What Is Competitive Intelligence? Definition, Types, Sources, and How to Get Started | Visualping Blog

By Eric Do Couto

Updated February 13, 2026

What Is Competitive Intelligence? Definition, Types, Sources, and How to Get Started

By Eric Do Couto, Head of Marketing at Visualping | Updated February 2026 | Originally published 2021

Competitive intelligence (CI) is the systematic process of collecting, analyzing, and acting on publicly available information about competitors, customers, and market conditions to make better business decisions.

If you have ever checked a competitor's pricing page before a sales call, scanned their job listings to see what roles they are hiring for, or read their latest press release to understand their product direction, you have already practiced a form of competitive intelligence. The difference between casual competitor research and true CI is discipline.

Summary: According to Crayon's 2025 State of Competitive Intelligence Report, sellers now encounter competitors in 68% of deals, yet companies rate their own competitive preparedness at just 3.8 out of 10. That gap costs businesses an estimated $2 million to $10 million per year in lost deals. This guide explains what CI is and how it differs from market research and business intelligence, walks through the five-phase CI process, ranks the highest-value intelligence sources by effort level, and includes a 15-minute quick start so you can build a competitive baseline today. It also covers how to measure CI effectiveness, where AI fits into modern CI programs, and the ethical boundaries every practitioner should know.

Disclosure: This article is published by Visualping, a website change monitoring platform used by businesses for competitive intelligence. Website monitoring is one of several CI methods discussed in this guide. We reference our own tools alongside other solutions, and this guide is designed to be useful regardless of which tools you choose. All third-party statistics have been independently verified.

What Is Competitive Intelligence?

CI transforms scattered data points into actionable insights that help organizations anticipate market changes, identify opportunities, and respond to competitive threats before they become revenue problems.

The Strategic Consortium of Intelligence Professionals (SCIP), a global nonprofit representing over 25,000 CI practitioners in 120 countries, describes CI as a discipline that enables organizations to reduce strategic risk and increase revenue opportunities by developing a deep understanding of their competitive environment.

Gartner defines competitive intelligence as the analysis of an enterprise's marketplace to understand what is happening, what will happen, and what it means to the enterprise.

Both definitions share a common thread: CI goes beyond data collection. The value comes from turning raw information into knowledge that drives specific decisions, whether that means adjusting a product roadmap, repositioning against a new competitor, or arming a sales team with talking points before a critical pitch.

CI vs. Market Research vs. Business Intelligence

These three disciplines are related but serve different purposes. Understanding the distinction helps organizations invest in the right capabilities for their specific needs.

| Dimension | Competitive Intelligence | Market Research | Business Intelligence |

|---|---|---|---|

| Core question | What are competitors doing, and what does it mean for us? | What do customers want, and how is the market evolving? | How is our own business performing? |

| Focus | Outward (rivals) | Outward (buyers and markets) | Inward (operations) |

| Primary sources | Competitor websites, press releases, patent filings, job postings, customer reviews | Surveys, focus groups, demographic data, purchasing behavior | CRM systems, analytics platforms, ERP software, internal databases |

| Typical output | Battle cards, competitor profiles, strategic briefings | Market sizing reports, buyer personas, demand forecasts | Dashboards, performance reports, trend analyses |

| Informs | Positioning, sales enablement, competitive strategy | Product development, go-to-market strategy | Operational decisions, resource allocation |

In practice, the most effective organizations combine all three: BI reveals internal performance gaps, market research explains what customers want, and CI reveals how competitors are positioning themselves to meet those same needs. Each discipline draws from different sources and serves different decisions, but together they provide a complete picture of where your business stands and where it should go.

If you want to start building a competitive baseline today, skip ahead to the 15-minute quick start.

Types of Competitive Intelligence

CI can be divided into two main categories based on the timeframe and scope of decisions it supports.

Strategic Competitive Intelligence

Strategic CI informs long-range planning and major business decisions. It addresses questions like: Should we expand into a new market? How are industry trends shifting over the next 3 to 5 years? Where should we invest R&D resources?

Example in practice: Your board is evaluating expansion into the Southeast Asian market. You analyze three competitors' APAC hiring patterns over the past 18 months, review their localized product launches, identify regional partnerships they have announced, and track regulatory filings in target countries. This composite picture reveals that two competitors have already committed to the region while a third pulled back after six months. That intelligence directly shapes your expansion timeline, resource allocation, and go-to-market approach.

Tactical Competitive Intelligence

A sales rep is pitching against Competitor X tomorrow morning. You pull their latest pricing page changes from the past 30 days, review three recent G2 reviews highlighting customer complaints about their onboarding process, and compile the key feature gaps they have not addressed. That intelligence goes into a one-page battle card the rep can reference during the call.

That is tactical CI in action: intelligence that supports day-to-day operational decisions. It addresses questions like: How should we position against Competitor X in tomorrow's pitch? What pricing changes have competitors made this quarter? How are competitors responding to the same regulatory change we are facing?

The most effective CI programs maintain both strategic and tactical capabilities. Strategic CI sets the direction. Tactical CI helps win the individual battles along the way.

Why Competitive Intelligence Matters

Sellers encounter competitors in 68% of deals. Companies rate their own competitive preparedness at 3.8 out of 10. That gap costs an estimated $2 million to $10 million per year in lost revenue.

Those figures come from Crayon's annual State of Competitive Intelligence research, which surveys hundreds of product marketers, CI professionals, and sales enablement leaders. The trend lines are consistent year over year:

- According to Crayon's 2025 research, 94% of companies report their markets have become more competitive, a trend that has compounded annually since Crayon began tracking this metric in 2018. The competitive pressure is not cyclical; it is structural.

- Teams that share competitive insights with sales daily saw an 84% increase in competitive sales effectiveness. Frequency of delivery matters as much as quality.

- Companies using conversational intelligence tools (like Gong or Chorus) for competitive intelligence report an 82% lift in win rates. What competitors say in live deals turns out to be the highest-signal source most teams underutilize.

- CI teams reported a 76% year-over-year jump in AI adoption, with 60% now using AI daily. Summarizing content and analyzing large datasets were the top use cases.

Competition is intensifying across every industry, and the organizations that systematically track and act on competitive signals consistently outperform those that rely on instinct alone.

CI delivers value across departments, but the specific value differs substantially depending on who receives the intelligence and how they use it.

For sales teams, CI provides battle cards, competitive positioning guides, and real-time intelligence on pricing changes. This helps reps handle objections, differentiate effectively, and close more competitive deals.

For product teams, CI reveals feature gaps, roadmap direction signals (through job postings and patent filings), and customer pain points expressed in competitor reviews. This helps prioritize development resources where they will have the most market impact.

For marketing teams, CI exposes competitor messaging strategies, content themes, and positioning shifts. This helps marketers differentiate campaigns and identify whitespace in the market narrative.

For executive leadership, CI provides the strategic context for major decisions: market entry, M&A evaluation, pricing strategy, and resource allocation. Without CI, these decisions rely on internal assumptions. With it, leadership can pressure-test strategy against what competitors are actually doing.

The Competitive Intelligence Process

Effective CI follows a cyclical process. Each phase feeds the next, and the cycle repeats as new questions emerge from the insights you uncover.

Phase 1: Define Your Intelligence Requirements

Start by identifying the specific questions your organization needs answered. Vague goals like "learn about our competitors" produce vague results. Specific intelligence requirements produce actionable insights.

Strong intelligence requirements look like: "Which of our top three competitors is investing most aggressively in AI capabilities, and how might that affect our product positioning in the next 12 months?" or "What pricing changes have our competitors made in the last quarter, and how do they compare to our current pricing tiers?"

Weak intelligence requirements look like: "What are our competitors up to?" or "Do a competitive landscape overview." These lead to sprawling, unfocused research that overwhelms stakeholders with data and underwhelms them with insight.

Phase 2: Identify and Prioritize Competitors

You cannot monitor every competitor with equal depth. Prioritize using a tiered approach:

Tier 1 (3 to 5 competitors): The companies your sales team encounters most frequently. These deserve continuous, deep monitoring across all intelligence categories. Check your CRM data to identify which competitors appear most often in lost deals.

Tier 2 (5 to 10 competitors): Emerging players, adjacent companies expanding into your space, or smaller specialists in specific verticals. These warrant regular monitoring with periodic deep dives when significant changes surface.

Tier 3 (broad awareness): The wider competitive landscape, including indirect competitors and potential disruptors. Monitor through industry news, analyst reports, and quarterly reviews.

This tiering prevents the most common CI program failure: trying to track everyone at equal depth, burning out within three months, and abandoning the effort entirely.

Phase 3: Collect Intelligence from Multiple Sources

The most valuable competitive intelligence combines data from multiple source categories. No single source provides a complete picture. The Key Sources section below ranks the highest-value sources by effort level and explains what each reveals. The critical principle at this phase is triangulation: a signal that appears in only one source is a data point. A signal that appears across job postings, website changes, and earnings call language is a pattern worth acting on.

Phase 4: Analyze and Interpret

Raw data becomes intelligence only through analysis. Useful analytical frameworks include:

SWOT analysis compares competitor strengths, weaknesses, opportunities, and threats against your own. This is most useful for strategic CI and executive briefings.

Win/loss analysis examines why deals were won or lost against specific competitors, revealing patterns in positioning, pricing, or product gaps. This is the highest-value analysis for sales enablement.

Trend analysis tracks changes over time, such as pricing trajectory, hiring patterns, or messaging evolution, to predict future moves rather than just documenting past ones. This is where monitoring tools provide the most leverage, turning point-in-time snapshots into ongoing narrative.

Phase 5: Distribute and Act

Intelligence that stays in a report nobody reads is wasted effort. Effective CI programs deliver intelligence in formats designed for their audience:

Battle cards for sales teams: one-page competitive summaries accessible in CRM, Slack, or email. These are the single most impactful CI deliverable. Crayon's State of CI data (first reported in 2021 and widely cited since) shows that 71% of businesses using battle cards report improved win rates, with 93% of those reporting improvements exceeding 20%. (Our free competitor tracking template includes a battle card tab to help you get started.)

Monthly competitor snapshots for product and marketing teams: key changes, trends, and strategic implications distilled into a format that can be consumed in five minutes.

Quarterly strategic briefings for leadership: market landscape shifts, emerging threats, and recommended responses supported by data from multiple sources.

Key Sources for Competitive Intelligence

Not all sources deliver equal value, and the most important sources vary by business type. Here is a prioritization framework organized by effort level and intelligence value.

| Source Category | Intelligence Value | Effort Level | Best For |

|---|---|---|---|

| Competitor websites | High | Low | Pricing strategy, product positioning, messaging shifts, hiring signals |

| Customer review platforms | High | Low | Unfiltered customer sentiment, feature gaps, competitive set identification |

| Social media and blogs | Moderate to High | Low | Thought leadership strategy, campaign themes, positioning shifts |

| Job postings | High | Moderate | Strategic priorities, product investment signals, geographic expansion |

| Financial filings and earnings calls | High | Moderate | Revenue trends, segment performance, forward-looking strategy |

| Patent and trademark filings | Moderate to High | Moderate | R&D direction, product pipeline |

| Field intelligence (sales team) | Very High | Higher | Competitive dynamics in deals, pricing tactics, objection handling |

| Industry analyst reports | High | Higher | Vendor positioning, technology evaluations, procurement influence |

| Conference presentations | Moderate to High | Higher | Strategic direction, roadmap hints, customer success metrics |

High Value, Low Effort (Start Here)

Start with competitor websites. They are the single richest public intelligence source available to any CI program.

Pricing pages reveal positioning and packaging strategy. Product pages reveal feature priorities and messaging direction. Career pages reveal hiring priorities, which often signal strategic investments 6 to 12 months before public announcements. Homepage messaging reveals brand positioning and target audience focus. (The section on what specific website changes reveal below goes deeper into how to interpret each type of change.)

Customer review platforms like G2, Capterra, TrustRadius, and Trustpilot provide unfiltered customer sentiment. Pay attention to recurring complaint themes (these reveal product weaknesses), feature requests (these reveal unmet needs), and comparisons reviewers draw to other tools (these reveal your real competitive set from the buyer's perspective).

Social media and blog content reveals thought leadership strategy, campaign themes, and product announcement cadence. Changes to LinkedIn company profiles often accompany rebranding or positioning shifts.

High Value, Moderate Effort

Job postings reveal strategic priorities before they become public. A competitor hiring five machine learning engineers signals an AI product investment. A sudden cluster of enterprise sales roles suggests a move upmarket. A new "Head of APAC" listing reveals geographic expansion plans. These signals are available months before official announcements.

Financial filings and earnings calls (for public competitors) contain detailed segment breakdowns, risk factors, revenue trends, and forward-looking statements. Earnings call transcripts are especially valuable because executives often reveal strategic priorities in response to analyst questions that they would never put in a press release.

Patent and trademark filings reveal R&D direction and product concepts competitors are developing or protecting.

High Value, Higher Effort

Field intelligence from your sales team captures competitive dynamics that never appear in public data: how competitors pitch, what discounts they offer, which features they emphasize, and how they handle objections. (For a deeper look at collection methods, see our guide to competitive intelligence gathering.) Systematizing this feedback through CRM fields, Slack channels, or regular debrief sessions transforms anecdotal observations into structured intelligence.

Industry analyst reports from firms like Gartner, Forrester, and IDC provide curated competitive landscapes and technology evaluations. These are particularly valuable for understanding how analysts position and compare vendors, since many enterprise buyers rely on analyst recommendations during procurement.

Conference presentations and webinars by competitor executives often reveal strategic direction, customer success metrics, and product roadmap hints that do not appear in any other public channel.

What Specific Website Changes Reveal

Because competitor websites are updated frequently and contain deliberate strategic signals, understanding what different types of changes mean is a critical CI skill:

Pricing page restructures often precede or accompany a shift in target market. Moving from simple pricing to enterprise "contact us" tiers suggests a move upmarket. Removing a free tier signals a shift toward higher-value customers. In one case, a B2B software company we work with noticed their primary competitor had quietly removed their lowest pricing tier over a weekend. Within two weeks, the competitor announced an "enterprise-first" repositioning. The pricing page change was the earliest signal, appearing days before any press release or blog post. That lead time allowed the company to proactively update their competitive positioning and brief their sales team before the announcement reached prospects.

New landing pages for specific industries reveal vertical expansion strategies. When a competitor launches a "/financial-services" or "/healthcare" page, they are investing in industry-specific messaging and likely pursuing those verticals with dedicated sales resources.

Feature page additions or removals reveal product roadmap priorities and, sometimes, deprecated capabilities. A competitor quietly removing a feature page may indicate a product pivot or an area where they have fallen behind.

Homepage messaging changes reveal evolving brand positioning. A shift from "easy to use" to "enterprise-grade" signals a maturing product strategy. A shift from feature-focused to outcome-focused messaging suggests a move toward value selling.

Career page spikes in specific departments correlate with upcoming product launches or market pushes.

Terms of service or compliance page updates can signal regulatory preparation, geographic expansion, or new data handling practices. SOC 2 or GDPR compliance pages appearing for the first time often precede a push into enterprise or European markets.

This interpretive layer, knowing what changes mean rather than just that changes occurred, is where CI delivers its greatest value.

Getting Started: A 15-Minute Quick Start

If you are new to CI or want to systematize an informal process, here is how to start today with zero budget and minimal time investment.

Step 1: Identify Your Top Three Competitors (3 minutes)

Open your CRM or ask your sales team: which competitors come up most often in deals? If you do not have CRM data, list the three companies whose names you hear most from prospects or customers. These are your Tier 1 competitors.

Do not overthink this. You can refine your competitive set later. The goal right now is to start with something concrete rather than getting stuck trying to identify every possible competitor.

Step 2: Conduct a Baseline Snapshot (10 minutes)

For each of your three Tier 1 competitors, visit their website and document:

- Their pricing structure: What plans do they offer? What are the price points? What features are included at each tier?

- Their primary messaging: What is the main headline on their homepage? What value proposition are they leading with?

- Their most recent product update: Check their blog, press page, or changelog for the latest product announcement.

Record these in our free competitor tracking template (or a simple spreadsheet of your own). You now have a competitive baseline you did not have 10 minutes ago.

Step 3: Set Up Basic Monitoring (2 minutes)

Bookmark these pages for a weekly manual check, or set up automated monitoring to catch changes as they happen. The critical pages to watch are pricing pages, product/feature pages, homepage messaging, and career listings.

This 15-minute exercise accomplishes two things: it gives you an immediate snapshot of your competitive landscape, and it creates a baseline against which you can track changes over time. Changes are where the real intelligence lives, because a pricing page that has stayed the same for a year tells a different story than one that changed twice last quarter.

Get the template: Download our free competitor tracking spreadsheet to record your baseline and track changes over time. It includes tabs for competitor snapshots, a change log, battle card template, and a CI program dashboard.

Scaling Beyond Manual Checks

Manual competitor research is where most CI programs start, and where many die. Checking three competitors' websites weekly sounds manageable. But within a few months, the scope inevitably expands: you need to track pricing, product pages, career listings, blog updates, press releases, and maybe a few review platforms. Across five or more competitors, that is dozens of pages to check every week. Missed changes during busy weeks start adding up. Two pricing shifts slip by unnoticed. A product launch gets caught a month late. The CI program quietly loses credibility.

This is the natural point where automated website change monitoring becomes the logical next step. Automated monitoring does not replace the analytical thinking that makes CI valuable. It replaces the tedious manual checking that causes CI programs to stall, freeing up your time for the interpretation and action that actually move the needle.

How Website Monitoring Supports Competitive Intelligence

The section below explains how website monitoring tools work for CI, using Visualping as an example. The principles apply to any monitoring solution. See the disclosure at the top of this article for context on our relationship to these tools.

Competitor websites contain some of the most valuable and frequently updated public intelligence signals available. Pricing strategy, product positioning, hiring priorities, partnership announcements, and messaging evolution all surface on websites before they appear in press releases, analyst reports, or industry coverage.

The challenge is that these changes happen unpredictably. A competitor might update their pricing at midnight on a Tuesday. A new product landing page might appear on a Friday afternoon. Without systematic monitoring, these signals get missed, and missed signals turn into lost deals. The key sources section above covers which pages to prioritize and what each type of change reveals. The question is how to catch those changes reliably.

How Automated Monitoring Works

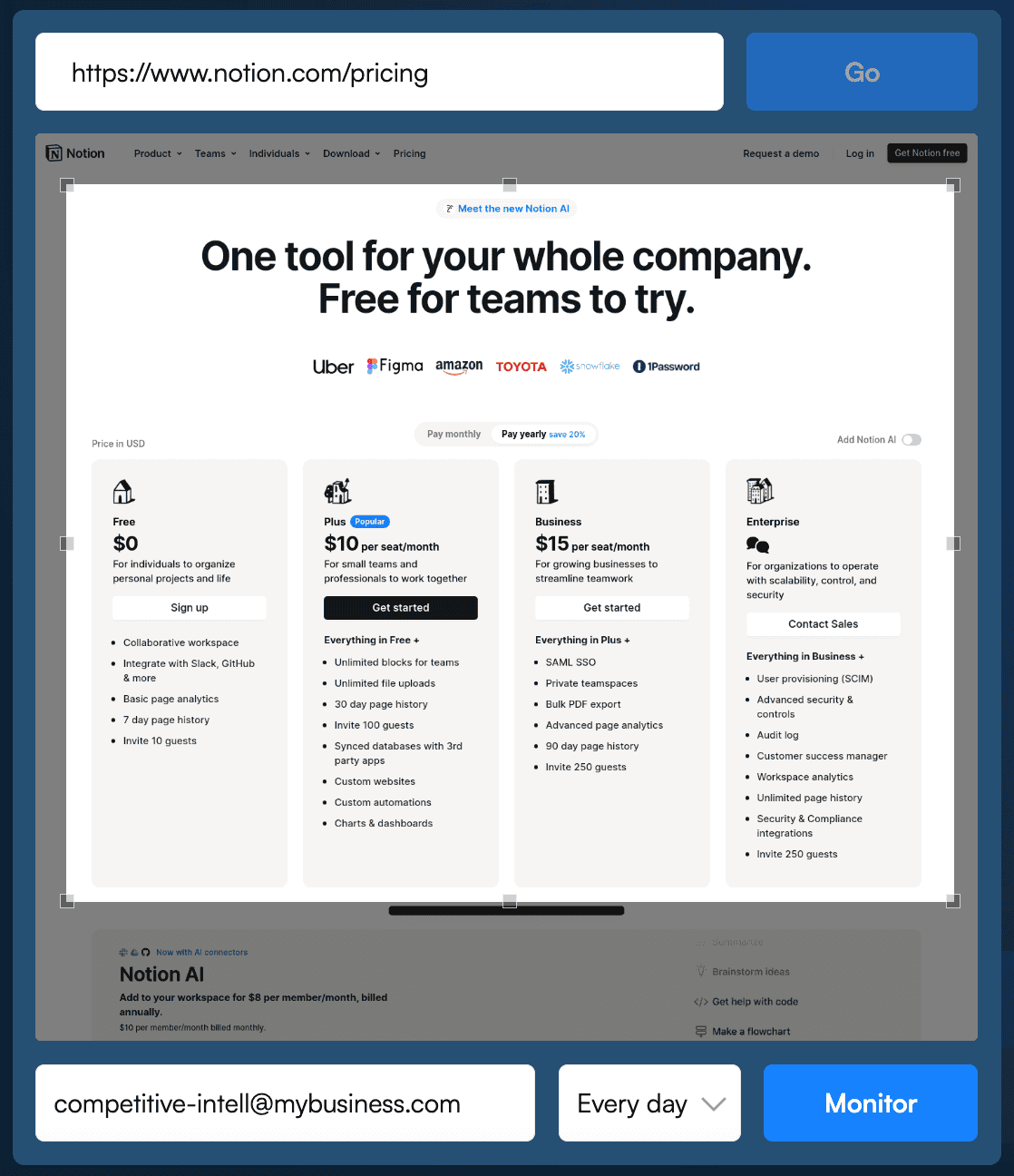

Website change monitoring tools work by capturing snapshots of web pages at regular intervals and comparing them to detect differences. When a change is detected, you receive an alert with details about what changed.

Visualping is an AI-powered website change monitoring platform used by businesses for competitive intelligence. When Visualping detects a change on a page you are tracking, you receive an alert that includes an AI-generated summary of the change distilled into a few sentences, plus a visual comparison highlighting exactly what changed. The platform's AI Important Alerts feature lets you define what matters to your team, such as pricing changes or new product announcements, and then uses AI to evaluate each detected change against your criteria, flagging only the updates that match so your team can skip the noise.

Setting Up Competitor Monitoring

To start monitoring a competitor's website:

- Identify the specific pages that matter most for your intelligence requirements (start with pricing and product pages).

- Set your monitoring frequency based on how often those pages typically change. Daily works for most competitive pages. Hourly may be appropriate during active competitive periods.

- Configure alert recipients so the right team members receive relevant intelligence. Route pricing changes to sales leads. Route product updates to product managers. Route messaging changes to marketing.

- Establish a review rhythm where your team discusses significant changes and their strategic implications.

This monitoring layer turns sporadic competitor checks into a systematic intelligence feed, ensuring your team never misses a significant competitive move.

Setup Process for Website Change Monitoring with Visualping

Setting up website monitoring requires following a systematic approach to track competitor pages effectively.

Here's an easy four step process to allow users to receive automatic notifications when changes occur to competitor websites you monitor.

Step 1: Add Your Target URL to Visualping's Main Page

Users begin by locating the webpage they want to track and copying its complete URL. They navigate to Visualping's main page and paste this URL into the designated input field. This action initiates the monitoring setup process and tells the system which page requires surveillance.

Step 2: Add the Visualping AI Important Definition

- Click on the Tell us what's important section.

- Pick a preset Important Definition or write a custom one in clear, plain language that states exactly what should count as Important and what to ignore.

- (Optional) Click the slider for 'Alert me for important changes only' to only get notifed of important changes.

Good custom examples (copy/paste & tweak):

- "Flag as Important if pricing amounts, plan names, limits, or billing terms change. Ignore blog posts and press releases."

- "Alert if Terms, Privacy, or Security pages add/remove clauses related to data retention, breach notification, encryption, or sub-processors."

- "Mark Important when feature names, availability, or API endpoints change on product or docs pages; ignore cosmetic wording and punctuation."

Pro tip #1: Aim for 2–4 crisp lines using verbs + nouns (e.g., "flag if X changes; ignore Y"). Avoid vague phrases like "major updates."

Pro tip #2 (summary formatting): In your definition, you can request the AI summary output style. Specify a format, language, or even a percentage change vs. the previous version. Add a line like one of these:

- "Summarize in bullet points with a final one-line business impact."

- "Return the summary in JSON with keys

,type, andchanged_fields."impact_level- "Respond in French."

- "Include the percentage change from the prior version for any numeric values (e.g., prices, counts)."

Example (drop-in line): "Format the summary as JSON:

and respond in English."{ "type": "pricing_change", "fields": ["plan", "price"], "percent_change": <number>, "impact": "<low|medium|high>" }

Step 3: Select Your Monitoring Frequency

The next phase involves choosing how frequently the system should scan the webpage for updates. Users can select from various time intervals:

- Hourly checks for urgent monitoring needs

- Daily scans for regular updates

- Weekly reviews for less critical pages

Higher frequency options ensure faster notification delivery when changes happen.

Step 4: Provide Your Notification Email Address and Start Free Monitoring

Users must enter a valid email address where they want to receive change alerts. This email becomes the primary communication channel for all notifications. Double-checking the email accuracy prevents missed notifications and ensures reliable communication.

And then click 'Start Monitoring' and verify your account to start your automated competitor monitoring.

Visualping integrates with tools teams already use, including Slack, Microsoft Teams, Zapier, and n8n, so competitive alerts flow directly into existing workflows without requiring team members to log into a separate platform.

Start monitoring competitor websites for free or explore how other teams use Visualping for competitive intelligence.

Measuring CI Effectiveness

How do you prove that competitive intelligence is worth the investment?

Most CI practitioners struggle with this question. Without clear metrics, CI programs risk being treated as a cost center rather than a revenue driver. In Crayon's 2023 State of CI report (the sixth edition of their annual survey), the share of CI programs with defined key performance indicators had grown 125% since the first report in 2018. The pattern is consistent across every subsequent edition: programs that measure their impact grow, and those that do not eventually get cut.

| Metric | What It Measures | How to Track | Why It Matters |

|---|---|---|---|

| Competitive win rate | % of deals won against known competitors | CRM competitive deal fields, tracked by competitor | Most direct measure of CI impact on revenue |

| Battle card adoption | How often reps access CI materials | Battlecard platform analytics, CRM usage logs | Validates CI content is accessible and useful |

| Intelligence freshness / Time to enablement | How current CI is and how fast changes reach the team | Last-updated timestamps, competitor event date vs. notification date | Outdated CI causes bad positioning; slow CI means missed windows |

| Revenue attribution | Deals won where CI materials were used | CRM fields flagging CI usage in closed-won deals | Ties CI program directly to revenue outcomes |

Competitive win rate is the metric to start with if you measure nothing else. Track the percentage of deals won when a known competitor is involved. Break it down by competitor to identify where your intelligence is strongest and where gaps remain. Even a 5 percentage point improvement in competitive win rate translates to significant revenue impact when applied across your full pipeline.

Battle card adoption rate tells you whether your intelligence is reaching the people who need it. High adoption with improving win rates validates that your CI content is both accessible and useful. Low adoption signals a distribution or format problem, not necessarily a content quality problem.

Intelligence freshness and time to enablement are two sides of the same coin: how current is your CI, and how quickly do competitive changes reach the people who need them? If your battle cards reference competitor pricing from six months ago, they may be doing more harm than good. If a competitor announces a major price cut on Monday and your sales team learns about it Thursday, that four-day window is a period where reps are walking into deals without current intelligence. Automated monitoring tools help close this gap, which is one reason teams with a dedicated CI platform report a 79% increase in effectiveness. One enterprise team we work with tracked this specific metric. Before implementing automated monitoring, the average gap between a competitor's pricing change and their sales team's awareness was 11 days. After implementation, it dropped to under 24 hours. Their competitive win rate against that rival improved by 8 percentage points over the following quarter.

Revenue attribution is the most ambitious metric: tying specific deals won to competitive intelligence inputs. Some organizations track this through CRM fields that flag deals where CI materials were used. Among teams that track this metric, the correlation between CI usage and higher win rates is consistent and measurable.

Teams with a sales executive sponsor for their compete program see a 76% boost in competitive sales effectiveness, according to Crayon's 2025 report. Yet 52% of compete programs still lack a sales executive sponsor. If you can only make one organizational change to improve your CI program, getting an executive champion should be the first priority.

Ethics and Legal Boundaries

A product marketer reads a competitor's public pricing page and records the changes in a spreadsheet. Legal. A sales rep asks a prospect what they liked about a competitor's demo. Legal. An employee creates a fake email address to request a competitor's internal sales deck. Illegal.

The line between competitive intelligence and corporate espionage is not blurry. CI is legal, ethical, and widely practiced. Drawing that line clearly matters for both legal compliance and organizational credibility.

CI is: collecting and analyzing publicly available information through ethical means. This includes reviewing competitor websites, reading public financial filings, analyzing customer reviews, attending industry events, and using monitoring tools that access publicly available web pages.

CI is not: hacking into competitor systems, bribing employees for proprietary information, posing as someone else to extract confidential data, stealing trade secrets, or accessing information through any deceptive or illegal means.

SCIP, introduced earlier in this guide, maintains a professional code of ethics for the CI community. The core principles are unambiguous: disclose your identity and organization when gathering information through direct interactions, comply with all applicable laws, and avoid conflicts of interest.

If the information is publicly accessible or voluntarily shared, collecting it is ethical. If accessing it requires deception, unauthorized access, or violation of any law, it is off limits. There is no gray area worth testing.

Organizations building CI programs should establish clear guidelines for their teams, ensure everyone understands what data sources and methods are permissible, and document their ethical standards. This becomes especially important as CI programs scale and involve team members who may not have formal training in intelligence ethics. The cost of getting this wrong is not just legal liability; it is the credibility of the entire CI function within the organization.

Frequently Asked Questions

What is the difference between competitive intelligence and corporate espionage?

CI uses publicly available information gathered through legal and ethical methods. Espionage involves illegal activities like hacking, theft, bribery, or deception to obtain proprietary information. The Ethics and Legal Boundaries section above covers the distinction in detail, including concrete examples and SCIP's professional code of ethics.

How much does a competitive intelligence program cost?

Costs vary widely depending on scope. A basic CI program using free tools (Google Alerts, manual website checks, public review monitoring) costs nothing beyond staff time. Mid-range programs using automated monitoring tools like Visualping or dedicated CI platforms typically cost between $50 and $500+ per month based on publicly listed pricing across common CI and monitoring tools. Enterprise CI programs with dedicated analysts, multiple platform subscriptions, and custom research can cost significantly more. Many organizations start with free tools and scale investment as they demonstrate ROI through improved win rates and faster competitive response times.

How often should I gather competitive intelligence?

Match frequency to the competitor tiers described above. Tier 1 competitors warrant continuous or at least weekly monitoring. Tier 2, monthly. Tier 3, quarterly. Critical pages like competitor pricing and product pages benefit from daily automated monitoring since changes can happen at any time and missed changes directly affect sales conversations.

What tools do I need to start a competitive intelligence program?

None. The 15-minute quick start above uses only a spreadsheet and a web browser. As your program matures, tools that automate repetitive tasks (like website change monitoring, review aggregation, or social listening) free up time for analysis and strategic thinking, which is where CI delivers the most value. See our roundup of top free competitive intelligence tools for options at every budget level.

How is AI changing competitive intelligence?

According to Crayon's 2025 data, 60% of CI teams now use AI daily, a sharp acceleration from prior years. The most common AI use cases in CI include summarizing large volumes of competitor content, categorizing intelligence by type and urgency, analyzing patterns across multiple data sources, and generating draft battle card content. AI does not replace the strategic judgment that makes CI valuable, but it significantly reduces the time spent on data collection and preliminary analysis, allowing CI professionals to focus on interpretation and action. Visualping's AI competitor monitoring capabilities are one example of how AI is being applied to automate the detection and summarization of competitive signals.

Related Resources

- The Complete Guide to Competitive Intelligence Sources (27 Sources)

- How to Conduct a Competitive Pricing Analysis

- Competitive Marketing Intelligence: The Complete Guide

- Top Free Competitive Intelligence Tools

- AI Competitor Monitoring: How It Works

- Crayon's State of Competitive Intelligence Report (annual industry benchmark)

- SCIP: Strategic Consortium of Intelligence Professionals (global CI community and certification)

Visualping: competitor monitoring made simple

Get targeted updates from the competition on autopilot. Trusted by 85% of Fortune 500 companies.

Eric Do Couto

*Eric Do Couto is the Head of Marketing at Visualping. He has over a decade of experience leading marketing and growth teams across finance, accounting, education, and food safety industries. His work in competitive intelligence draws on hands-on experience building monitoring systems and CI workflows for B2B organizations.*