Regulatory Compliance in Banking: What’s Ahead in 2025 - Visualping

By Emily Fenton

Updated January 1, 2025

Regulatory Compliance in Banking: What’s Ahead in 2025

Regulatory compliance in banking is a foundational part of operating an ethical and successful financial business or service. Since banking regulations are constantly evolving, it can be hard to keep up with critical changes in compliance, and 2025 is bringing with it a variety of important changes within banking laws and industry regulations in the US.

Here are some of the latest developments in the banking regulatory compliance sector, as well as suggestions on how you can stay updated with an AI-powered regulatory tracking software like Visualping.

Section 1071: New Rules for Small Business Data Collection

Between 2009 and 2010, Congress directed the Consumer Financial Protection Bureau (CFPB) to adopt a series of regulations that govern the collection of data for small business lending. These rules are written into the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Within the Dodd-Frank Act lies Section 1071, which amended the Equal Credit Opportunity Act (ECOA) to require that financial institutions put together, maintain, and then submit data to the CFPB regarding applications for certain businesses. Specifically, the businesses include those that are:

- Minority-owned

- Women-owned

- Considered small businesses

The purpose of this rule is twofold:

- To enforce fair lending laws

- To enable communities, creditors, and government entities to identify opportunities for business and community development through supporting minority-owned, women-owned, and small businesses

In September 2022, the rule proposed by the CFPB would go on to affect institutions that have had a minimum of 25 small credit transactions directed toward small businesses during the prior two calendar years. The business data requirements dictated by Section 1071 have been in process for years, with a deadline set for the end of March 2023 to issue new changes.

New Developments in the Fintech Landscape

Still battling the global pandemic and economic chaos that it wrought, 2022 was a year of difficult times for Fintech companies across the globe due to financial strain and declining valuations. There have been a handful of scandals within cryptocurrency institutions, as well, such as the FTX scandal, that are aiming a renewed sense of bitter scrutiny toward Fintech companies.

The fallout of these various events in 2022 is likely to result in adverse effects on the cryptocurrency sector that include:

- Increased difficulty for crypto firms to attain institutional capital due to an upsurge in caution and heightened uncertainty as a result of the industry’s instability

- Further regulatory scrutiny, as well as newer and evolving regulations, due to heightened interest in consumer protection

- A significant decline in VC funding

- Declining interest and enthusiasm by retail investors who are no longer interested in crypto as a means of personal investment

Cryptocurrency has been a volatile industry since its inception, largely due to its youth and avant-garde nature, and though predictions for 2023 may seem dreary, it’s still also possible for crypto to experience a comeback of sorts.

Increased Cryptocurrency Transaction Monitoring

Regulators have developed a new focus on increasing the monitoring and scrutinization of cryptocurrency transactions.

The purpose behind this is to prevent not only money laundering but all forms of illegal financial activity. Money launderers can move illicit funds through dozens, if not hundreds, of wallets, which can be opened without proof of identity, unlike bank accounts.

In 2022, there was a discovery that certain crypto criminals laundered a whopping $540 million through the RenBridge system and that these criminal activities had been going on since 2020. Hence, the heightened interest in monitoring crypto transactions more carefully.

Changes to Overdraft Fee Regulations

There are also anticipated changes to regulations for overdraft fees in 2023. In fact, experts say this is one of the key areas of focus in 2023 for regulators.

Changes in overdraft fees will mostly impact community financial institutions. Community banks rely heavily on overdraft fees as a source of revenue, meaning they are under greater pressure to change their overdraft fees compared to some of the biggest banks in the nation.

In a recent report, three banks showed that 10% of their operating revenue was generated from overdraft fees alone. Rather than decreasing or eliminating overdraft fees altogether, these changes will likely come in the form of enhanced disclosures.

Scrutiny of Appraisal Bias

Appraisal bias within the financial sector and its offshoots has been a topic of conversation for decades, ever since “redlining” was officially coined. Now more than ever, fair lending is a priority for financial institutions. Although the world seems to shift toward a greater understanding of inherent bias, recent studies reveal appraisal bias is still prevalent today.

The Fair Housing Finance Agency is seeking to take bigger steps to combat lending discrimination and appraisal bias, as these discriminatory practices disproportionately affect minority communities, essentially resulting in modern forms of financial redlining.

How to Use Visualping to Stay on Top of Regulatory Changes

Since regulations and compliance issues are always changing and evolving, it can be difficult to stay updated on changes or updates to regulations in your industry, but that is exactly where software tools like Visualping come into play.

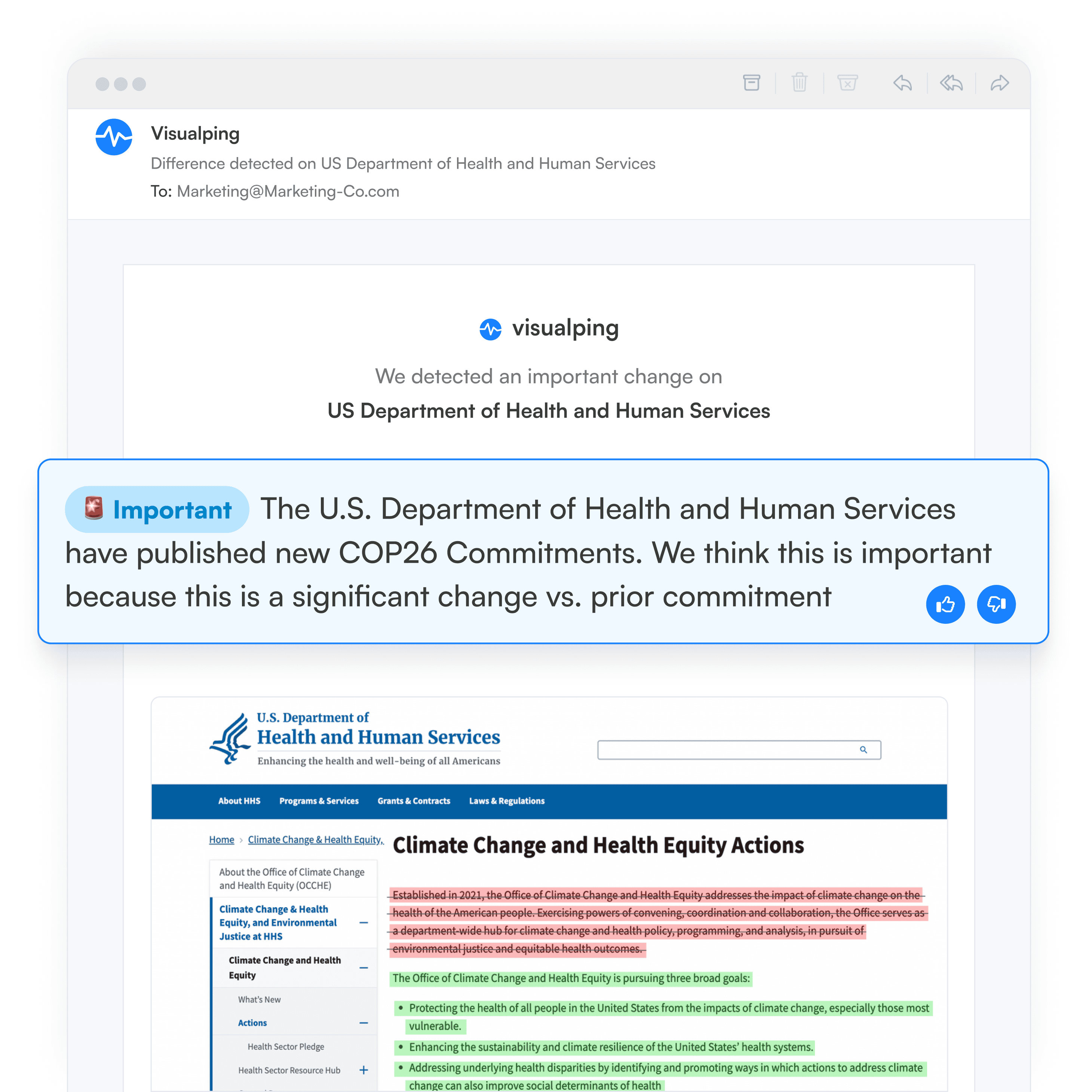

Visualping is an AI website monitoring tool that operates 100% online, and can monitor changes to any web pages with AI, in real-time. You can get notified of changes either from the entire page, or specific sections within that page, as soon as the change is detected.

When a change is detected, Visualping sends you an AI-generated summary and screenshot of the change for you to see.

For example, if you wanted to stay updated on Section 1071 and any of its potential changes, you could input the URL of Section 1071 from the CFPB website. After inputting the URL, Visualping will take over for you, monitoring and running reports on the web page to determine any changes.

Visualping also has a feature that allows you to compare new versions of a page to its previous iterations, which is particularly useful if there have been subtle changes in verbiage made between two versions of the page. Analyzing the two side-by-side can help you understand wording subtleties so you can stay in compliance.

Step-by-Step Tutorial

Here’s how you can use Visualping to monitor websites for updates in legislation or regulations:

Step 1: Sign Up for an Account with Visualping

Signing up is easy. With a few simple pieces of information and the confirmation of your email address, you can start using Visualping for free.

Step 2: Click “New Job”

Once you’re signed into your newly created account, click on “New Job” to begin setting up a new report.

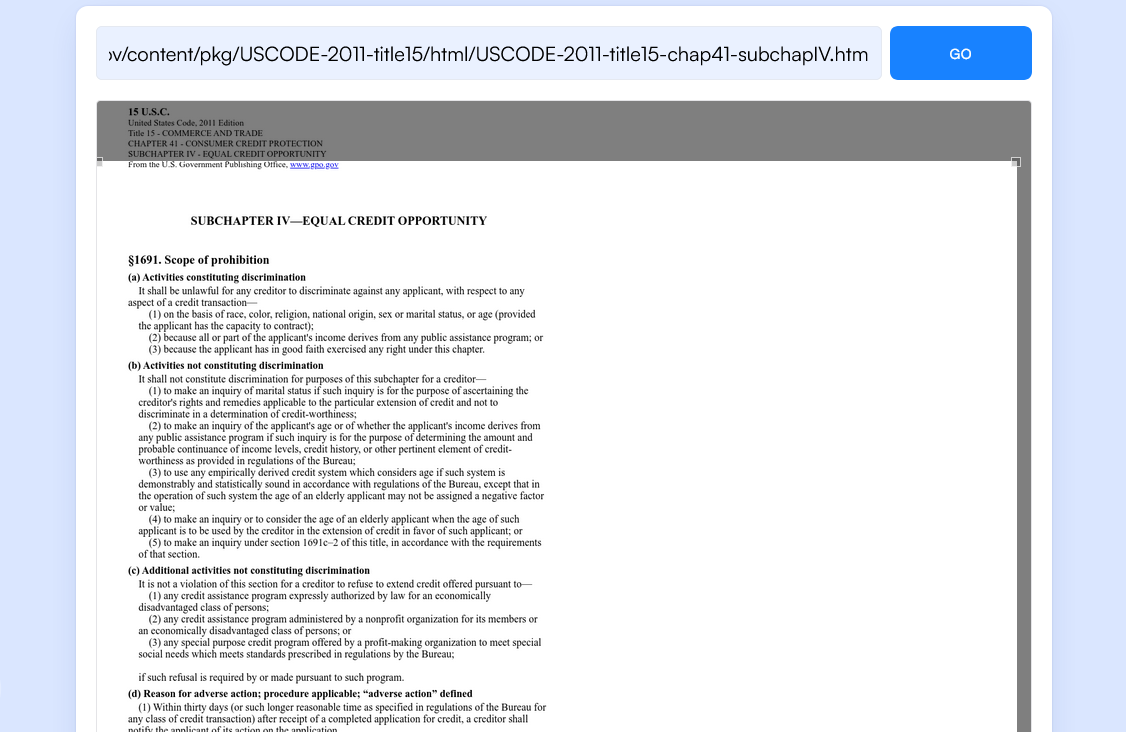

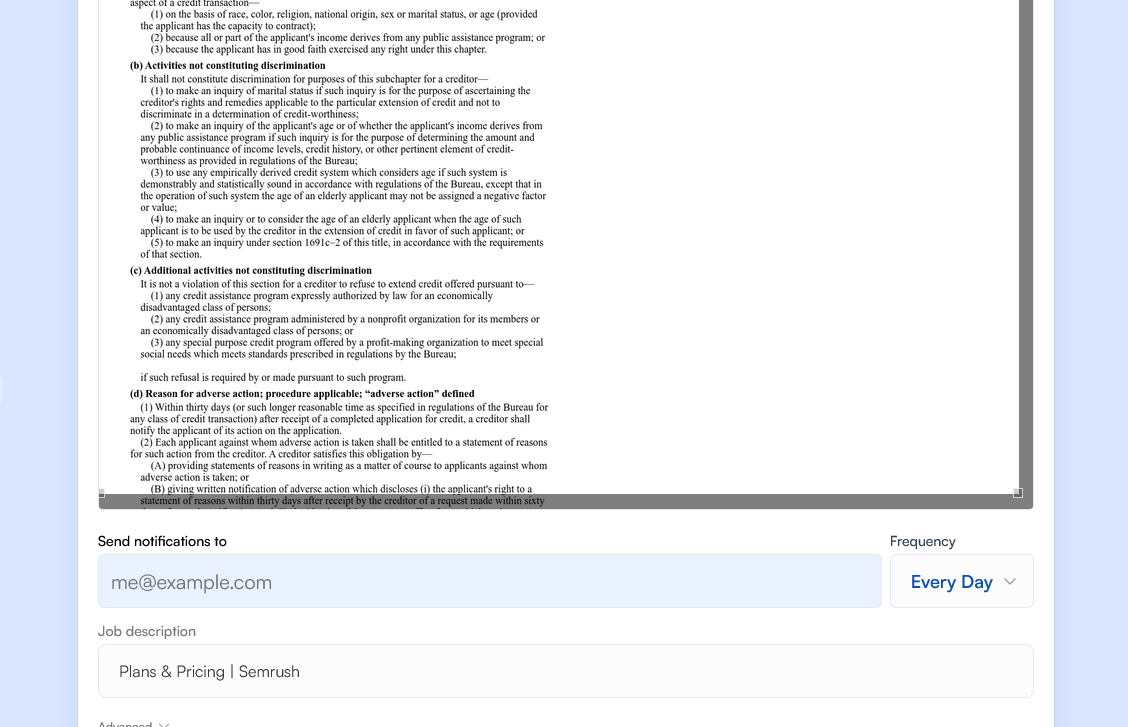

Step 3: Copy the URL and Paste It into Visualping

Next, copy the URL from the page in question (in this case, the page on Section 1071 from the CFPB). Paste that URL into the field at the top of the Visualping page.

Step 4: Select “Text” Under Compare Type

Selecting “Test” under the “Compare Type” filter helps reduce the likelihood of false positives from pulling through in the report, as the “Text” option ignores any visual elements on the webpage.

Step 5: Click “Create Job”

Clicking “Create Job” finishes the task, creating a trigger that will initiate an alert from Visualping if there are any changes. You can define how often Visualping runs these reports, that way — if you only need something like a monthly report — you aren’t bombarded by notifications.

Stay Prepared for Banking Changes in 2025

There are many changes coming to the banking sector in 2023. In order to stay prepared for these changes and the ways they may affect you, and to remain in regulatory compliance in banking, it’s important to use tools like Visualping so you never miss an update. Sign up today to get started.

Get regulatory updates -- straight from the source.

Sign up with Visualping to get alerted of regulatory changes from anywhere online.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.