The Complete Guide to Competitive Intelligence Sources: 27 Essential Channels to Monitor in 2026

By Eric Do Couto

Updated January 8, 2026

The Complete Guide to Competitive Intelligence Sources: 27 Essential Channels to Monitor in 2026

Originally Published: 2024

Author: Eric Do Couto, Head of Marketing at Visualping

Reading Time: 18 minutes

Disclosure: This article is written by the Head of Marketing at Visualping, a website change detection tool. The methodologies described can be implemented using various tools or manual processes, and readers should evaluate solutions based on their own requirements and budget.

Introduction: Why Competitive Intelligence Matters

Competitive intelligence (CI) is no longer optional for businesses seeking sustainable growth. The Strategic Consortium of Intelligence Professionals (SCIP), the global nonprofit organization representing over 25,000 CI practitioners in 120 countries, defines CI as a discipline that enables organizations to reduce strategic risk and increase revenue opportunities by developing a deep understanding of their competitive environment.

The numbers underscore CI's business impact:

- 90% of Fortune 500 companies actively use competitive intelligence tools and techniques to gain market advantage (Source: Emerald Insight, cited by Evalueserve)

- The global competitive intelligence market was valued at approximately $50.87 billion in 2024 and is projected to grow to $122.77 billion by 2033, reflecting a 9.1% compound annual growth rate (Source: DataHorizon Research)

- Organizations with dedicated CI platforms outperform the global stock market average, according to Valona Intelligence's Global Intelligence Report

- Companies using conversational intelligence tools for competitive intelligence report an 82% lift in win rates (Source: Crayon 2025 State of Competitive Intelligence Report)

Yet the fundamental challenge remains: where do you look, and how do you prioritize what to monitor?

This guide provides a comprehensive framework for identifying, prioritizing, and monitoring the most valuable competitive intelligence sources. Whether you are building your first CI program or refining an existing one, these 27 sources represent the foundation of effective competitive monitoring. Website change detection tools can automate much of this monitoring process (see The Ultimate Guide to Competitor Tracking for implementation details).

The Competitive Intelligence Framework

Before diving into specific sources, it helps to understand how competitive intelligence fits into broader business strategy. Gartner's Market Guide for Competitive and Market Intelligence Tools (June 2024) identifies three core phases of CI activity:

1. Intelligence Gathering

Collecting raw information from diverse sources, including websites, financial filings, social channels, and industry publications.

2. Analysis and Synthesis

Transforming raw data into actionable insights through pattern recognition, trend identification, and strategic interpretation.

3. Distribution and Action

Delivering insights to stakeholders in formats that enable decision-making, from sales battlecards to executive briefings.

The sources outlined in this guide primarily support the first phase, though many provide data that facilitates analysis as well.

The Intelligence Cycle

Effective CI programs follow a continuous cycle:

Plan → Collect → Process → Analyze → Disseminate → Evaluate → Plan

This cycle ensures that intelligence gathering remains aligned with business objectives and that insights reach the people who need them.

Prioritization Guide: Where to Start

Not all intelligence sources deserve equal attention. Your prioritization should depend on your industry, competitive landscape, and available resources.

High Priority (Monitor Daily)

These sources provide high-value signals that often indicate strategic shifts:

| Source | Why It Matters | Best For |

|---|---|---|

| Pricing Page | Pricing changes directly impact competitive positioning | SaaS, E-commerce, B2B services |

| Home Page | Major messaging shifts signal strategic pivots | All industries |

| Press Releases | Official announcements of partnerships, products, funding | All industries |

| Job Postings | Hiring patterns reveal investment priorities | Tech, Professional services |

| Ad Libraries | Advertising activity shows marketing focus areas | Consumer brands, E-commerce |

Medium Priority (Monitor Weekly)

These sources provide valuable context and early warning signals:

| Source | Why It Matters | Best For |

|---|---|---|

| Blog Content | Marketing focus and thought leadership direction | B2B, Content-driven businesses |

| Executive Team Page | Leadership changes signal strategic shifts | Enterprise, Funded startups |

| Help Center | Product feature emphasis and customer success focus | SaaS, Tech products |

| Third-Party Reviews | Customer sentiment and competitive perception | Consumer products, SaaS |

| Social Media Profiles | Positioning and campaign messaging | Consumer brands, B2C |

Lower Priority (Monitor Bi-Weekly)

These sources provide supplementary intelligence:

| Source | Why It Matters | Best For |

|---|---|---|

| Terms and Conditions | Service level and policy changes | SaaS, Financial services |

| Robots.txt/Sitemap | Site structure and content strategy insights | Digital-first competitors |

| Wikipedia | Company narrative and public perception | Public companies, Large enterprises |

| Crunchbase | Funding and growth trajectory | Startups, Tech companies |

Resource Allocation Guidance

Small teams (1-2 people): Focus exclusively on high-priority sources for your top 3-5 competitors. Manual monitoring may be sufficient at this scale, supplemented by free competitive intelligence tools.

Medium teams (3-5 people): Cover high and medium priority sources. Use automation tools like AI-powered competitor monitoring to increase coverage and reduce manual effort.

Large teams (6+ people): Comprehensive monitoring across all source types, integrated with analysis workflows and automated distribution.

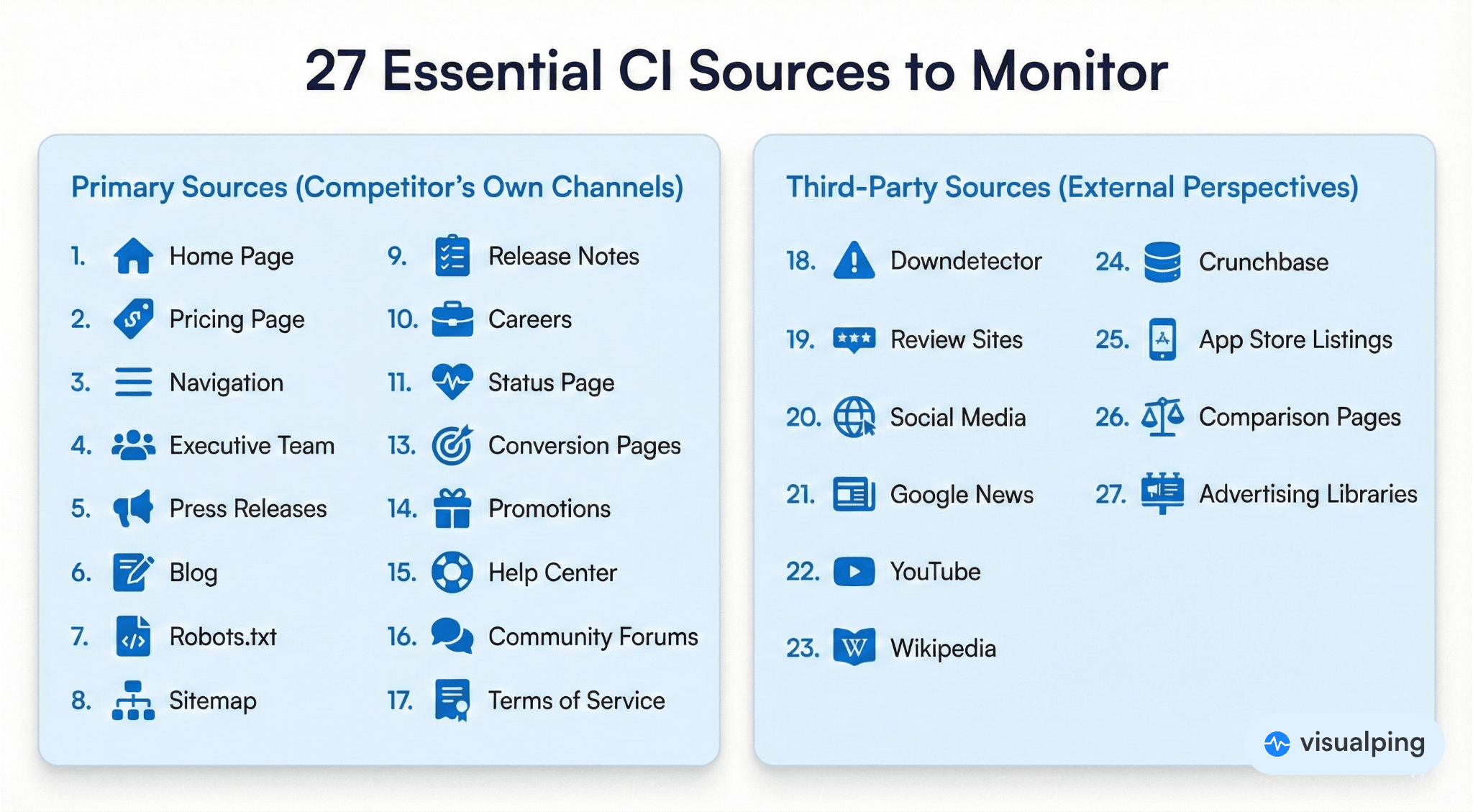

Primary Intelligence Sources: Your Competitor's Own Channels

The most reliable intelligence often comes directly from competitors themselves. These sources reveal intentional communications and unintentional signals about strategy and priorities.

1. Home Page

The home page represents your competitor's primary external communication. Changes here require significant internal alignment, meaning they signal deliberate strategic decisions.

What to Monitor:

- Main headline and value proposition changes

- Featured customer logos or testimonials

- Navigation structure modifications

- Visual design overhauls

- Call-to-action messaging

Intelligence Value: High. Home page changes often precede or accompany major strategic pivots, rebranding efforts, or market repositioning.

Monitoring Frequency: Daily

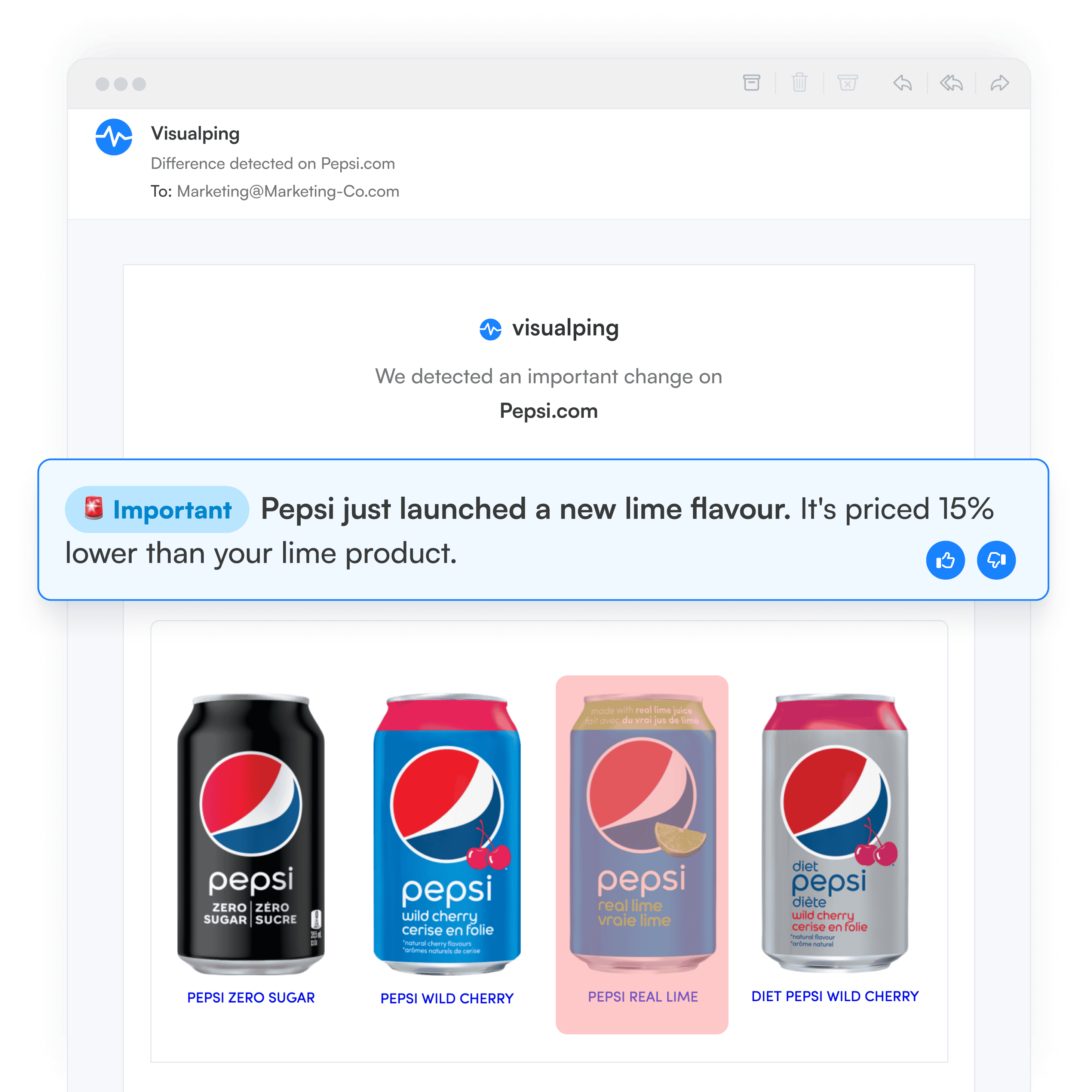

How to Monitor: Use Visualping's home page monitoring to receive automatic alerts when competitors update their main messaging or design.

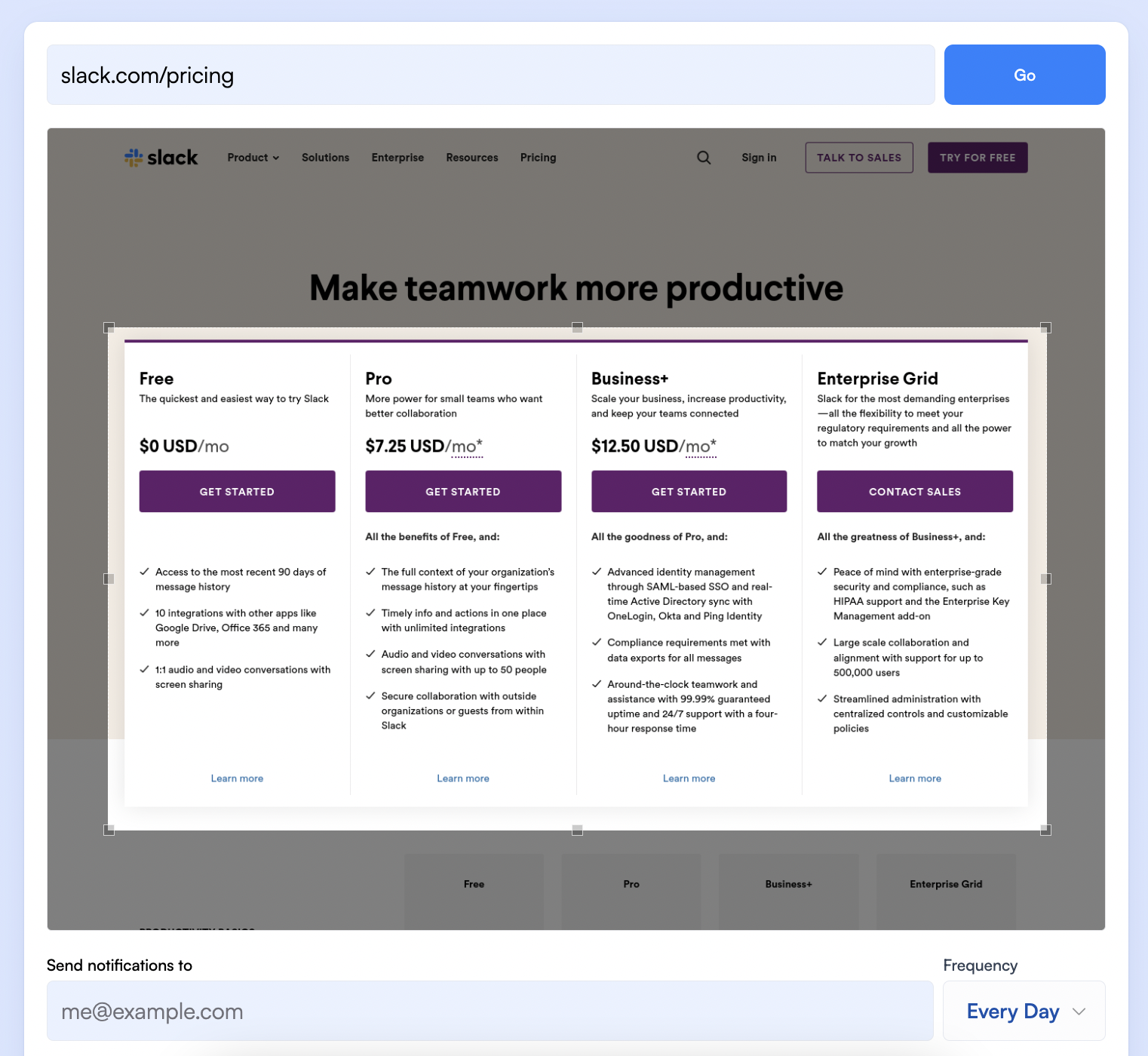

2. Pricing Page

For businesses with published pricing, this page offers direct insight into competitive positioning, packaging strategy, and target market focus.

What to Monitor:

- Price point changes (increases or decreases)

- Tier restructuring or new plan introductions

- Feature allocation across tiers

- Free trial or freemium model changes

- Enterprise or custom pricing messaging

Intelligence Value: Very High. Pricing changes directly impact competitive dynamics and often reflect broader market pressures or strategic shifts.

Monitoring Frequency: Daily

How to Monitor: Set up competitive pricing analysis monitoring to track competitor pricing pages and receive alerts when prices, tiers, or packaging change.

Try it yourself: Set up a free pricing monitor for one competitor to see automated tracking in action.

Note: According to Gartner's 2023 Tech Marketer Role Survey, 74% of respondents said they must address competitive and market intelligence challenges within 12 months to ensure their teams' success, highlighting the strategic importance of pricing intelligence.

3. Navigation and Site Architecture

Navigation changes reveal how competitors want visitors to experience their site and which areas they consider most important.

What to Monitor:

- New menu items or categories

- Removed or consolidated sections

- Dropdown structure changes

- Featured link prominence

Intelligence Value: Medium to High. Navigation changes often accompany new product launches, market expansions, or deprecation of offerings.

Monitoring Frequency: Weekly

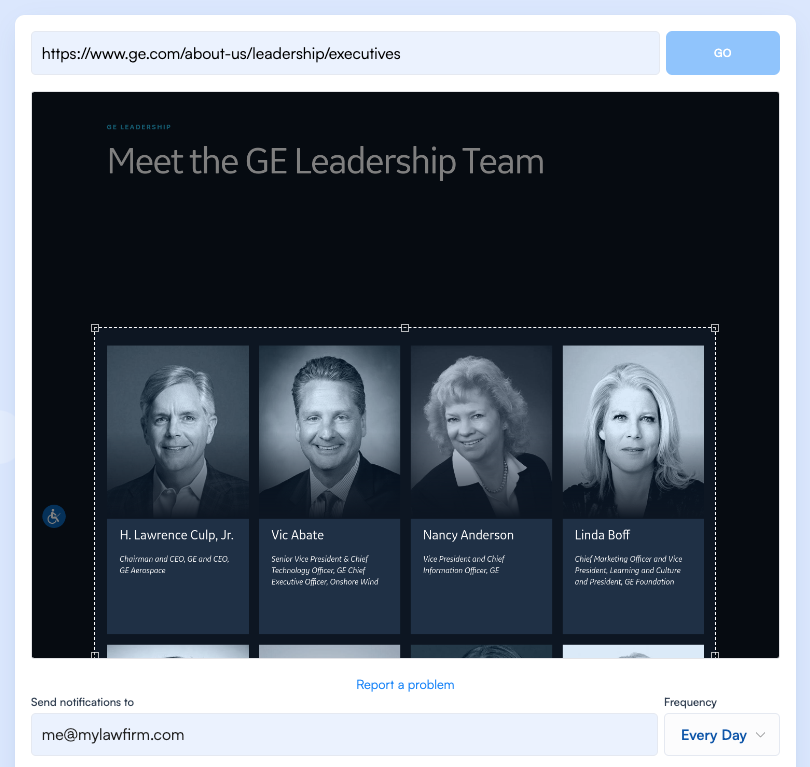

4. Executive Team Page

Leadership composition and changes provide insight into strategic direction, investment priorities, and organizational health.

What to Monitor:

- New executive hires (especially in specific functions like AI, international expansion, or enterprise sales)

- Departures of key leaders

- Title changes suggesting reorganization

- Advisory board additions

Intelligence Value: High. Executive changes often precede strategic shifts. A new Chief Revenue Officer might signal sales strategy changes; a new VP of International suggests geographic expansion.

Monitoring Frequency: Weekly

5. Press Release Page

Official press releases provide verified information about company developments, partnerships, and achievements.

What to Monitor:

- Product launches and updates

- Partnership announcements

- Funding rounds and financial news

- Awards and recognition

- Executive appointments

Intelligence Value: High. Press releases represent curated information the company wants publicized, making them reliable (if sometimes incomplete) sources.

Monitoring Frequency: Daily

6. Company Blog

Blog content reveals marketing priorities, target audience focus, and thought leadership positioning.

What to Monitor:

- Topic patterns and content themes

- Publishing frequency changes

- Author diversity (internal vs. external contributors)

- Content format evolution (articles, videos, podcasts)

- Keyword and SEO focus areas

Intelligence Value: Medium to High. Consistent blog themes often reflect product roadmap priorities or market positioning strategies.

Monitoring Frequency: Weekly

7. Robots.txt File

The robots.txt file, located at any website's root directory (e.g., example.com/robots.txt), provides technical insight into site structure and content organization.

What to Monitor:

- Disallowed directories (may reveal unreleased products or features)

- Sitemap file locations

- Changes to crawling permissions

Intelligence Value: Medium. While technical, this file can reveal staging environments, unreleased product areas, or site structure changes before they become public.

Technical Background: According to Search Engine Land's comprehensive guide on robots.txt, this file tells web crawlers which pages they can and cannot access. For CI purposes, the disallowed sections sometimes reveal areas competitors want to keep from search engine indexing.

Monitoring Frequency: Bi-weekly

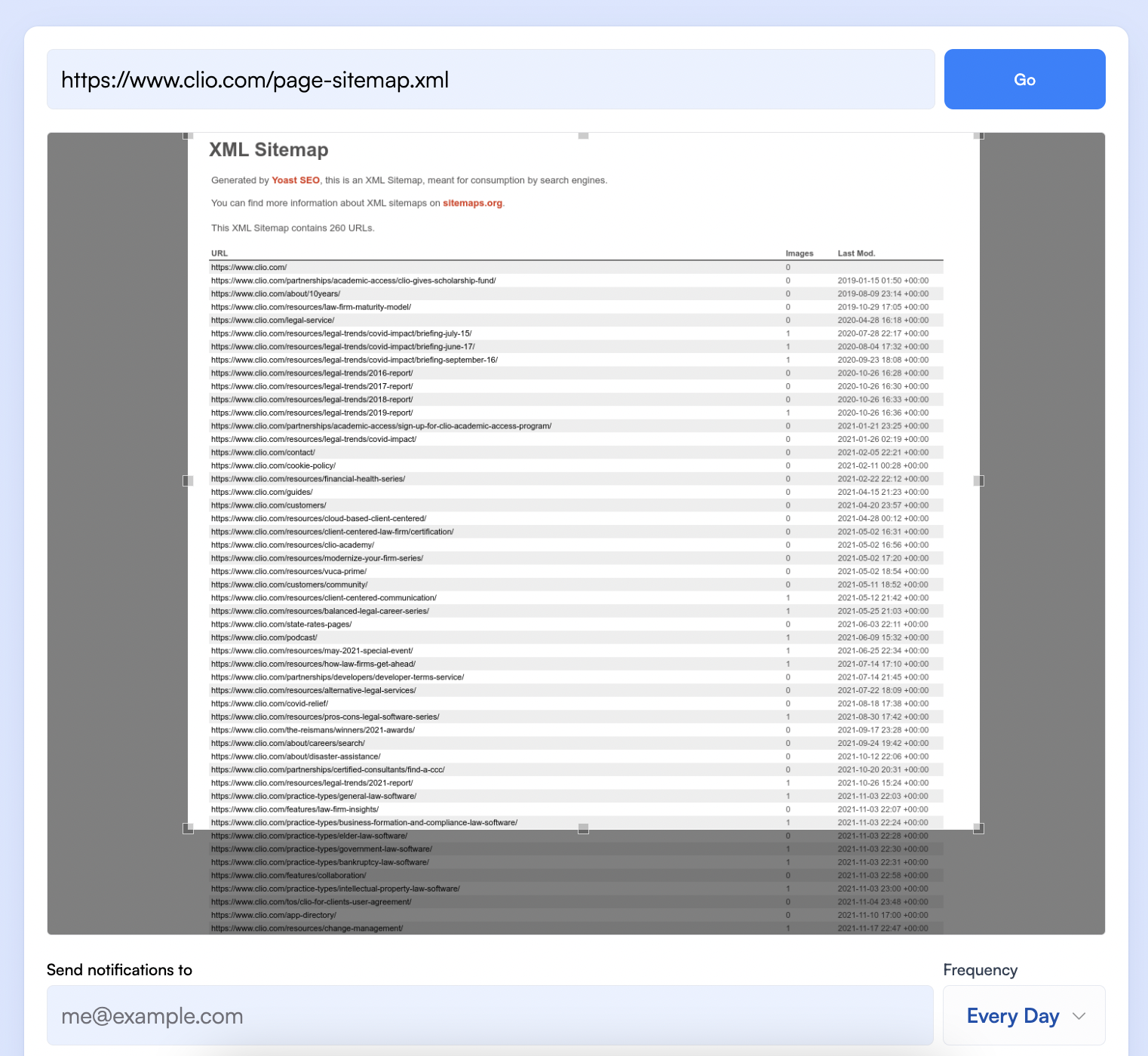

8. Sitemap Files

Sitemaps provide a technical inventory of all pages a competitor considers important enough to submit to search engines.

What to Monitor:

- New page additions

- URL structure changes

- Content category organization

- Page removal patterns

Intelligence Value: Medium. Sitemap changes can reveal new content initiatives, product pages, or market focus areas before they appear in navigation.

Monitoring Frequency: Bi-weekly

9. Release Notes / What's New Page

For software and technology companies, release notes provide a detailed record of product development priorities and velocity.

What to Monitor:

- Feature release frequency

- Bug fix patterns (may indicate quality issues)

- Integration announcements

- Performance improvements

- Deprecated features

Intelligence Value: Very High for software competitors. Release notes offer the most granular view of product evolution available publicly.

Monitoring Frequency: Daily for direct competitors; weekly for adjacent competitors

How to Monitor: Configure Visualping to track changelog and release notes pages for automatic notifications when competitors ship new features.

10. Careers Page

Job postings reveal investment priorities, growth plans, and organizational structure.

What to Monitor:

- New role types (e.g., first AI hire, international expansion roles)

- Hiring velocity changes

- Location expansion

- Department headcount ratios

- Seniority level patterns

Intelligence Value: High. A company hiring five machine learning engineers signals AI investment; a surge in enterprise sales hiring suggests upmarket movement.

Monitoring Frequency: Daily

How to Monitor: Use Visualping job monitoring to track changes to competitor career pages and receive alerts when new positions are posted.

11. Status Page

Many companies, particularly SaaS providers, maintain status pages that document uptime, incidents, and maintenance.

What to Monitor:

- Incident frequency and severity

- Affected services

- Resolution times

- Scheduled maintenance patterns

Intelligence Value: Medium. Status pages can reveal reliability issues, infrastructure investments, or scaling challenges. This intelligence can inform competitive positioning in sales conversations.

Monitoring Frequency: Daily during critical periods; weekly otherwise

12. Investor Relations / Financial Filings

For public companies, investor relations sections and regulatory filings provide detailed financial and strategic information.

What to Monitor:

- Quarterly earnings reports and transcripts

- Annual reports (10-K filings for US companies)

- Investor presentations

- Insider trading activity (via SEC filings)

Intelligence Value: Very High for public competitors. Financial filings contain detailed segment breakdowns, risk factors, and forward-looking statements.

Monitoring Frequency: Quarterly, aligned with reporting cycles

Resource: SEC EDGAR database provides free access to all US public company filings.

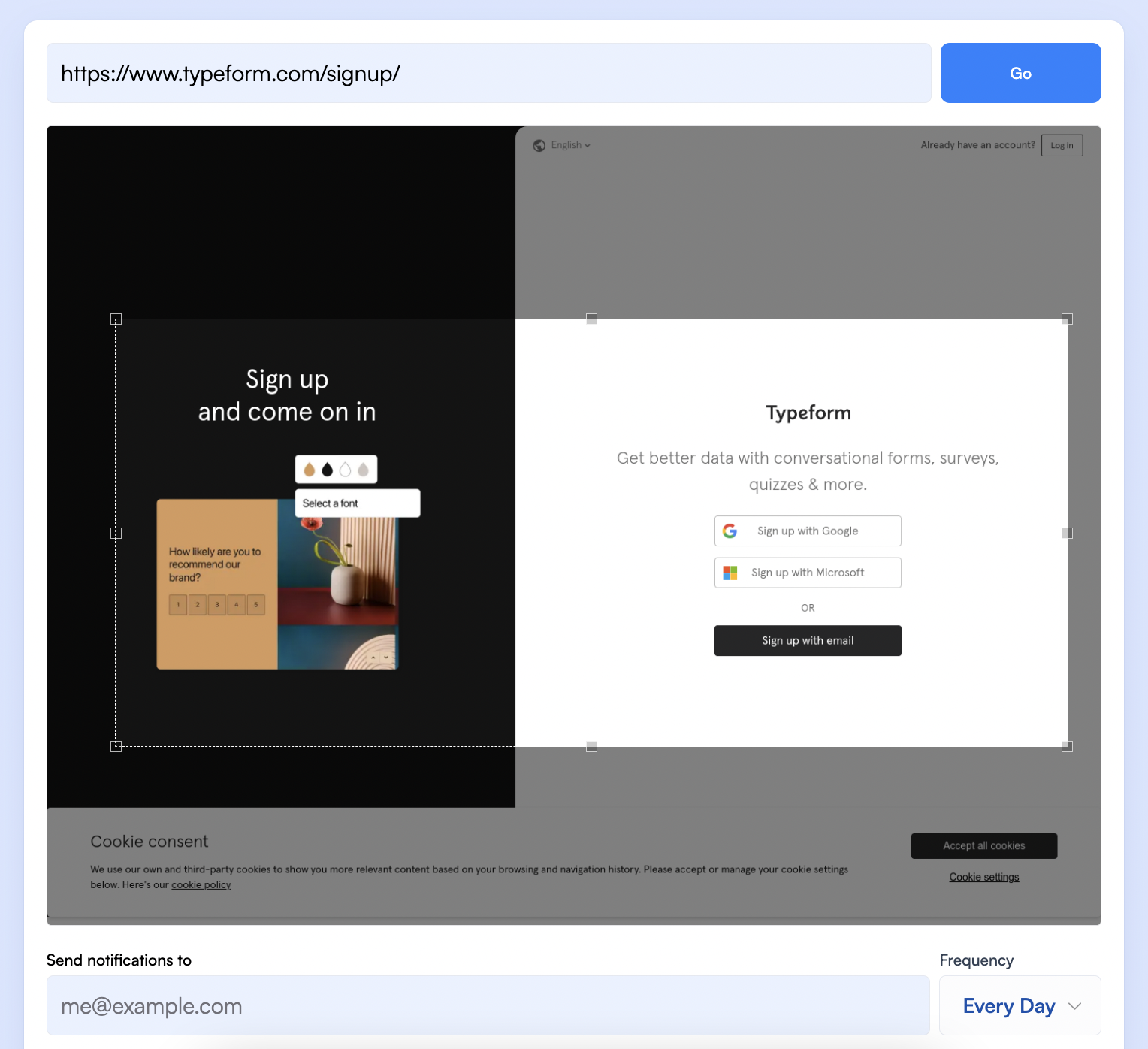

13. Key Conversion Pages

Conversion pages (signup, checkout, contact forms) reveal how competitors optimize their customer acquisition funnel.

What to Monitor:

- Form field changes (fewer fields may indicate conversion optimization)

- Social proof elements (testimonials, customer counts)

- Trust indicators (security badges, guarantees)

- Call-to-action messaging

- Pricing presentation

Intelligence Value: Medium. Conversion page changes often reflect A/B testing results and can inspire your own optimization efforts.

Monitoring Frequency: Weekly

14. Promotions and Deals Pages

Promotional activity reveals demand generation strategies, seasonal patterns, and potential inventory or sales pressure.

What to Monitor:

- Discount frequency and depth

- Promotional timing patterns

- Bundle offers

- Limited-time campaigns

- Free trial extensions

Intelligence Value: Medium to High for e-commerce and SaaS. Frequent or deep discounting may signal competitive pressure or sales challenges.

Monitoring Frequency: Daily during peak seasons; weekly otherwise

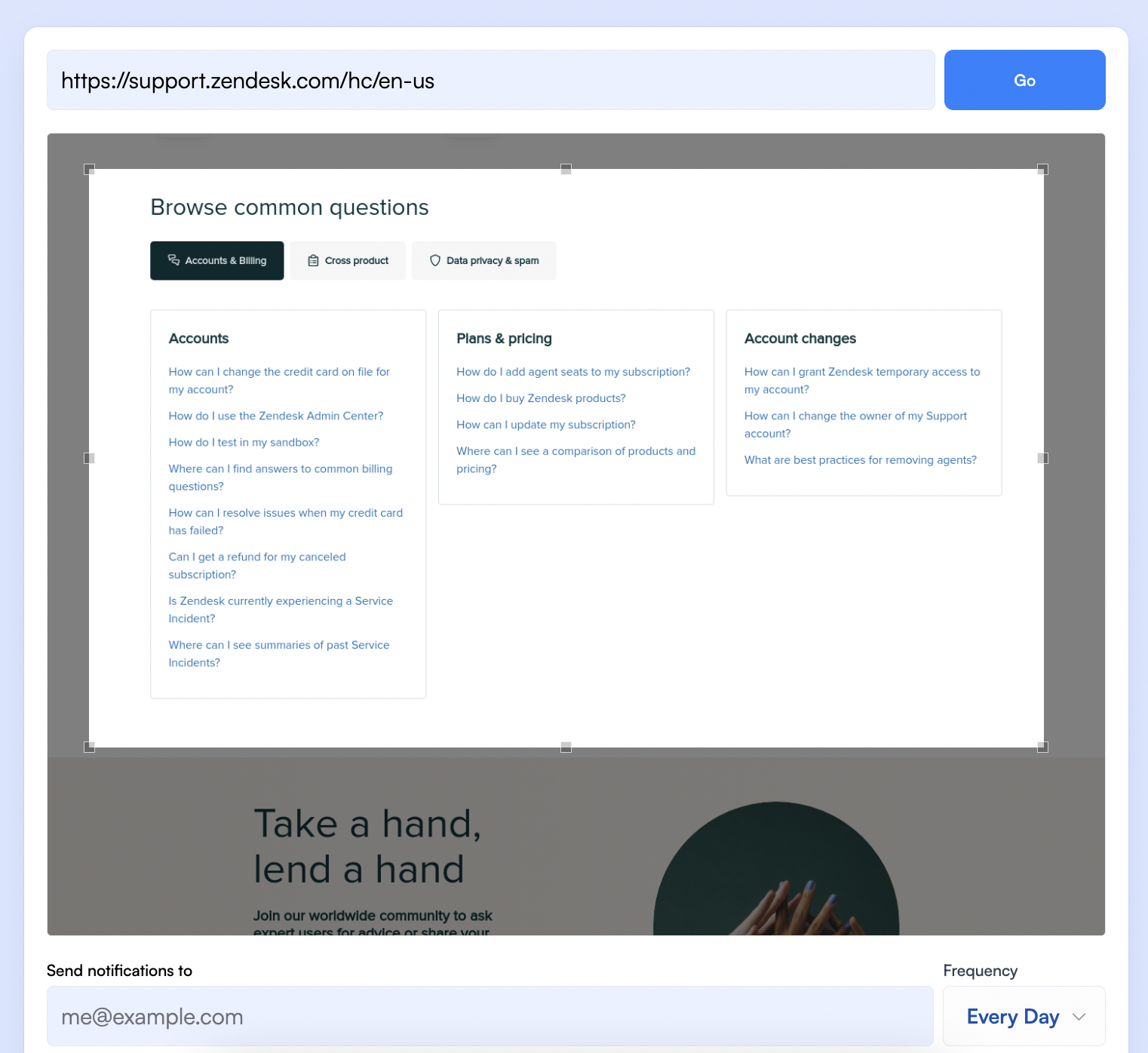

15. Help Center / Knowledge Base

Help center content reveals product capabilities, common customer challenges, and feature emphasis.

What to Monitor:

- Featured articles (indicate priority features)

- New documentation (may precede feature launches)

- Updated troubleshooting guides (may indicate problem areas)

- Integration documentation

- API documentation changes

Intelligence Value: Medium to High. Help content often reveals features and use cases not prominently marketed elsewhere.

Monitoring Frequency: Weekly

16. Community Forums / Feature Request Boards

Some companies maintain public forums where customers discuss products, report issues, and request features.

What to Monitor:

- Common feature requests (reveals product gaps)

- Customer complaints (reveals pain points)

- Product roadmap discussions

- Company response patterns

Intelligence Value: High when available. Direct customer feedback provides unfiltered insight into product perception and unmet needs.

Monitoring Frequency: Weekly

17. Terms of Service / Privacy Policy

Legal documents can reveal service structure, liability approaches, and upcoming regulatory compliance.

What to Monitor:

- Service level agreement changes

- Data handling policy updates

- Geographic coverage modifications

- Acceptable use policy changes

Intelligence Value: Low to Medium. While not strategic, these documents occasionally reveal operational changes or new service areas.

Monitoring Frequency: Bi-weekly

How to Monitor: Use website change detection to track terms of service and privacy policy pages, which are frequently updated without announcement.

Third-Party Intelligence Sources: External Perspectives

Third-party sources provide perspectives that competitors do not control, often revealing information they might prefer to keep private.

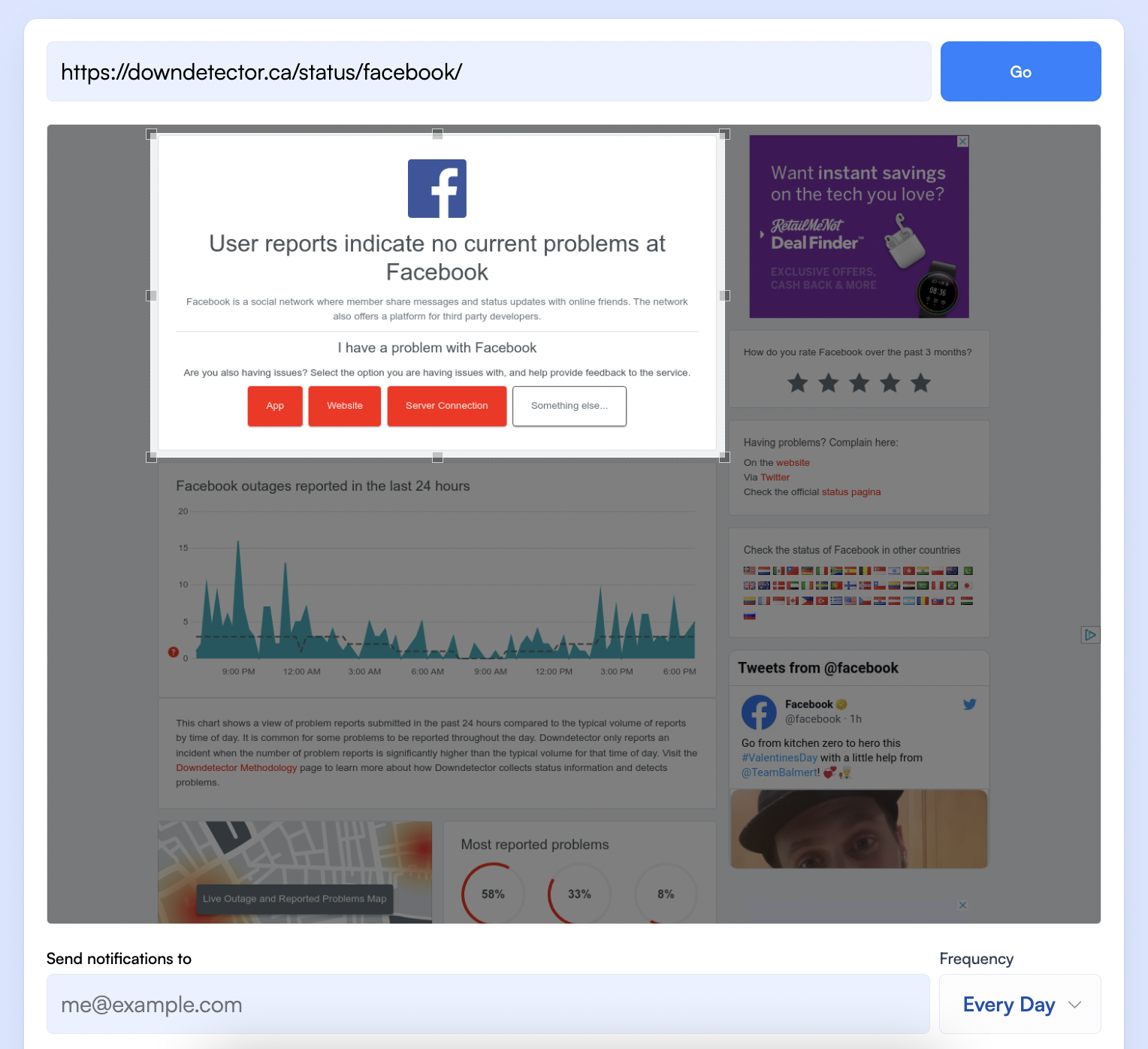

18. Downdetector

Downdetector aggregates user-reported outages and service issues across thousands of services.

What to Monitor:

- Outage reports and patterns

- User complaint spikes

- Geographic distribution of issues

Intelligence Value: Medium. Downdetector can reveal reliability issues not documented on official status pages.

Monitoring Frequency: Weekly; daily during competitive sales cycles

19. Third-Party Review Sites

Review platforms like G2, Capterra, TrustRadius, and Trustpilot provide customer sentiment data.

What to Monitor:

- Overall rating trends

- Recent review sentiment

- Commonly praised features

- Recurring complaints

- Competitive comparison mentions

Intelligence Value: High. Reviews provide unfiltered customer perspective and often mention competitor comparisons directly.

Monitoring Frequency: Weekly

Key Platforms:

- B2B Software: G2, Capterra, TrustRadius

- Consumer Products: Trustpilot, Consumer Affairs

- Local Services: Yelp, Google Business Profile

20. Social Media Profiles

Social media bio and profile changes reflect positioning shifts and campaign priorities.

What to Monitor:

- Bio text changes

- Profile and cover image updates

- Linked content (websites, landing pages)

- Follower growth patterns

Intelligence Value: Medium. Profile changes often accompany rebranding or campaign launches.

Monitoring Frequency: Weekly

21. Google News

News coverage provides third-party perspective on competitor activities and industry perception.

What to Monitor:

- Press coverage frequency

- Coverage sentiment

- Industry analyst mentions

- Crisis or controversy coverage

Intelligence Value: Medium to High. News coverage reveals how the market perceives your competitors and can surface information not available through official channels.

Monitoring Frequency: Weekly

Implementation: Set up Google Alerts for competitor brand names, executive names, and product names.

22. YouTube and Video Platforms

Video content reveals marketing investments, product demonstrations, and customer education priorities.

What to Monitor:

- New video publications

- Video topic patterns

- Production quality changes

- Customer testimonial videos

- Webinar recordings

Intelligence Value: Medium. Video content represents significant production investment and often reveals strategic messaging priorities.

Monitoring Frequency: Weekly

23. Wikipedia

Wikipedia entries provide curated company histories and notable events, though they require verification.

What to Monitor:

- Company information updates

- Controversy or criticism sections

- Recent edit activity

- Citation additions

Intelligence Value: Low to Medium. Wikipedia can surface historical context and publicly documented controversies.

Monitoring Frequency: Bi-weekly

24. Crunchbase

Crunchbase provides startup and company data including funding history, leadership, and acquisitions.

What to Monitor:

- Funding round announcements

- Valuation changes

- Leadership updates

- Acquisition activity

- Employee count changes

Intelligence Value: High for startup competitors. Funding activity directly indicates growth trajectory and investor confidence.

Monitoring Frequency: Bi-weekly

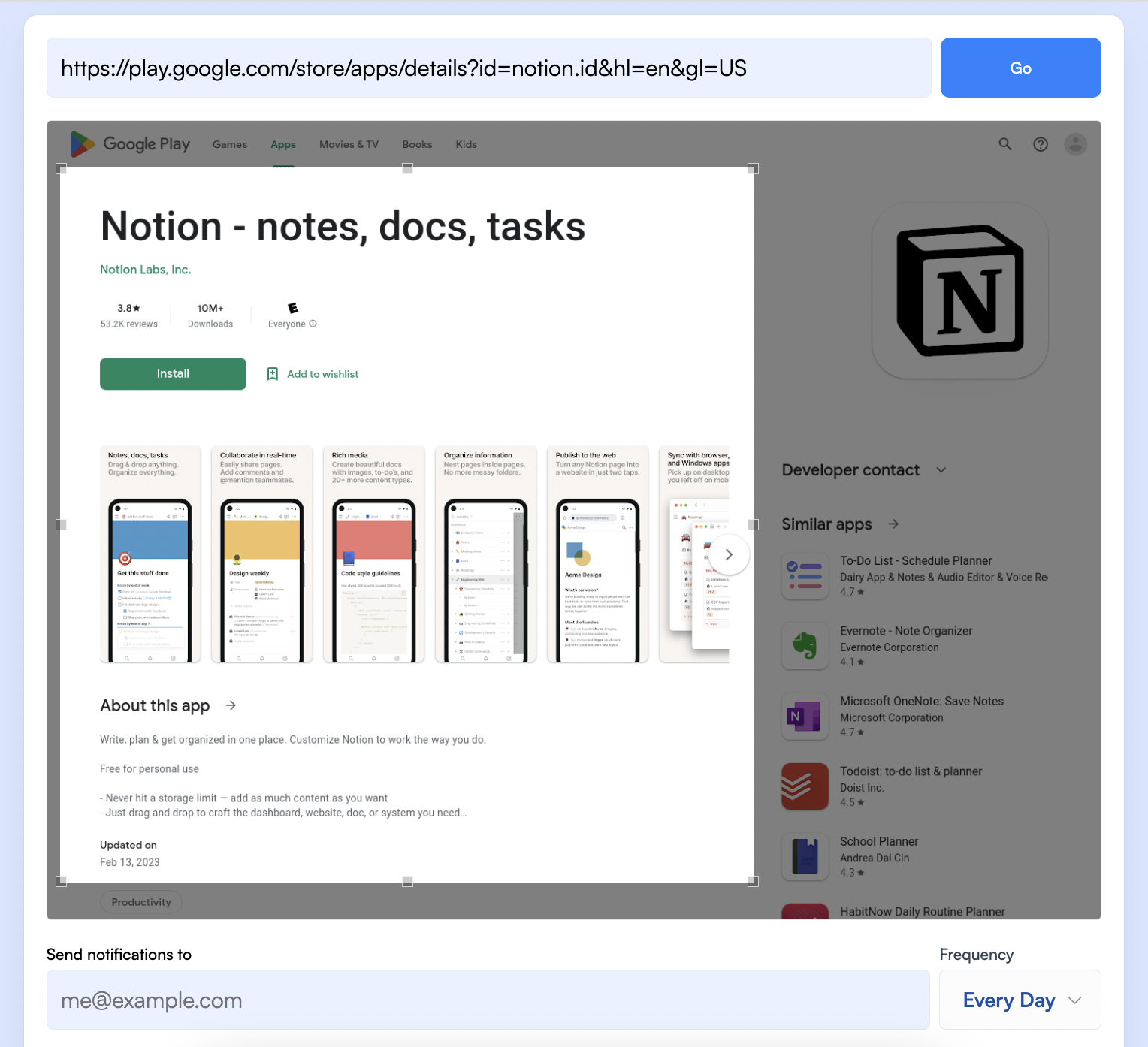

25. App Store Listings

For competitors with mobile applications, app store listings reveal product updates and user feedback.

What to Monitor:

- Version release frequency

- Update notes and new features

- User ratings and review trends

- Screenshot and description changes

Intelligence Value: Medium to High for mobile-first competitors. App store data provides granular product evolution insight.

Monitoring Frequency: Weekly

Platforms: Apple App Store, Google Play Store

26. Competitor Comparison Pages

Many companies publish pages comparing themselves to competitors. These pages reveal positioning strategy and perceived competitive advantages.

What to Monitor:

- New comparison pages (indicates competitive focus)

- Feature comparison changes

- Messaging and positioning shifts

- Pricing comparison updates

Intelligence Value: High. Comparison pages explicitly state how competitors view their differentiation.

Monitoring Frequency: Weekly

27. Advertising Libraries

Social platforms now provide transparency libraries that reveal active advertising campaigns.

What to Monitor:

- Active ad creative and messaging

- Campaign longevity (long-running ads often perform well)

- Audience targeting signals (for EU ads)

- Seasonal campaign patterns

- Promotional offer messaging

Intelligence Value: Very High. Advertising libraries provide direct insight into marketing strategy, messaging tests, and promotional timing.

Key Resources:

- Meta Ad Library (Facebook, Instagram, Messenger, Threads)

- Google Ads Transparency Center

- TikTok Commercial Content Library

- LinkedIn Ad Library

According to Meta's Transparency Center documentation, the Ad Library is a comprehensive, searchable database that allows anyone to view ads currently running across Meta platforms, including Facebook, Instagram, Messenger, and Audience Network. For ads about social issues, elections, or politics, Meta provides additional information including spend ranges, reach, and funding entities, and these ads remain visible for seven years. Ads delivered in the EU and associated territories show additional targeting information and are archived for one year after their last impression.

Monitoring Frequency: Daily

Implementation Methodology

Successful competitive intelligence programs require systematic implementation beyond simply identifying sources.

Step 1: Define Intelligence Requirements

Before monitoring anything, clarify what you need to know:

- What decisions will this intelligence inform?

- Who are the primary consumers of this intelligence?

- What format and frequency do stakeholders need?

- How will insights be distributed and acted upon?

Step 2: Identify and Prioritize Competitors

Not all competitors deserve equal attention:

- Direct Competitors: Similar products, same target market

- Indirect Competitors: Different products, overlapping customer needs

- Aspirational Competitors: Market leaders you want to learn from

- Emerging Competitors: New entrants that may disrupt the market

Start with 3-5 direct competitors before expanding coverage.

Step 3: Select Monitoring Approach

Your approach should match your resources:

Manual Monitoring:

- Appropriate for 2-3 competitors and 5-10 sources

- Time investment: 2-4 hours per week

- Tools: Browser bookmarks, spreadsheets, calendar reminders

Automated Monitoring:

- Appropriate for 5+ competitors and comprehensive coverage

- Time investment: 1-2 hours per week for analysis (monitoring automated)

- Tools: Website change detection platforms (see 6 Smart Tactics for Gathering Competitive Intelligence), RSS feeds, alert services

Hybrid Approach:

- Automate high-frequency, low-interpretation sources

- Manually review high-interpretation sources (financial filings, blog content)

Step 4: Establish Workflows

Create processes for:

- Collection: How and when sources are checked

- Storage: Where information is documented

- Analysis: How raw data becomes insight

- Distribution: How insights reach stakeholders

- Action: How insights inform decisions

Step 5: Measure and Refine

Track the value your CI program delivers:

- Insights that influenced decisions

- Competitive threats identified early

- Opportunities discovered through monitoring

- Time saved through automation

Refine source selection and monitoring frequency based on what delivers value.

Ethical and Legal Considerations

Competitive intelligence must operate within ethical and legal boundaries. The Strategic Consortium of Intelligence Professionals (SCIP) Code of Ethics is the industry standard set of guidelines for ethical behavior in competitive and market intelligence activities.

Ethical Principles

Use Only Public Information: All sources in this guide are publicly accessible. Never attempt to access protected systems, impersonate individuals, or obtain confidential information through deception.

Maintain Transparency: When gathering information through conversations (at trade shows, with industry contacts), accurately disclose your identity and organization prior to all interviews, as required by the SCIP Code.

Respect Intellectual Property: Monitor and analyze competitor content, but do not reproduce copyrighted material.

Avoid Conflicts of Interest: Do not pressure employees hired from competitors to reveal confidential information covered by non-disclosure agreements. Fulfill your duties without conflicts of interest.

Provide Honest Recommendations: Provide realistic conclusions in the execution of your duties. The SCIP Code emphasizes striving to increase recognition and respect for the profession through ethical practice.

Legal Considerations

Several laws govern competitive intelligence activities:

- Economic Espionage Act: Prohibits theft or misappropriation of trade secrets

- Computer Fraud and Abuse Act: Restricts unauthorized access to computer systems

- GDPR and Privacy Regulations: Govern collection and use of personal data

According to Pragmatic Institute's guide on CI ethics, if you find yourself questioning whether a practice is legal, you probably should not do it.

The Front Page Test

Before any CI activity, ask: "Would I be comfortable if this activity were reported on the front page of a major newspaper?" If the answer is no, reconsider the approach.

Measuring CI Effectiveness

According to Valona Intelligence's research on CI ROI, nearly 60% of organizations globally measure the value of intelligence in some way.

Quantitative Metrics

- Win rate improvement in competitive deals

- Time to awareness of competitor moves

- Revenue influenced by competitive insights

- Cost savings from avoided strategic errors

Qualitative Metrics

- Decision quality improvement

- Stakeholder satisfaction with intelligence delivery

- Strategic alignment of product and marketing decisions

Valona's Value Discovery Framework

Consider mapping the areas where intelligence brings extra value:

- Revenue Protection: Intelligence that prevents customer churn or competitive losses

- Revenue Generation: Intelligence that identifies new opportunities

- Cost Avoidance: Intelligence that prevents poor investments

- Efficiency Gains: Intelligence that accelerates decision-making

Frequently Asked Questions

What techniques are used to gather competitive marketing intelligence?

Effective competitive intelligence combines multiple methods. Primary research includes customer surveys, industry expert interviews, and trade show attendance where competitors present their offerings. Secondary research involves analyzing publicly available information such as websites, press releases, financial filings, and marketing materials. Digital monitoring tracks competitor online activities including website changes, advertising campaigns, and social media content. The most effective programs triangulate insights across multiple sources rather than relying on any single channel.

How do organizations analyze and understand market share data?

Market share analysis begins with defining the relevant market and identifying key competitors. Organizations collect data from industry reports (such as those from Gartner, Forrester, and IDC), government statistics, and specialized research firms. Analysis methods include revenue-based calculations comparing total sales across competitors, unit-based measurements analyzing product quantities, and customer-based metrics examining acquisition and retention rates. Geographic segmentation reveals competitor strengths in different regions and highlights expansion opportunities.

Note: Market size estimates for competitive intelligence vary significantly depending on scope. The broader market including services, consulting, and tools is measured in tens of billions, while the software/tools segment alone is typically measured in the low single-digit billions. When evaluating market research, verify whether figures include the full ecosystem or specific segments.

What is the difference between competitive intelligence and corporate espionage?

Competitive intelligence uses legal, ethical methods to gather publicly available information. It relies on open sources like websites, press releases, financial filings, and public conversations. Corporate espionage involves illegal or unethical methods such as theft, hacking, bribery, or misrepresentation to obtain confidential information. As Crayon's research on CI ethics emphasizes, the best CI professionals never need illegal or unethical methods because extensive competitive data is available through legitimate channels.

How often should competitive intelligence sources be monitored?

Monitoring frequency should match how quickly information changes and its strategic importance. High-velocity sources like pricing pages, job postings, and advertising should be checked daily. Medium-velocity sources like blog content, press releases, and review sites warrant weekly review. Lower-velocity sources like legal documents, Wikipedia entries, and site architecture changes can be monitored bi-weekly. During critical periods such as competitive deals, product launches, or market shifts, increase monitoring frequency across all sources.

What is the ROI of competitive intelligence programs?

Research indicates significant returns from well-implemented CI programs. According to Valona Intelligence's Global Intelligence Report, companies with dedicated CI platforms outperform stock market averages, and nearly 60% of organizations globally measure the value of intelligence in some way. Crayon's 2025 State of Competitive Intelligence report found that teams using conversational intelligence tools to track competitor mentions in calls reported an 82% lift in win rates. Teams with dedicated competitive intelligence platforms reported a 79% increase in effectiveness, and having a sales executive sponsor boosted effectiveness by 76%. However, ROI varies significantly based on implementation quality, stakeholder adoption, and how effectively insights translate into action.

How can small teams implement competitive intelligence effectively?

Small teams should focus rather than attempt comprehensive coverage. Start with 3-5 direct competitors and the highest-priority sources: pricing pages, home pages, press releases, job postings, and advertising libraries. Establish a consistent weekly review routine, even if brief. Use free tools like website change monitoring for competitor tracking, Google Alerts for news, and browser bookmarks for manual checks before investing in more comprehensive automation. Document insights in a simple shared spreadsheet. As you demonstrate value, expand coverage incrementally. The key is consistency rather than comprehensiveness.

What role does AI play in competitive intelligence?

AI adoption in competitive intelligence has accelerated significantly. According to Crayon's 2025 State of Competitive Intelligence Report, CI teams saw a 76% year-over-year increase in AI adoption, with 60% now using AI daily (up from 48% the previous year). AI contributes to CI through automated monitoring that tracks changes across hundreds of sources simultaneously, pattern recognition that identifies trends humans might miss, natural language processing that summarizes large volumes of content, and analysis of competitive data (64% of teams now use AI for this, nearly double the previous year). However, human judgment remains essential for strategic interpretation and action planning.

Additional Resources

Professional Organizations

- Strategic Consortium of Intelligence Professionals (SCIP) - Global CI professional organization

- Competitive Intelligence Alliance - CI community and resources

Industry Research

- Gartner Market Guide for Competitive and Market Intelligence Tools (June 2024)

- Forrester Wave: Market and Competitive Intelligence Platforms, Q4 2024

Free Monitoring Tools

- Visualping - Website change detection and competitor monitoring (see also: Free Competitor Analysis Tools)

- Google Alerts - Email notifications for search terms

- Meta Ad Library - Facebook and Instagram ad transparency

- Google Ads Transparency Center - Google advertising transparency

- SEC EDGAR - US public company filings

- Crunchbase - Startup and company data

Regulatory and Compliance Resources

- SEC EDGAR Company Filings - Search for public company filings

- Google Search Console - Your own site's search performance

Put This Guide Into Practice

Monitoring 27 competitive intelligence sources manually is not realistic for most teams. Automated website change detection lets you focus on analysis and action rather than checking pages.

Visualping tracks competitor websites and sends you alerts when important changes happen, whether that is a pricing update, new product announcement, or messaging shift.

Get started free: Create your first competitor monitor and receive alerts when competitors update their pricing, messaging, or product pages. No credit card required.

This guide is provided for educational purposes. Methodologies described should be implemented in accordance with applicable laws and ethical guidelines. Readers are responsible for ensuring their competitive intelligence activities comply with relevant regulations and organizational policies.

Visualping: competitor monitoring made simple

Get targeted updates from the competition on autopilot. Trusted by 85% of Fortune 500 companies.

Eric Do Couto

Eric Do Couto is Head of Marketing at Visualping, where he leads growth and competitive intelligence strategy. He has over 10 years of experience implementing pricing and competitive monitoring systems for SaaS businesses.