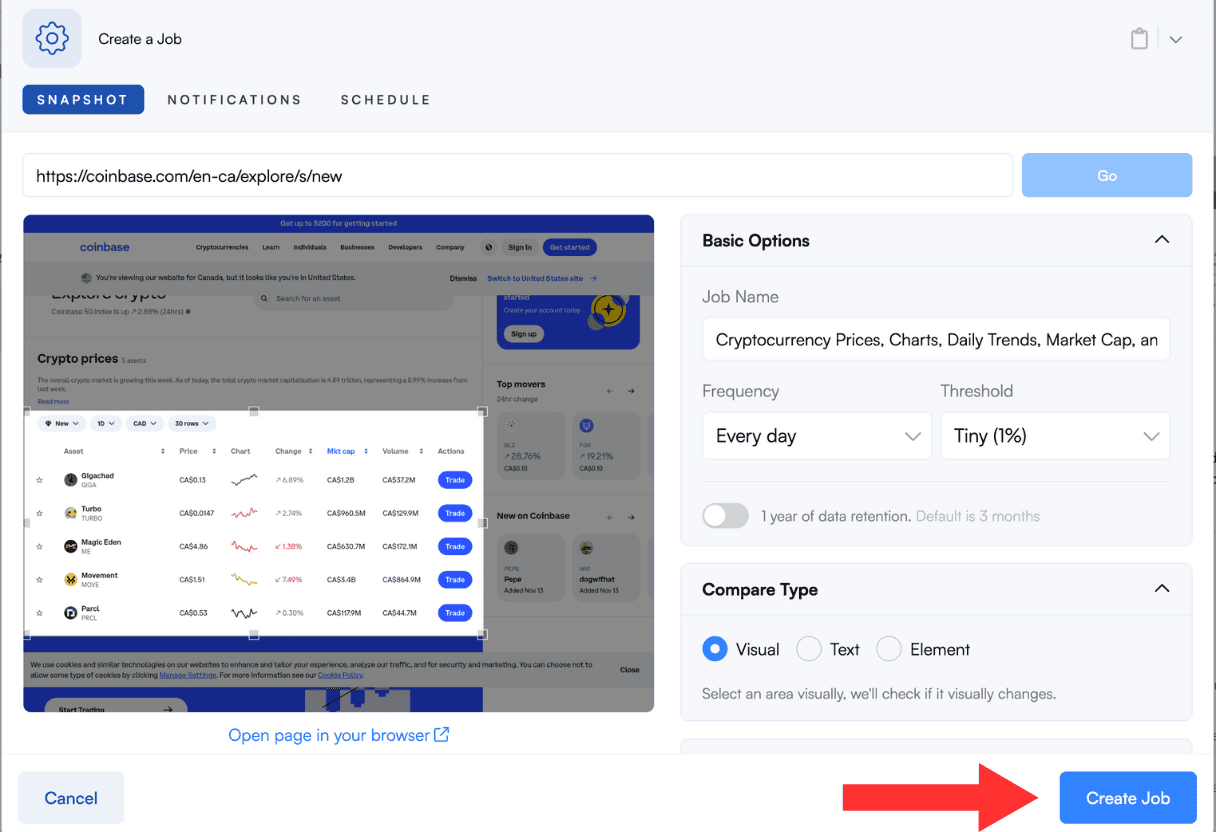

How to get Coinbase New Coin Listing Alerts with Visualping

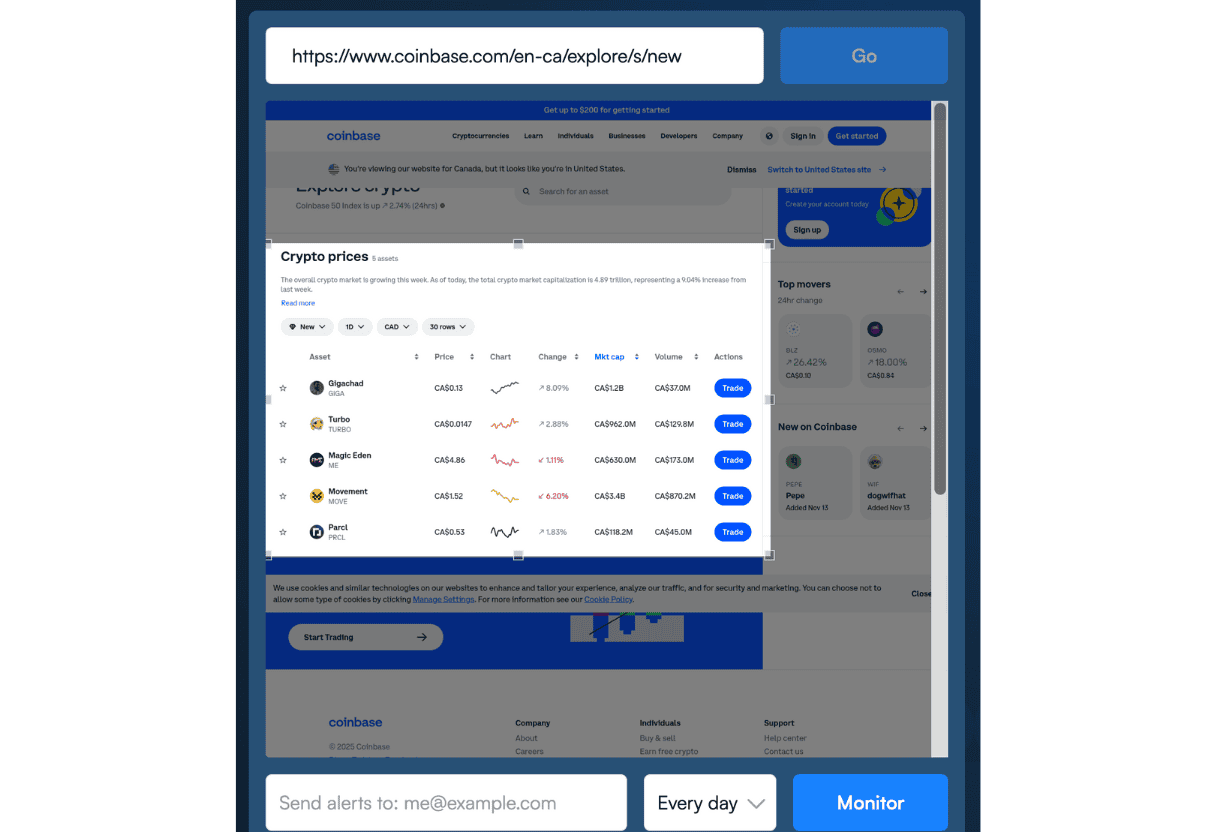

To get started with new Coinbase crypto coin alerts, simply copy the URL of the Coinbase web page you want to track, navigate to Visualping's homepage, and paste the URL into the address bar.

Step 1: Copy and paste the URL of the Coinbase crypto page you want to monitor into the search field on Visualping’s homepage. You don’t need to sign up first. Click Go.

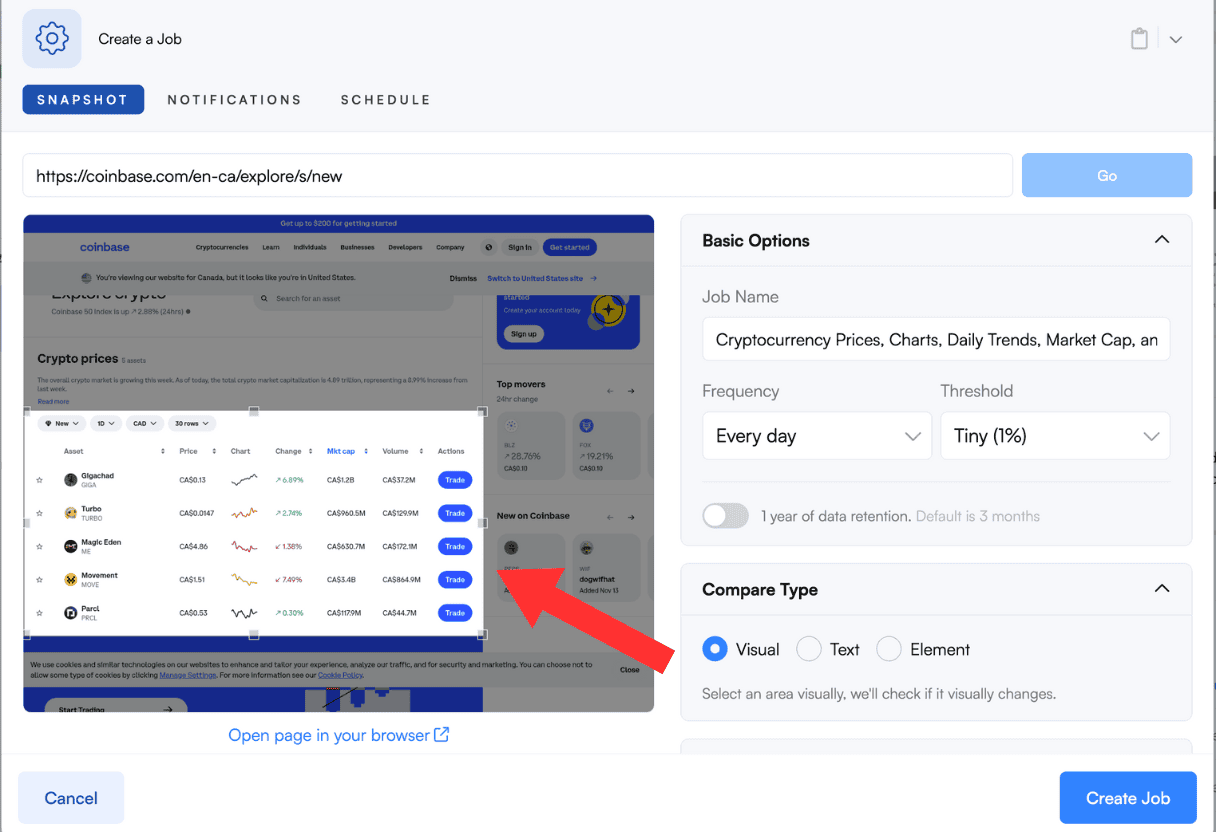

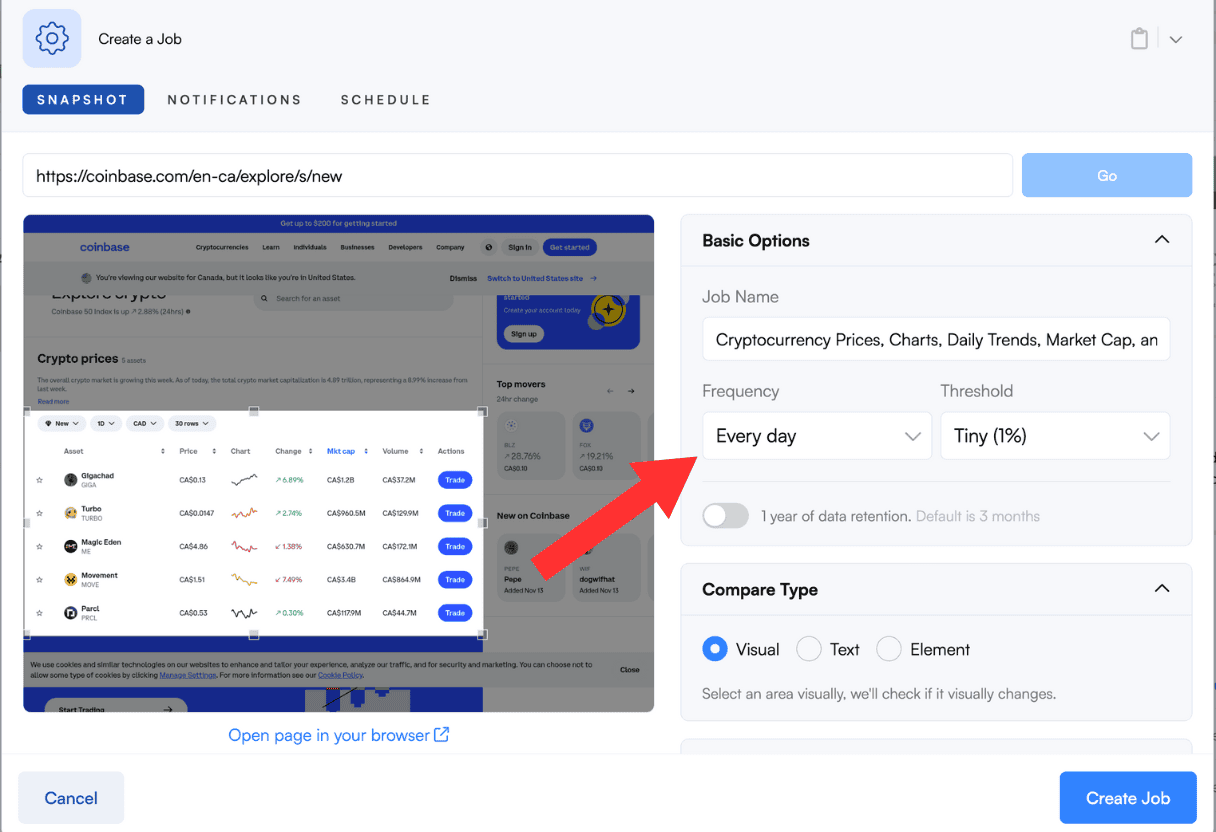

Step 2: Once the page appears in the viewport, select the part of the page you want monitored.

Step 3: Specify the frequency you want Visualping to check the page – every 5 minutes, 30 minutes, hourly, daily, etc.

Step 4: Type the email address you want the alerts to be sent to. Click Start Monitoring, and that’s it!

Step 5: Visualping will send you an email, asking you to make a password for your account. Don’t forget to do this. The password completes your account, and allows you to login to your user-dashboard, where you can view all your Visualping monitors and email alerts in one location.

Criteria for Coinbase Listings

Coinbase maintains strict standards for listing new cryptocurrencies. The exchange evaluates factors such as security, compliance, and technological innovation. Projects must demonstrate strong fundamentals, a clear use case, and robust development teams.

Transparency is key. Coinbase requires detailed documentation and code audits. The platform also assesses the token's distribution model and community engagement. Coins with centralized control or questionable tokenomics are typically rejected.

Legal compliance is non-negotiable. Coins must adhere to regulatory standards in jurisdictions where Coinbase operates. This includes anti-money laundering (AML) and know-your-customer (KYC) protocols.

Impact of New Listings on Market Trends

New Coinbase listings often lead to significant price movements. The "Coinbase Effect" refers to the surge in value many tokens experience upon listing announcement. This phenomenon is driven by increased visibility and accessibility to a wider investor base.

Trading volume typically spikes as new coins become available on the platform. This can lead to short-term volatility and potential arbitrage opportunities across exchanges.

Long-term impacts vary. Some coins maintain their gains, while others experience corrections. Investors should be cautious of pump-and-dump schemes that may coincide with new listings.

Market sentiment towards a project often improves post-listing. This can attract more developers, partnerships, and institutional interest.

Understanding Coinbase Alerts

For those preferring information around trends or price movements instead of new coins, Coinbase offers its own alert system through its mobile app and website. Users can customize their notification preferences in the settings to receive updates about price movements, biggest gainers/losers, and other relevant information. This built-in feature ensures that Coinbase users stay informed about the latest additions to the platform's offerings.

Coinbase offers a robust alert system to keep users informed about cryptocurrency price movements. These alerts help traders stay on top of market fluctuations and make timely decisions.

Types of Alerts and Notifications

Coinbase provides several types of alerts to cater to different user needs. Price alerts notify users when cryptocurrencies reach specific price points. These can be set for both upward and downward movements.

Real-time notifications inform users about significant market changes as they happen. Coinbase also sends alerts for completed transactions and account activity.

Users can receive watchlist notifications for cryptocurrencies they're particularly interested in. This feature allows for personalized monitoring of selected assets.

Configuring Alert Settings in the Mobile App

Setting up alerts in the Coinbase mobile app is straightforward. Users can access alert settings through the app's main menu.

To configure price alerts:

- Go to Settings > Notifications > Price Alerts

- Choose push notifications or in-app alerts

- Select assets from your watchlist

Users can customize alert frequency and thresholds based on their preferences. This flexibility allows for tailored monitoring of price movements.

Benefits of Staying Informed on Price Movements

Timely alerts empower users to make informed trading decisions. By staying updated on price fluctuations, investors can capitalize on market opportunities quickly.

Real-time price alerts help users track their portfolio performance without constantly checking the app. This saves time and reduces stress associated with market volatility.

Alerts also serve as a risk management tool. Users can set notifications for price drops, allowing them to take action to protect their investments if needed.

By leveraging Coinbase's alert system, users gain a competitive edge in the fast-paced cryptocurrency market. The ability to respond promptly to price movements can significantly impact investment outcomes.

Advice for Navigating the Cryptocurrency Exchange Landscape

Cryptocurrency exchanges play a crucial role in the digital asset ecosystem. These platforms facilitate buying, selling, and trading of various cryptocurrencies, each offering unique features and advantages to users.

Comparing Exchange Trading Volumes

Trading volume is a key metric for assessing an exchange's popularity and liquidity. Websites like CoinMarketCap and CoinGecko provide real-time data on exchange volumes.

Binance consistently leads in global trading volume, often handling billions of dollars worth of trades daily. Coinbase, while not always matching Binance's volume, maintains a strong position, especially in the US market.

Volume can fluctuate based on market conditions and new coin listings. Crypto exchange listing alerts can help traders capitalize on potential volume spikes when new assets are added to a platform.

It's important to note that some exchanges have been accused of inflating their reported volumes. Traders should consider multiple data sources when evaluating exchange activity.

Upcoming Coinbase Listings

Coinbase maintains a public roadmap for potential new listings. This transparency allows investors to prepare for upcoming additions. As of November 2024, several promising projects are under consideration.

Investors can set alerts with Visualping to get notified when new coins start trading on Coinbase.

Presale opportunities may exist for tokens slated for Coinbase listing. However, investors should exercise caution and conduct thorough research before participating in any presales.

Buying and Selling Digital Currencies

Coinbase Advanced offers a sophisticated platform for buying and selling cryptocurrencies. Investors can create up to 25 portfolios, each serving as a separate environment for different trading strategies. This feature allows for better fund management and experimentation with various approaches.

To execute trades effectively, investors should:

- Set clear entry and exit points

- Use limit orders to control purchase and sale prices

- Consider dollar-cost averaging for long-term investments

Timing is crucial when buying or selling digital assets. Traders often use technical analysis tools to identify potential market trends and make informed decisions.

Assessing Investment Potential and Risks

Evaluating the investment potential and associated risks of cryptocurrencies is essential for building a robust portfolio. Investors should consider:

- Market capitalization and trading volume

- Project fundamentals and team credibility

- Technological innovations and real-world use cases

- Regulatory environment and compliance

Risk assessment involves analyzing historical price volatility, liquidity, and potential vulnerabilities. Diversification across different types of cryptocurrencies can help mitigate risks and balance the portfolio's overall performance.

Utilizing Watchlists and Price Alerts

Watchlists and price alerts are valuable tools for staying informed about market movements. Coinbase allows users to create watchlists for assets they're interested in and set up customized price alerts.

To make the most of these features:

- Add promising cryptocurrencies to your watchlist

- Set price alerts for significant resistance and support levels

- Use alerts to trigger potential buy or sell decisions

Investors can receive notifications for large price swings over short periods, helping them capitalize on market opportunities or protect their investments from sudden downturns.

Visualping offers an alternative method for monitoring new cryptocurrency listings and market changes. Users can set up alerts for specific web pages, allowing them to track updates on exchanges or project websites.

Understanding ICOs and Presales

Initial Coin Offerings (ICOs) and presales are popular fundraising methods in the cryptocurrency world. ICOs allow startups to bypass traditional venture capital routes by selling tokens directly to investors.

Presales often precede ICOs, offering early access to tokens at discounted rates. This phase helps gauge market interest and secure initial funding.

Key benefits of ICOs include:

- Accessibility to a global investor base

- Potential for rapid capital acquisition

- Tokenization of assets or services

Risks associated with ICOs:

- Regulatory uncertainty

- Potential for fraud

- High volatility of token value

Investors should conduct thorough research before participating in ICOs or presales. Crypto alerts can help track new opportunities in this fast-moving space.

Good luck with your Coinbase account and with your cryptocurrency journey!

Coinbase New Coin Alerts: How to Get Alerted when Coins Go Live

Visualping is a simple tool that helps over 2 million users effortlessly detect important changes on any web page.

Eric Do Couto

Eric is the Senior Partnerships Manager at Visualping. Eric has over 10+ years of experience in Marketing and Growth Leadership roles across various industries.