Top Tools for Competitor Price Tracking (2026) – Clear Picks & Setup | Visualping Blog

By Eric Do Couto

Updated February 9, 2026

Top Tools for Competitor Price Tracking in 2026: A Comprehensive Comparison

Disclosure & Editorial Standards

Important Disclosure: This article is written by Eric Do Couto, Head of Marketing at Visualping. Visualping is one of the tools evaluated in this guide. While we have made every effort to provide objective, fact-based information:

- Conflict of interest exists: As an employee of Visualping, I have a financial interest in Visualping's success.

- Verification encouraged: All claims about third-party tools are based on publicly available information, verified G2 reviews, and vendor documentation. Readers should independently verify features and pricing before making purchasing decisions.

- We recommend testing multiple tools: Trial periods are available for most platforms. Your specific needs may be better served by a competitor.

This disclosure appears prominently because trust and transparency is the foundation of useful content.

Quick Overview

If you're researching competitor price tracking tools, you're looking for solutions that range from simple change monitoring to enterprise-scale dynamic repricing. This guide evaluates five leading platforms across different use cases and price points.

What you'll find here:

- Comparison of 5 price tracking solutions with verified information

- Real-world use case matching

- Setup guidance for multiple tools

- Honest assessment of when each tool works best, including when competitors outperform Visualping

What this guide does NOT cover: Commodity pricing, stock tickers, or API-level price feeds require different solutions.

Understanding Your Price Tracking Needs

Before evaluating specific tools, identify what you actually need:

Speed Requirements

| Alert Speed | Best For | Example Use Cases |

|---|---|---|

| Real-time (30 seconds -30 min) | Flash sales, MAP violations | Consumer electronics, limited drops |

| Daily | Most retail, stable categories | Apparel, CPG, general merchandise |

| Weekly | Long-tail inventory | Slow-moving SKUs, niche products |

Catalog Size Considerations

| SKU Count | Recommended Approach |

|---|---|

| Under 100 | Simple monitoring tools work fine |

| 100–1,000 | Dedicated monitoring platform |

| 1,000+ | Enterprise solution with automation |

Monitoring vs. Repricing

| Need | Solution Type |

|---|---|

| Monitoring only | Change detection tools |

| Manual repricing | Monitoring + alerts to team |

| Automated repricing | Full dynamic pricing platform |

Tool Comparison Matrix

| Tool | Best For | Monitoring Speed | Price Point | Technical Level | Automated Repricing |

|---|---|---|---|---|---|

| Visualping | Fast alerts, visual proof, AI analysis | 30 sec–60 min | Free–$250+/mo | Low–Medium | No |

| Competera | Enterprise optimization | Scheduled + feeds | Custom ($$$$) | Medium–High | Yes |

| Omnia Retail | Multi-channel retail | Scheduled + real-time | Custom ($$$) | Medium | Yes |

| Skuuudle | Managed daily intel | Daily–hourly | Custom ($$$) | Low | No |

| Fluxguard | Technical audits, compliance | Scheduled | Free–$499+/mo | High | No |

Pricing note: Enterprise pricing varies significantly based on SKU count, features, and contract terms. Always request custom quotes.

Industry Recognition (Verified)

The following recognition claims have been independently verified through public sources:

Visualping

- G2 Winter 2026: Ranked #1 in six categories including Website Change Monitoring, Website Screenshot, and Implementation Index. Over 40 total category placements. (Source: G2)

- G2 2025 Best Software Awards: Ranked #23 in Best Content Management Software Products and #34 among Best Canadian Software Companies. (Source: Business Wire, Feb 2025)

Competera

- Gartner: Named Representative Vendor in the 2024 Gartner Market Guide for Retail Unified Price, Promotion and Markdown Optimization Applications - Short Life Cycle (three consecutive years). (Source: Competera)

- Inc. 5000: 2025 Honoree of the Inc. 5000 List of Fastest-Growing Companies in America

Omnia Retail

- G2 Winter 2026: Ranked as Leader in Retail Pricing Software Grid, recognized for enterprise-ready features, rapid onboarding, and real-time capabilities. (Source: G2)

- G2 Winter 2022: Awarded both G2 Leader and G2 Momentum Leader badges in Pricing Software. (Source: Omnia)

Important note about Gartner: Per Gartner's standard disclaimer, Gartner does not endorse any vendor, product, or service depicted in its research publications. Being named a "Representative Vendor" indicates market presence, not endorsement.

When Each Tool Makes Sense

Scenario 1: You need fast alerts with visual proof

Strong options: Visualping, Fluxguard

If your priority is catching price changes quickly and having screenshot evidence, Visualping excels at monitoring frequency (as low as 30 seconds on Business plans) and visual diff capabilities. Its AI filtering reduces alert fatigue by summarizing changes.

Why Visualping works here:

- Fastest monitoring cadence among visual tools

- AI-generated summaries save time on review

- Screenshot proof useful for MAP enforcement

- No complex setup required

When to consider Fluxguard instead: If you need more technical capabilities out of the box like HTML/DOM comparison, network traffic capture, or compliance audit trails, Fluxguard offers technical features, though at a higher price point ($99–$499+/month).

When to consider other alternatives: If you need automated repricing, Visualping cannot help. You'll need Competera or Omnia.

Scenario 2: You need enterprise repricing with demand modeling

Best fit: Competera or Omnia Retail

For catalogs over 5,000 SKUs where you're automating price changes based on competitive position, demand elasticity, and margin rules, you need a full repricing platform.

Competera advantages:

- Deep learning price recommendations

- Cause-effect analysis on price changes

- Claims 95%+ forecasting accuracy (verify with vendor)

- Sophisticated guardrails and approval workflows

- Strong fit for retailers with short product life cycles

Omnia Retail advantages:

- Strong European marketplace integrations (Amazon, eBay, bol.com, Kaufland, idealo, Google Shopping)

- Multi-channel price synchronization

- Pricing Strategy Tree™ provides transparent, explainable pricing logic

- Self-described as "European leader in pricing software" with over a decade of experience

Honest assessment: Neither Visualping, Skuuudle, nor Fluxguard compete in this space. They don't offer automated repricing. If you need this capability, evaluate Competera and Omnia directly.

Scenario 3: You want managed competitive intelligence

Best fit: Skuuudle

If you prefer a managed service that handles setup, maintenance, and data quality verification, Skuuudle positions itself as a white-glove option.

Why Skuuudle works here:

- Daily price + stock level reports (hourly monitoring available)

- Managed onboarding and catalog mapping

- Human QA team verifies data accuracy

- Founded in 2007 with 16+ years in the industry

- Less overwhelming than minute-by-minute alerts

Pricing context: Based on Skuuudle's website, a company with $500M revenues might spend $50K–$100K annually. This is significantly higher than self-serve tools but includes human-verified data quality.

When to consider alternatives:

- If you need intraday alerts for flash sales, Visualping offers faster monitoring

- If you have internal resources to manage tools yourself, self-serve options cost less

Important clarification: Skuuudle provides competitive intelligence and monitoring. It does not offer automated repricing.

Scenario 4: You need technical-grade audits and compliance

Best fit: Fluxguard

For compliance teams, QA engineers, or situations requiring precise HTML/DOM comparison and network capture, Fluxguard offers developer-focused features.

Why Fluxguard works here:

- Side-by-side HTML diffs

- Network traffic capture

- Detailed change logs for audits

- Strong for regulatory compliance (GDPR, CCPA monitoring)

- Proxy network for geo-specific monitoring

- Form submission tracking for gated content

Pricing: Free tier (3 sites), Standard ($99/mo for 25 sites), Plus ($199/mo), Premium ($499/mo for 100 sites). (Source: TechRadar)

When to consider alternatives: If non-technical team members need to use the tool, Visualping offers a more accessible interface. If visual diffs are sufficient and you don't need HTML-level analysis, you may be overpaying for Fluxguard's capabilities.

Scenario 5: General competitive monitoring beyond just pricing

Strong options: Visualping, Fluxguard

If price tracking is just one part of broader competitive monitoring (content changes, feature launches, policy updates), generalist tools work well.

Why these work here:

- Broader monitoring beyond just prices

- Side-by-side visual comparisons

- Historical archives with timestamps

- Simpler setup than enterprise pricing tools

Setup Walkthrough: Visualping

Time required: 10–15 minutes for initial setup

Step 1: Account Setup

- Sign up at visualping.io

- Choose plan based on check frequency needs

- Install browser extension (optional but helpful for selection)

Step 2: Add Your First Monitor

- Enter competitor product page URL

- Use visual selector to highlight just the price region, or use "Full Page" monitoring with AI context

Step 3: Configure Check Frequency

| Product Category | Recommended Frequency |

|---|---|

| Consumer electronics, flash sales | 15–30 minutes |

| Standard retail | 30–60 minutes |

| Stable categories | Daily |

Step 4: Set Up AI-Powered Alerts

Example AI prompt for the "Alert me when" field:

Alert me when:

- Price decreases by any amount

- Price increases by more than 5%

- Product shows as "out of stock"

- Free shipping is added or removed

Ignore:

- Small formatting changes

- Review count updates

- Timestamp changes

Step 5: Configure Notifications

- Email: Immediate for critical changes

- Slack: Team channel for visibility (integration guide)

- Webhook: Custom integrations

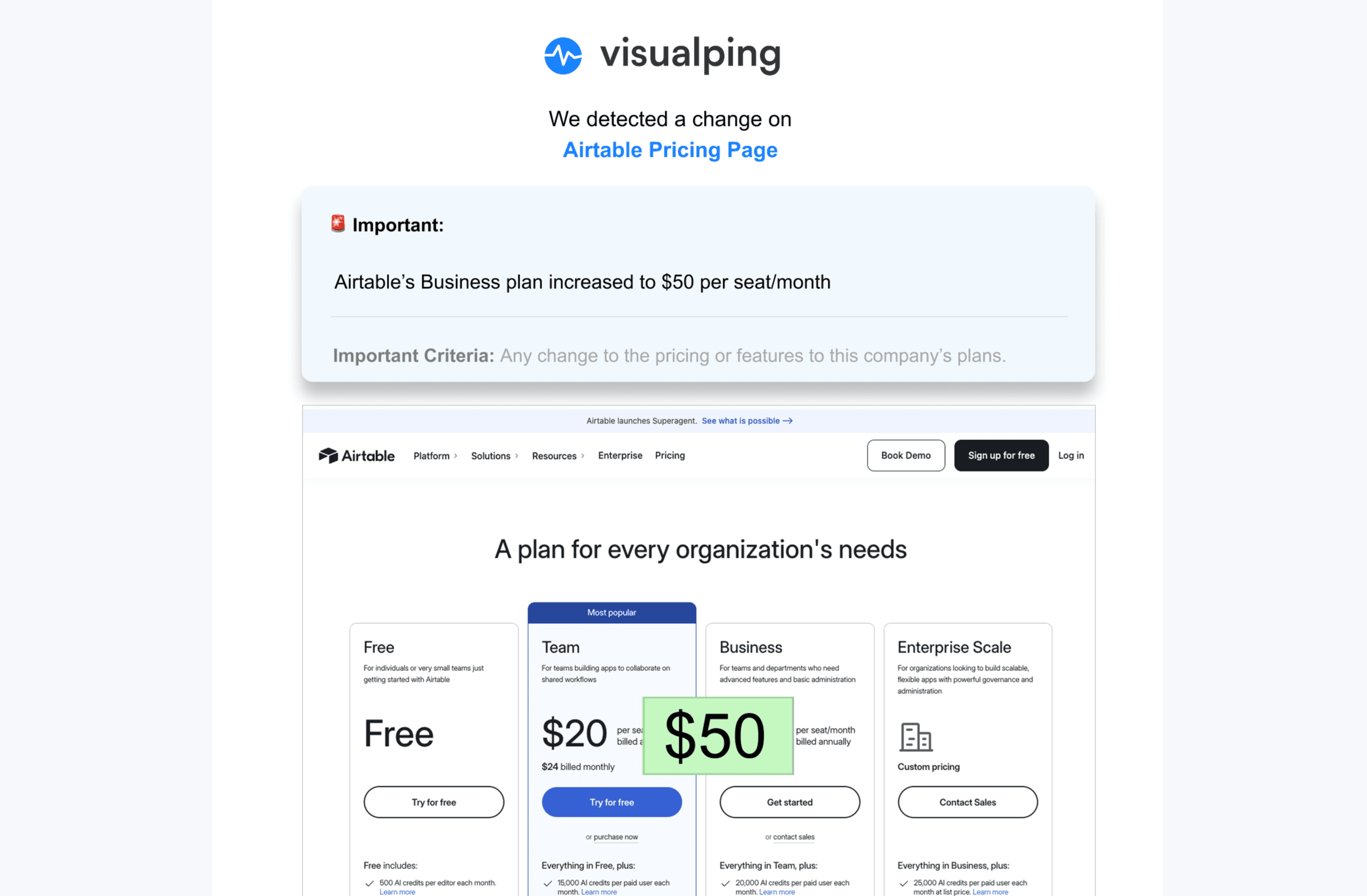

Here's an example of what a Visualping competitor price tracking alert looks like (fictional price increase):

Step 6: Scale with CSV Upload For monitoring multiple SKUs:

- Create CSV with columns: name, url, check_frequency, tags

- Use bulk upload feature

- Apply tags for category-level management

Common mistakes to avoid:

- Using same check frequency for all items (wastes resources on stable products)

- Forgetting to tag monitors (hard to manage at scale)

Setup Overview: Competera

For readers evaluating enterprise repricing, here's what Competera implementation typically involves:

Time required: Several weeks to months (varies by project scope)

Phase 1: Discovery

- Catalog audit and SKU mapping

- Competitor identification

- Define matching logic (UPC, EAN, manual equivalence)

- Set business rules and constraints

Phase 2: Integration

- Connect pricing system via API or FTP

- Set up competitor data feeds

- Configure matching algorithms

- Build approval workflows

Phase 3: Training

- Historical data analysis (2+ years ideal, 6 months minimum)

- Demand curve modeling

- Elasticity calculation

- Rule refinement

Phase 4: Launch

- Shadow mode testing

- Gradual rollout by category

- Monitor results vs. expectations

- Algorithm tuning

Resource requirements:

- Dedicated project manager

- IT team for integrations

- Category managers for rules

- Executive sponsor for governance

For detailed implementation guidance, contact Competera directly.

Setup Overview: Omnia Retail

Time required: Implementation timeline varies by project complexity

Omnia Retail uses a consultative deployment model:

Onboarding Phase

- Catalog mapping workshop

- Competitor selection

- Portal access and training

Data Setup

- Product feed configuration

- Competitor scraping setup

- Marketplace connections (Amazon, eBay, bol.com, etc.)

Strategy Building

- Pricing strategy workshops

- Rule configuration using Pricing Strategy Tree™

- Approval workflow design

Testing & Launch

- Test pricing scenarios

- Monitor mode deployment

- Gradual automation increase

Key differentiator: Omnia's Pricing Strategy Tree™ provides transparency into pricing logic, allowing users to see exactly why each price recommendation was made.

For detailed implementation guidance, request a demo from Omnia.

Best Practices That Actually Work

Based on real-world pricing operations:

1. Match products precisely

The problem: Tracking "similar" items creates bad data.

The solution:

- Match exact SKUs when possible (UPC, EAN, GTIN)

- Document equivalence rules (Size L vs. Size 12, etc.)

- Track regional variants separately

- Note packaging differences that affect price

Tool comparison:

- Visualping: Manual matching. You control quality

- Competera/Omnia: Automated matching with potential for errors. Spot-check critical SKUs

- Skuuudle: Managed matching. Human QA team handles it

2. Monitor total landed price, not just list price

The problem: Customers buy based on final price, not list.

What to track:

- Base price

- Shipping costs

- Promotional discounts

- Membership pricing (Amazon Prime, etc.)

- Bundle pricing

- Volume discounts

3. Tier your monitoring cadence

The problem: Checking everything every 5 minutes wastes resources.

Smart tiering:

| Priority Level | Check Frequency | Examples |

|---|---|---|

| Critical | 5–15 min | Consumer electronics, MAP-protected brands, flash sale windows |

| High | 30–60 min | Best sellers, seasonal items, promotional periods |

| Standard | Daily | Fashion, apparel, general catalog |

| Low | Weekly | Long-tail, slow-moving inventory |

4. Create response SOPs

The problem: Alerts without action plans create alert fatigue.

Build playbooks:

Competitor drops price by 5–10%:

- Alert category manager (Slack)

- Review within 2 hours

- Match if margin > 15%

- Escalate if margin would drop below 15%

Competitor drops price by 10%+:

- Alert VP Merchandising (SMS)

- Emergency pricing meeting

- Decision within 1 hour

5. Review and refresh quarterly

Quarterly checklist:

- Add new competitors that entered market

- Remove competitors that exited

- Update product URLs (pages change with redesigns)

- Refine monitoring regions

- Review tag/category structure

- Audit alert effectiveness

Frequently Asked Questions

How accurate is automated price matching?

Honest answer: It depends on product complexity.

| Product Type | Expected Accuracy |

|---|---|

| Electronics with clear UPCs | 95%+ |

| Apparel with standard sizing | 80–90% |

| Private label, ambiguous descriptions | 60–80% |

Recommendation: Start with manual matching for your top 20% of revenue-driving SKUs. Use automated matching for long-tail with spot-check validation.

Should I monitor marketplaces differently than retailer sites?

Yes. Marketplaces have unique challenges:

- Multiple sellers for same product

- Pricing changes every few minutes

- Stock levels fluctuate rapidly

- Shipping costs vary by seller

Best approach:

- Use API connections when available (Amazon SP-API, Walmart Marketplace API)

- Track "winning buy box" price, not all sellers

- For your listings: Use Omnia or Competera marketplace-specific features

How do I avoid alert fatigue?

-

Monitor specific elements, not full pages

- Use region selection and AI context filtering

-

Use AI filtering

- Set criteria for "important" changes

- Set minimum change thresholds (only alert if >$5 or >5%)

-

Aggregate notifications

- Daily digest for non-critical items

- Real-time only for high-priority SKUs

-

Route intelligently

- Different teams get different alerts

- Slack channels by category

When do I need full repricing vs. just monitoring?

Monitoring only if:

- Manual price changes work fine for your team

- Small catalog (under 500 SKUs)

- Slow-changing markets

- Limited pricing team bandwidth

Repricing automation if:

- Catalog over 1,000 SKUs

- Prices change multiple times per day

- Compete on multiple channels

- Sophisticated pricing strategies required

Cost consideration: Monitoring tools cost $100–1,000/month. Repricing platforms cost thousands to tens of thousands monthly on custom enterprise contracts.

Can I monitor competitors legally?

General guidance (not legal advice; consult counsel for your situation):

- Viewing publicly accessible web pages: Generally acceptable

- Automated scraping at scale: Gray area, depends on jurisdiction and terms

- Creating accounts under false pretenses: Generally problematic

- Circumventing technical protections: Risky

Safer approaches:

- Use official APIs where available

- Use tools that respect robots.txt

- Monitor at reasonable frequencies

- Don't impersonate users or bypass authentication

Honest Limitations and Trade-offs

Every tool has weaknesses. Here's what users typically encounter:

Visualping

| Strengths | Limitations |

|---|---|

| Fast, visual, easy setup, affordable | No automated repricing |

| AI summaries reduce alert fatigue | Limited trend analytics |

| Strong G2 ratings for ease of use | Manual product matching required |

| Flexible monitoring intervals |

Best for: Teams that want visibility and speed but handle pricing decisions manually.

Not right for: Large enterprises needing automated repricing at scale.

Competera

| Strengths | Limitations |

|---|---|

| Sophisticated AI algorithms | Enterprise-level investment required |

| Demand modeling capabilities | Complex implementation (months, not days) |

| Gartner-recognized | Requires significant historical data |

| Enterprise-grade features | May be overkill for small catalogs |

Best for: Large retailers with 5,000+ SKUs doing automated repricing.

Not right for: Small businesses, monitoring-only use cases.

Omnia Retail

| Strengths | Limitations |

|---|---|

| Multi-channel excellence | Enterprise pricing tier |

| Strong marketplace integrations | Best suited for retail, less for B2B |

| Transparent Pricing Strategy Tree™ | Requires catalog structure discipline |

| G2 Leader recognition |

Best for: Multi-channel retailers selling on marketplaces, particularly in Europe.

Not right for: B2B businesses, monitoring-only use cases.

Skuuudle

| Strengths | Limitations |

|---|---|

| Managed service with less internal work | Enterprise pricing ($50K–$100K+/year typical) |

| Human QA verification | Daily updates standard (hourly at premium) |

| 16+ years industry experience | Less flexibility than self-serve tools |

| Easy for non-technical teams | No automated repricing |

Best for: Teams that want someone else to handle data collection with budget for managed services.

Not right for: Cost-conscious teams, those needing real-time alerts.

Fluxguard

| Strengths | Limitations |

|---|---|

| Technical depth, compliance features | Requires technical expertise |

| AI translation and filtering | Overkill for simple price monitoring |

| Form submission tracking | Less user-friendly for marketing teams |

| Geo-specific monitoring via proxy | Higher price than basic tools |

Best for: Technical teams.

Not right for: Non-technical teams, high-frequency price tracking needs.

Making Your Decision

Decision Framework by Budget

| Monthly Budget | Recommended Options |

|---|---|

| Under $100 | Visualping basic tiers, Fluxguard free/standard |

| $100–$500 | Visualping higher tiers, Fluxguard Plus |

| $500–$2,000 | Visualping Business, Fluxguard Premium |

| $2,000–$10,000 | Skuuudle entry level, consider enterprise options |

| $10,000+ | Competera, Omnia, full enterprise solutions |

Decision Framework by Catalog Size

| SKU Count | Recommended Options |

|---|---|

| Under 100 | Any monitoring tool. Choose by features |

| 100–1,000 | Mid-tier monitoring or entry enterprise |

| 1,000–5,000 | Enterprise monitoring or repricing |

| 5,000+ | Full repricing platform typically required |

Decision Framework by Technical Capability

| Team Profile | Recommended Options |

|---|---|

| Non-technical | Visualping, Skuuudle |

| Some technical skills | Any tool |

| Developer team | Fluxguard, custom integration with enterprise tools |

Test Before Committing

Most tools offer trials or demos. Here's what to evaluate:

- Setup difficulty: How long to get first monitor running?

- Alert accuracy: False positive rate?

- Alert timing: How fast do you learn about changes?

- Usability: Can your team actually use it daily?

- Support responsiveness: Do they help when you're stuck?

Testing tip: Set up the same 10 competitor products in 2–3 tools simultaneously. Run for 2 weeks. Compare speed of detection, false positive rate, ease of management, and cost per monitored SKU.

Implementation Checklist

Week 1: Planning

- Define objectives (monitoring only or repricing?)

- Identify top 100 SKUs by revenue

- List primary 5–10 competitors

- Document current pricing process

- Set budget constraints

- Choose 2–3 tools to trial

Week 2–3: Setup

- Sign up for trial accounts

- Configure first 10 monitors in each tool

- Set up notification routing

- Create tags/categories structure

- Document setup process

- Train team on basic usage

Week 4–5: Testing

- Monitor same products across tools

- Track false positive rates

- Measure alert speed

- Test team adoption

- Review cost per SKU

- Evaluate support quality

Week 6: Decision

- Compare results matrix

- Calculate ROI projection

- Select primary tool

- Negotiate contract/pricing

- Create implementation plan

Week 7–8: Rollout

- Add full SKU list

- Configure all notifications

- Create response SOPs

- Train full team

- Document processes

- Set quarterly review date

Ongoing: Optimization

- Weekly: Review alert effectiveness

- Monthly: Audit coverage gaps

- Quarterly: Update competitor list

- Quarterly: Refine monitoring cadences

- Quarterly: Review tool performance vs. contract

Additional Resources

Vendor Documentation & Reviews

| Tool | Documentation | G2 Reviews |

|---|---|---|

| Visualping | Help Center | G2 Reviews |

| Competera | Contact for docs | G2 Reviews |

| Omnia Retail | Resource Center | G2 Reviews |

| Skuuudle | Contact for demo | G2 Reviews |

| Fluxguard | Documentation | Capterra Reviews |

Industry Standards

- National Retail Federation: Pricing Standards

- E-commerce Europe: Fair Pricing Guidelines

Independent Comparison Resources

For additional perspectives beyond this vendor-authored guide:

- G2 Competitive Intelligence Software Grid

- G2 Retail Pricing Software Grid

- Capterra Website Monitoring Software

Summary Recommendations

For monitoring-focused use cases (no automated repricing):

| Your Situation | Consider | Why |

|---|---|---|

| Need fast alerts, easy setup | Visualping | Strong G2 rankings, AI summaries, accessible pricing |

| Need technical audits, compliance | Fluxguard | HTML diffs, compliance features, proxy network |

| Want managed service, have budget | Skuuudle | Human QA, less internal work, 16+ years experience |

For automated repricing use cases:

| Your Situation | Consider | Why |

|---|---|---|

| Enterprise, demand modeling focus | Competera | Gartner-recognized, AI optimization |

| Multi-channel, marketplace focus | Omnia Retail | G2 Leader, strong European marketplace integrations |

Our honest recommendation:

- Trial multiple tools before committing. Every business is different

- Start with monitoring if you're unsure. It's lower cost and lower risk

- Upgrade to repricing when manual decisions become a bottleneck

- Consider Visualping if speed, visual proof, and ease of use are priorities, but acknowledge this recommendation comes from a biased source

Contact: LinkedIn | press@visualping.io

Editorial Note

This article was last updated in February 2026. Pricing, features, and industry recognition may change. Always verify current information directly with vendors before making purchasing decisions.

Fact-checking methodology:

- G2 rankings verified via G2.com

- Gartner recognition verified via vendor press releases and Gartner.com

- Pricing verified via vendor websites and third-party sources where possible

- Feature claims verified via vendor documentation and user reviews

Corrections: If you identify factual errors in this article, please contact press@visualping.io. We are committed to accuracy and will update promptly.

Visualping: competitor monitoring made simple

Get targeted updates from the competition on autopilot. Trusted by 85% of Fortune 500 companies.

Eric Do Couto

Eric Do Couto is Head of Marketing at Visualping, where he leads growth and competitive intelligence strategy. He has over a decade of experience implementing pricing and competitive monitoring systems for SaaS businesses.