Powering Events-Driven Investing with Real-Time Data from Any Source

By Emily Fenton

Updated October 25, 2023

Introduction

Investment professionals can stay one step ahead of the market by getting event alerts from the sources that publish it first – before they hit the Bloomberg terminal.

Website change detection tools are a common strategy used to capitalize on event-driven investment opportunities. Investors deploy these tools to automatically monitor updates from any niche source on the web, receiving real-time alerts as information changes.

Used by over half of the top multi-platform hedge funds in the United States, Visualping is the leading website monitoring tool for monitoring stock-moving events. When an update occurs on a web source an finance professional is tracking, Visualping sends a near real-time alert of the web data change.

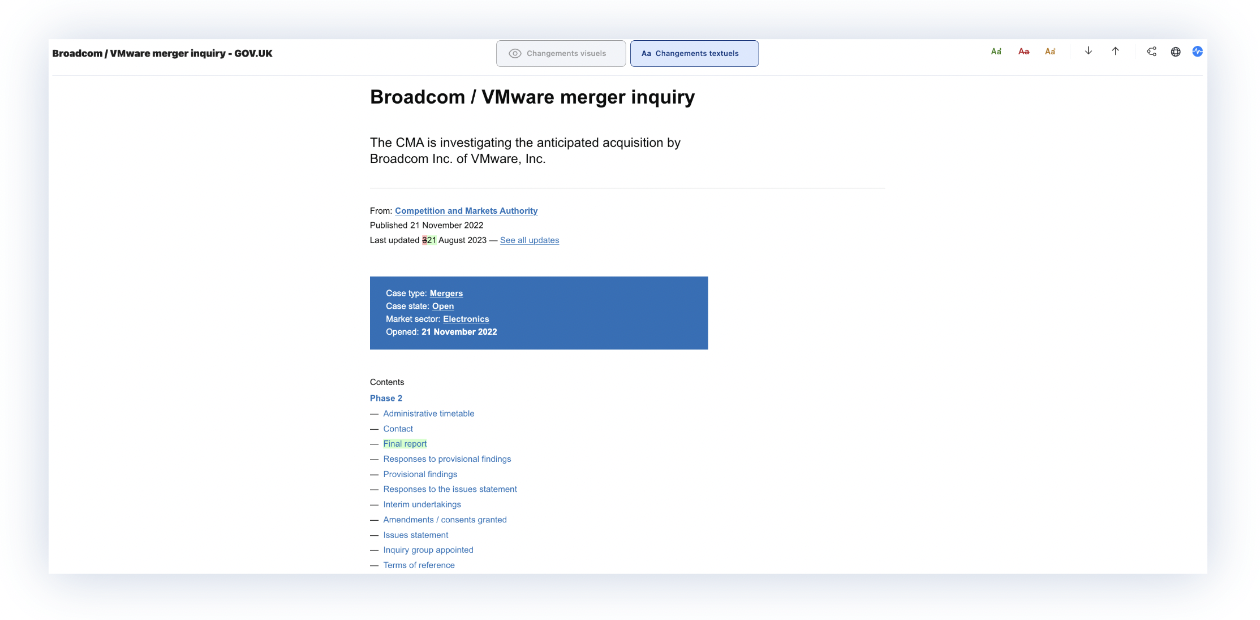

In August 2023, Visualping detected the UK approval of U.S. tech company Broadcom’s (AVGO.O) purchase of VMware (VMW.N). VMware’s stock opened later that morning at $162 – up from $155 at the prior close. Visualping’s client benefited from knowing about this change before the broader market.

In this white paper, we present the order of events in this case and describe the benefits of using Visualping for events-driven investing strategies such as merger arbitrage.

Website Monitoring Tools and Events-Driven Investing

Events-driven investing is a tactic most often deployed by advanced private equity and hedge funds because it requires in-depth market expertise to analyze corporate events for successful execution of trades. By reacting to and predicting notable events that impact market conditions, investors are able to generate alpha and deliver returns to their clients.

Investors generally keep an eye on news, corporate announcements, regulatory changes, mergers and acquisitions, and bankruptcies. By taking action fast when news breaks, they can capitalize on short-term price fluctuations that result from these events.

Investors also use website change detection tools to gain an information advantage while navigating the uncertainties involved in executing a merger arbitrage strategy. In this style of investing, carefully monitoring every available source of data from the involved companies and external regulators is crucial. Quickly updating a price target based on new information can yield extremely beneficial opportunities.

Visualping enables merger arbitrageurs to monitor the web sources they need to have an in-depth understanding of the conditions around a particular deal; for example: the Broadcom acquisition of VMware. But there are many web sources you can track with Visualping to make strong investing decisions.

UK’s Approval of Broadcom Acquisition of VMware: A Timeline

On August 22 2023, UK's competition regulator announced well before the U.S. markets opened that it had cleared U.S. tech company Broadcom's $69 billion purchase of VMware. Visualping, by monitoring the UK government’s page, detected the approval.

In after-hours trading, the VMware stock lagged behind the news. A few hours later, the VMware stock on the NYSE opened at $162 – up from $154 at the previous close. Thomson Reuters published the story at 11:51AM – five hours after Visualping detected the update.

Below is a timeline of the Broadcom Acquisition of VMware, approved by the UK:

- Fri Aug 18: VMWare stock closes $155 at 4PM

- Mon Aug 21: UK approval detected by Visualping at 6:37AM

- Mon Aug 21: VMware stock opens at $162 at 9:30AM

- Mon Aug 21: Reuters publishes the story at 11:51 AM

Conclusion

An event-driven strategy exploits the tendency of a company’s stock price to fluctuate during a period of change. Hedge funds often use website monitoring tools to detect important updates online to capitalize on events.

Used by half of the world’s top hedge funds, investment professionals use Visualping to automatically track updates from any niche source on the web, and get notified of real-time alerts of events-driven opportunities.

Interested in finding out more about how you can use Visualping to power your investing strategies? Contact us for more information, or to get started on our 14-day free trial.

Want to monitor web changes that impact your business?

Sign up with Visualping to get alerted of important updates, from anywhere online.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats