Regulatory Compliance: How to Monitor Changes Effectively in 2025

By Eric Do Couto

Updated January 8, 2025

Regulatory Compliance: How to Monitor Changes Effectively in 2025

Understanding Regulatory Compliance

Regulatory compliance forms the foundation of ethical and legal business operations. It encompasses adherence to laws, regulations, and industry standards that govern organizational activities.

Defining Compliance and Regulations

Regulatory compliance refers to an organization's adherence to laws, regulations, and standards established by government agencies, industry bodies, and other external entities.

These rules cover various aspects of business operations, including:

- Financial reporting and auditing

- Data privacy and security

- Environmental protection

- Labor practices

Regulations can be industry-specific, like HIPAA for healthcare, or broadly applicable, such as GDPR for data protection. Organizations must stay informed about relevant regulations to ensure compliance.

Importance of Regulatory Compliance

Maintaining regulatory compliance is crucial for businesses to operate legally and ethically. Key benefits include:

- Risk mitigation: Compliance reduces the risk of legal penalties, fines, and reputational damage.

- Enhanced trust: Adhering to regulations builds customer and stakeholder confidence.

- Operational efficiency: Compliance often leads to improved internal processes and controls.

- Competitive advantage: Some industries view good compliance as a competitive differentiator.

Failure to comply can result in severe consequences, including financial losses, legal action, and damage to brand reputation. Organizations must allocate adequate resources for compliance efforts, including budget and personnel, to effectively navigate the regulatory landscape.

Monitoring Regulatory Changes

Regulatory compliance is a critical aspect of modern business operations. Companies must stay informed about changes in laws, regulations, and industry standards to maintain compliance and avoid potential penalties. This process involves continuous monitoring of various sources for updates that may impact an organization's operations.

Regulatory change management is a complex task that requires diligence and attention to detail. Compliance professionals are responsible for tracking and interpreting new regulations, assessing their impact on the company, and implementing necessary changes to ensure ongoing compliance.

The regulatory landscape constantly evolves, introducing new laws and amendments regularly. Organizations must be prepared to adapt quickly to new requirements to avoid compliance risks and potential legal issues.

Effective regulatory monitoring involves staying up-to-date with changes from multiple sources, including:

- Government websites

- Regulatory agency publications

- Industry associations

- Legal databases

- News outlets

Compliance teams often need help managing the sheer volume of regulatory information. Manual monitoring can be time-consuming and prone to human error. As a result, many organizations are turning to automated solutions to streamline their regulatory change management processes.

Start monitoring pages for regulatory changes

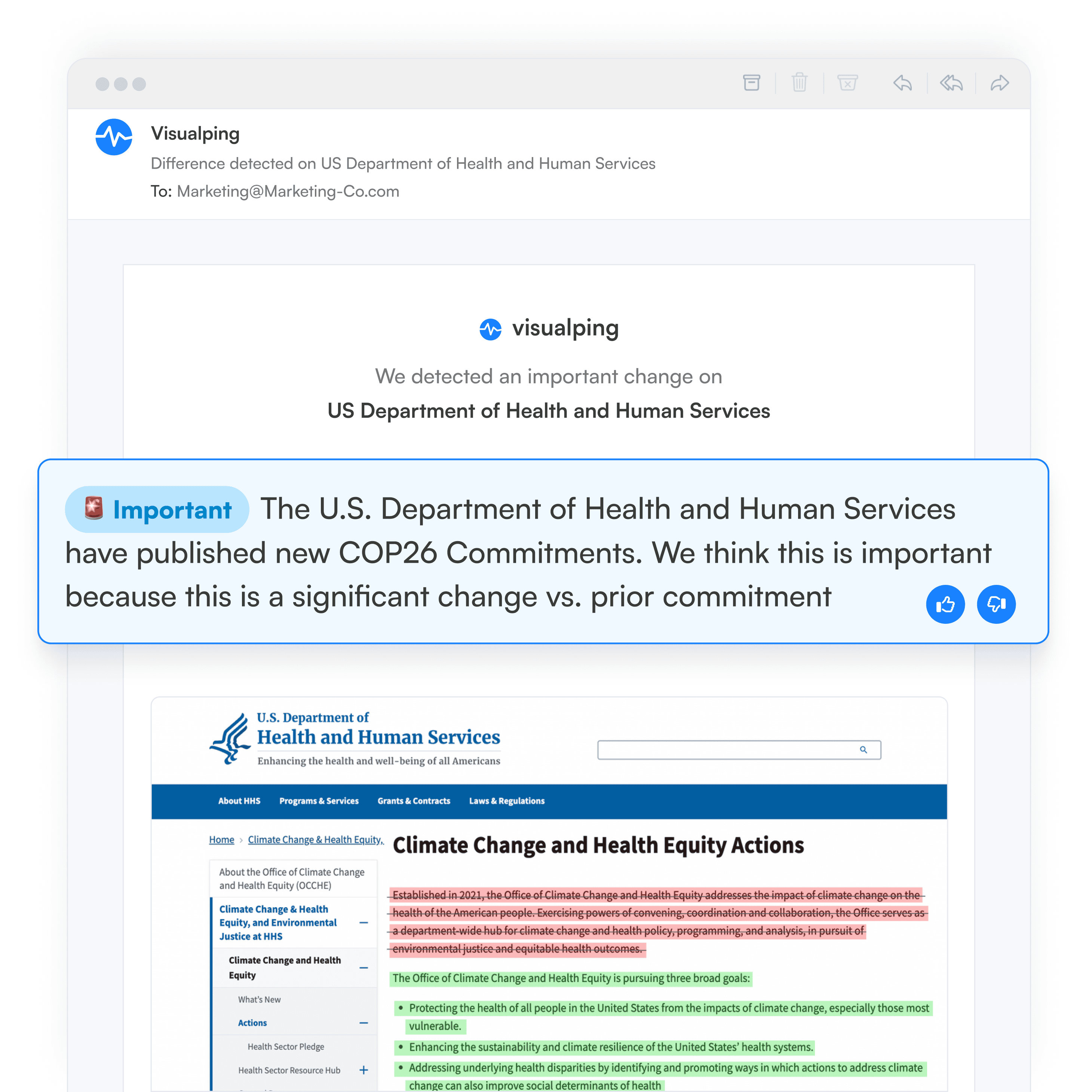

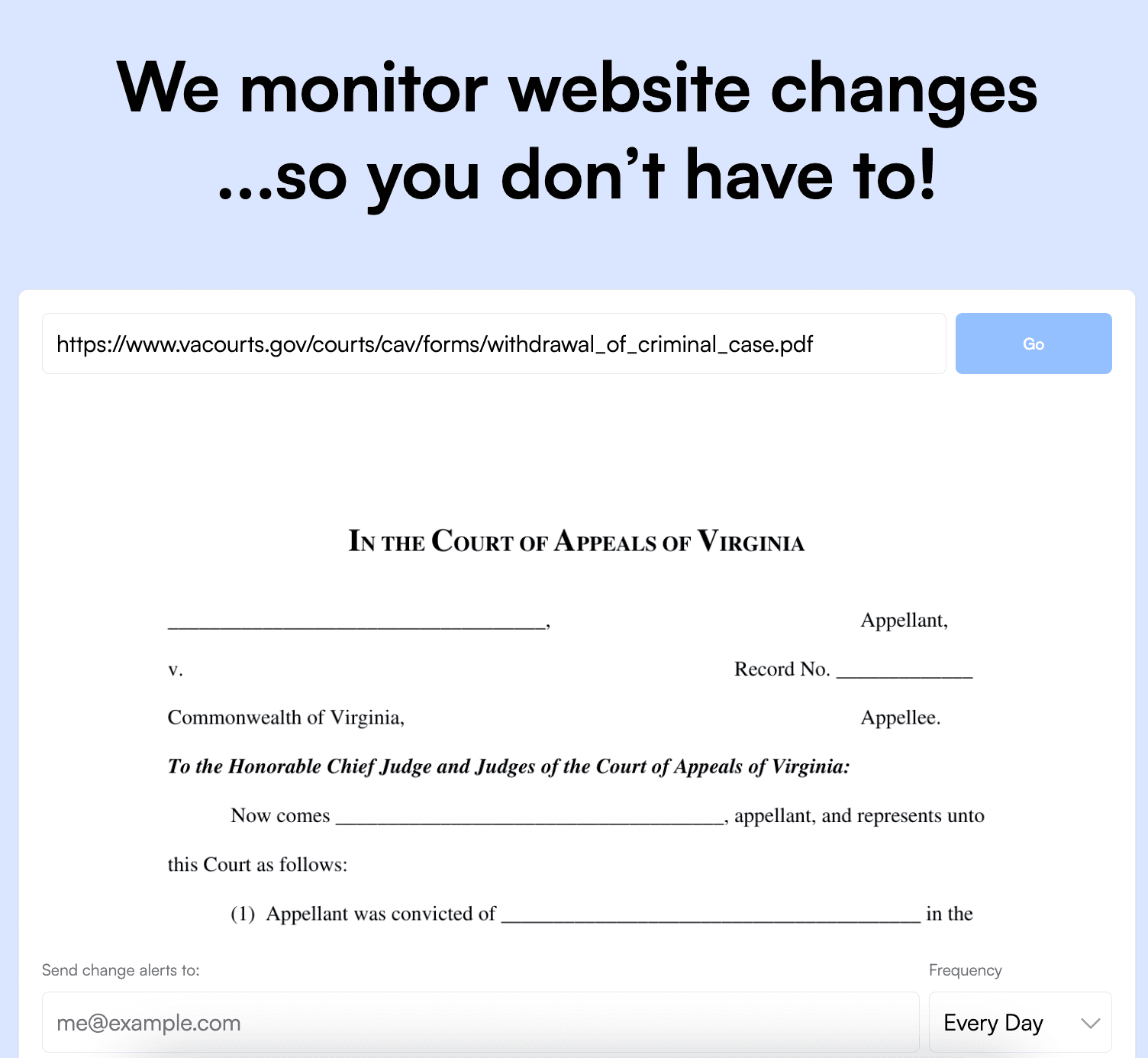

Visualping is an AI-powered regulatory tracking software. It tracks any web pages with AI, automatically notifying you, via email, when a change occurs. The notification includes an AI summary of the change, and a screenshot, allowing compliance professionals to focus on analyzing and implementing necessary changes.

Key features of Visualping for regulatory monitoring include:

- AI Summaries: Understand the regulatory update quickly with a summary that distills the change in two to three lines.

- Customizable monitoring frequency: Depending on the urgency of potential changes, users can set checks as often as every 2 minutes or as infrequently as once a week.

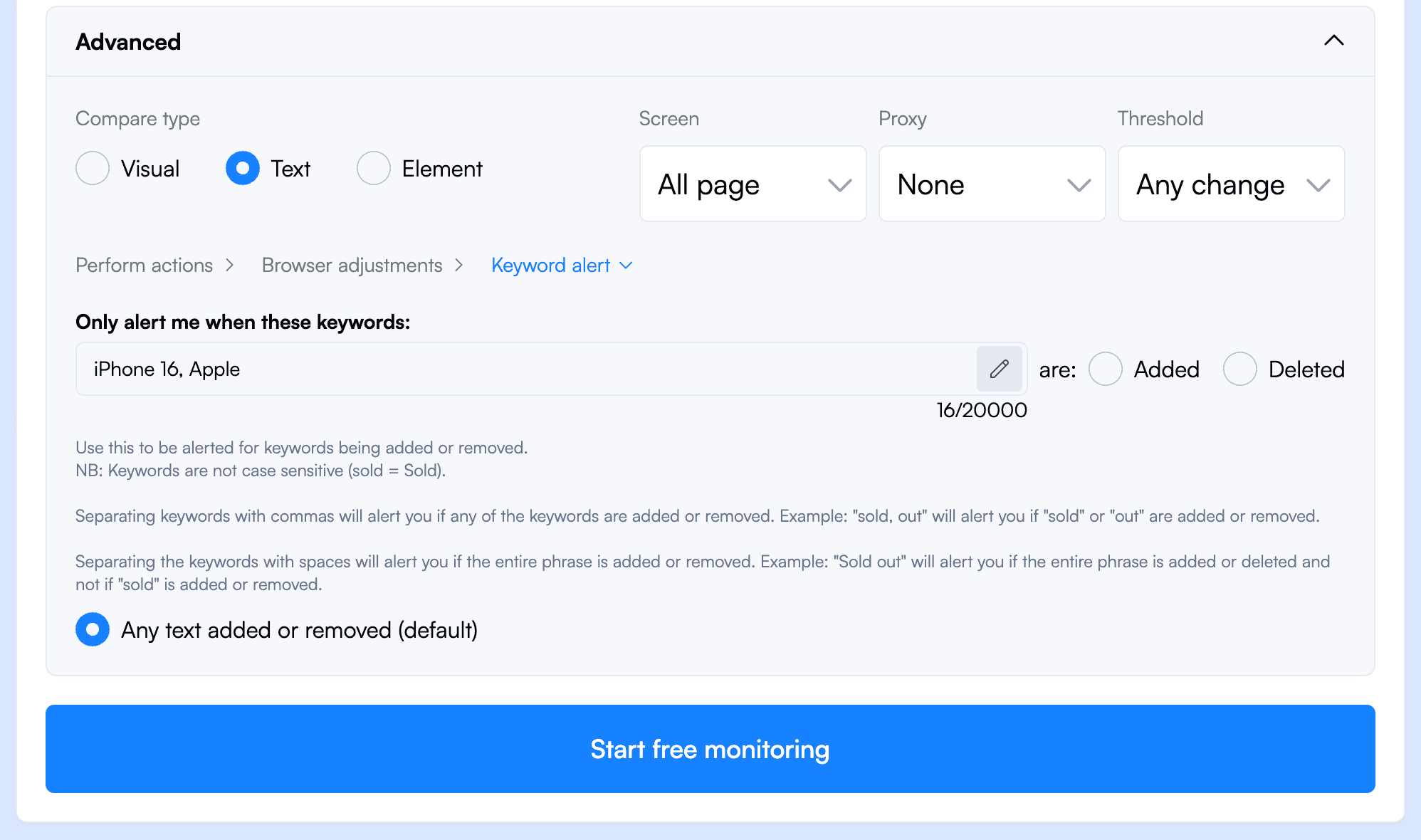

Text and visual comparison modes:

- Text-compare mode highlights textual changes, which is ideal for monitoring legal documents or policy statement updates.

- Visual-compare mode captures visual changes, which is useful for tracking schedule updates or graphical representations of data.

And tools designed to save time and detect only important changes:

- Keyword alerts: This feature allows users to filter notifications based on specific keywords, ensuring they only receive alerts for relevant changes.

- Real-time email notifications: When changes are detected, Visualping sends immediate email alerts with screenshots highlighting the modifications.

- AI Summaries and Analysis: These are used to summarize and identify key information on any detected change, allowing the reader to quickly understand what’s changed and its impact.

Visualping's capabilities extend beyond simple change detection. The tool can be particularly valuable for:

Legal firms monitoring changes in legislation for their clients Healthcare organizations tracking updates to HIPAA regulations Financial institutions staying compliant with evolving banking regulations Environmental compliance officers monitoring changes in sustainability requirements

By automating the monitoring process, compliance teams can:

Reduce the risk of missing critical updates Save time on manual checks Improve accuracy in detecting changes Focus more on strategic compliance activities Visualping offers various subscription plans to accommodate different organizational needs.

Implementing an automated regulatory monitoring system like Visualping can significantly enhance an organization's compliance efforts. It systematically tracks regulatory changes, enabling companies to respond promptly to new requirements and maintain continuous compliance.

As regulatory scrutiny increases across industries, the importance of efficient and reliable compliance monitoring tools cannot be overstated. Organizations can better protect themselves from compliance risks, reputational damage, and potential legal penalties by leveraging technology to streamline the regulatory change management process.

Engaging in Regulatory Intelligence

Regulatory intelligence involves analyzing trends, predicting future changes, and understanding the broader regulatory landscape.

Key activities include:

- Monitoring proposed rules and public comments

- Tracking enforcement actions and regulatory priorities

- Analyzing industry peer responses to new regulations

- Engaging with regulators through industry forums and consultations

Building relationships with regulators and participating in industry working groups can provide valuable insights. This proactive approach allows organizations to anticipate changes and influence regulatory outcomes.

Leveraging external expertise through consultants or legal advisors can supplement internal knowledge. These experts often have broad perspectives on regulatory trends across multiple jurisdictions and industries.

Developing a Compliance Program

A compliance program forms the foundation for effectively monitoring regulatory changes. It encompasses creating internal policies, training staff, and implementing verification processes to ensure adherence to regulations.

Creating Internal Policies

Internal policies serve as the backbone of a compliance program. They outline specific procedures and guidelines that align with regulatory requirements.

Organizations should develop clear, concise policies that address key compliance areas relevant to their industry.

These policies must be easily accessible to all employees and regularly updated to reflect changing regulations. A centralized policy management system can streamline this process, ensuring version control and timely distribution of updates.

Effective policies include detailed instructions on handling sensitive information, reporting violations, and escalating concerns. They should also define roles and responsibilities for compliance-related tasks within the organization.

Training and Awareness

Compliance training is crucial for fostering a culture of regulatory adherence.

Organizations should implement comprehensive training programs that cover relevant regulations, internal policies, and compliance obligations.

Training sessions should be tailored to different roles within the company, focusing on job-specific compliance requirements.

Interactive e-learning modules, workshops, and scenario-based exercises can enhance engagement and retention of compliance knowledge.

Regular refresher courses help keep employees up-to-date with evolving regulations. Tracking attendance and completion rates ensures all staff members receive the necessary training.

Awareness campaigns, such as compliance newsletters or intranet posts, can reinforce key compliance messages between formal training sessions.

Compliance Verification and Evidence Collection

Verifying compliance and collecting evidence are essential for demonstrating regulatory adherence.

Organizations should establish systematic processes to monitor compliance across all relevant areas.

Regular audits and assessments help identify gaps in compliance practices. These can include internal reviews, third-party audits, and department head self-assessments.

Implementing compliance management software can automate evidence collection, making tracking and storing relevant documentation easier.

This may include training records, policy acknowledgments, and audit reports.

Organizations should maintain a clear audit trail of compliance activities. This includes documenting decisions, actions taken, and remediation efforts in response to identified issues.

Integration of Compliance in Operations

Integrating compliance into operations requires aligning business strategies, maintaining continuous compliance, and ensuring good data management and protection.

These elements combine to create a comprehensive approach that embeds regulatory adherence into daily activities.

Aligning Compliance with Business Strategies

Organizations can integrate advanced analytics and AI-driven tools into their finance and operational functions to proactively monitor and respond to regulatory changes.

This approach enhances organizational efficiency by automating compliance processes.

Key strategies include:

- Embedding compliance objectives into business goals

- Training employees on regulatory requirements

- Implementing risk assessment frameworks

Regular review of business processes ensures they align with current regulations. Companies can create cross-functional teams to identify areas where compliance intersects with operations, fostering a culture of responsibility.

Continuous Compliance

Maintaining continuous compliance involves establishing systems that adapt to evolving regulatory landscapes.

Organizations need to create support networks, both internally and externally, involving in-house teams and industry experts.

Effective practices include:

- Developing "compliance champions" within departments

- Utilizing real-time monitoring tools for regulatory updates

- Conducting regular compliance audits

Automated compliance software can help track changes and ensure ongoing adherence to regulations. This proactive approach minimizes risks and reduces the likelihood of non-compliance incidents.

Data Management and Protection

Organizations must prioritize effective data management as data protection and privacy laws become more stringent.

This involves implementing systems that safeguard sensitive information while ensuring accessibility for authorized personnel.

Key considerations include:

- Encrypting sensitive data

- Implementing access controls

- Regularly updating data security protocols

Organizations should conduct periodic assessments of their data handling practices to ensure compliance with regulations like GDPR or CCPA.

Tailorable monitoring modes can be implemented to track changes in data protection laws and adjust practices accordingly.

Responding to Compliance Violations

Effective response to compliance violations requires swift action and a strategic approach. Addressing enforcement fines, legal penalties, and mitigating reputational damage are crucial steps in managing the aftermath of regulatory breaches.

Handling Enforcement Fines and Legal Penalties

Organizations must act quickly to minimize financial impact when faced with enforcement fines or legal penalties. The first step is to assess the violation's severity and understand the regulatory body's expectations for remediation.

Engage legal counsel immediately to navigate the complexities of the enforcement process. They can negotiate with regulators and potentially reduce penalties.

Create a detailed corrective action plan outlining steps to address the violation and prevent future occurrences. This plan should include:

- Root cause analysis

- Specific remediation actions

- Timelines for implementation

- Responsible parties for each task

Allocate resources to implement the corrective measures promptly. Consider establishing a dedicated team to oversee the remediation process and ensure compliance.

Mitigation of Reputational Damage

Compliance violations can significantly harm an organization's reputation. To mitigate this damage, develop a comprehensive communication strategy targeting key stakeholders.

Be transparent about the violation and the steps being taken to address it. Provide regular updates on progress to maintain trust and credibility.

Consider the following actions:

- Issue a public statement acknowledging the violation

- Engage in proactive media outreach to control the narrative

- Communicate directly with customers, partners, and investors

Implement enhanced compliance monitoring systems to demonstrate commitment to preventing future violations. This may include adopting new technologies or strengthening internal controls.

Internal training sessions should be conducted to reinforce compliance practices among employees. This shows a dedication to fostering a culture of compliance within the organization.

Collaboration and Stakeholder Engagement

Effective regulatory compliance monitoring requires active participation from various parties within an organization. Companies can create a strong compliance framework that adapts to changing regulations by fostering collaboration and engaging stakeholders.

Involving Stakeholders in Compliance Processes

Stakeholder engagement is crucial for successful compliance management. Identify key stakeholders affected by regulatory changes, including employees, managers, and external partners. Establish clear communication channels to inform them about new requirements and potential impacts on their roles.

Organize regular meetings and workshops to gather input from stakeholders. Their insights can help identify potential compliance risks and practical solutions. Encourage open dialogue and create a culture where stakeholders feel comfortable raising concerns or suggestions.

Implement a feedback system to improve compliance processes continuously. This can include surveys, suggestion boxes, or digital ideas-sharing platforms. Regularly review and act on stakeholder feedback to refine compliance strategies.

Role of Compliance Teams and Legal Departments

Compliance teams and legal departments are crucial in monitoring regulatory changes. They must stay up-to-date with evolving regulations and interpret their implications for the organization.

These teams should:

- Conduct regular compliance audits

- Develop and update policies and procedures

- Provide training to employees on new compliance requirements

- Collaborate with other departments to implement necessary changes

Legal departments can offer expert guidance on regulatory issues. They should work closely with compliance teams to thoroughly understand new regulations and their legal implications.

Establish a cross-functional team comprising members from compliance, legal, and other relevant departments. This team can assess the impact of regulatory changes and develop comprehensive implementation strategies.

We hope that, with these ideas, you’ll have a solid grasp of the basics of regulatory compliance and monitoring and can start developing your own compliance strategies. Good luck!

Want to stay on top of non-compliance?

Sign up with Visualping to detect issues from any web page online – before your business is on the line.

Eric Do Couto

Eric is the Senior Partnerships Manager at Visualping. Eric has over 10+ years of experience in Marketing and Growth Leadership roles across various industries.