Top 10 Web Sources to Track for Changes and Make Better Investments

By Emily Fenton

Updated December 11, 2024

Introduction

Harnessing alternative web data to make informed investment decisions and generate alpha can be challenging.

If you’re looking for events-driven opportunities online, then you have to know about the latest developments right away – before they hit the news.

Other updates to public web data may not necessarily be time-sensitive, but if they’re niche and specific to your focus area, requiring you to integrate a Bloomberg terminal alternative into your research process.

You may draw upon a pre-built dataset purchased from a third-party provider, but, after taking a closer look at the data, there’s the risk it won’t be suitable for your project.

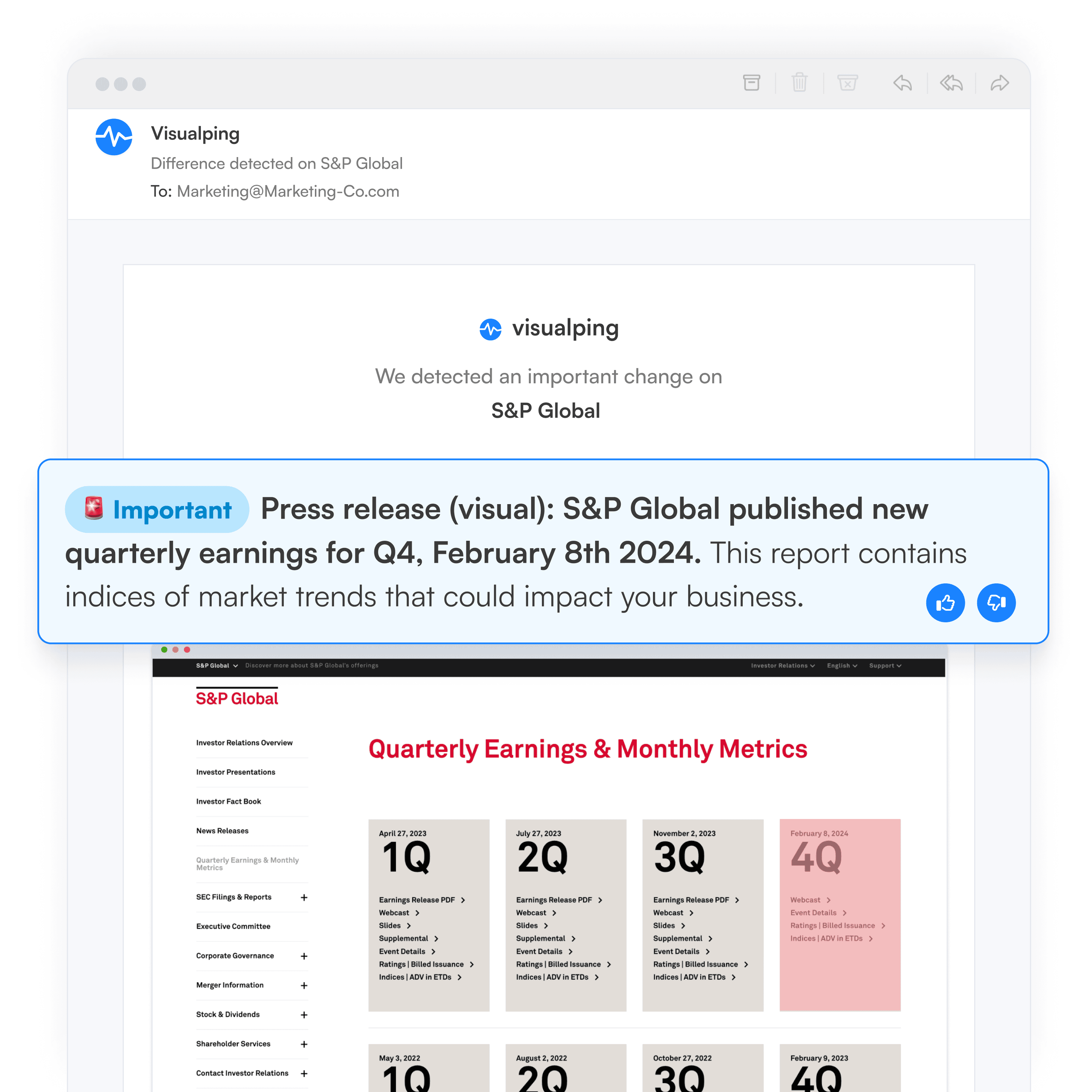

Investment managers and analysts can elevate their pipeline with a stock research tool, like Visualping. These website trackers automatically monitor any specific sources you want online, and send you data alerts when there’s a change – whether to take advantage of events-driven investment opportunities, to stay on top of developments from a niche source, or even build your own exclusive dataset.

But you can’t leverage the power of website monitoring if you don’t know the full extent of web sources you could be tracking to generate alpha.

Here’s a look at how website change monitoring tools can help elevate your process, as well as the top ten sources to monitor for alternative data and optimize your process.

How to Track Websites for Changes?

Website change monitoring tools automatically monitor any web pages you want online, at a preset frequency, and check them for changes.

When a change is detected, you receive an email alert, with a screenshot of the page. The updates are highlighted, making it easy to identify the change with minimal effort.

Some tools, like Visualping, include AI features that make tracking web changes even easier, such as AI-generated summaries of the change in the alert.

Why Incorporate Web Tracking into Your Investment Strategy?

Half of the world’s top hedge funds use Visualping to supplement their stock market research. Website trackers automatically pull alternative data from the web. Here's how that helps investment professiononals make better investment decisoins.

Self-Serve Design – No Code Required

Many portfolio managers and analysts have to turn to the software engineers at their hedge fund to build custom scrapers for a web source they want to track. The process can be time-consuming for the investment managers, and the scrapers may miss changes, send false alerts, or get blocked, such as behind a login screen.

With website monitoring tools, you can set up your own monitored pages, on-demand, without relying on developers to do it for you. No coding is required to use these tools.

Understand Changes Faster

When a change is detected, website change trackers send email alerts that include a screenshot of the source page, with the changes highlighted, so it’s easy to understand what changed.

With Visualping, you can also generate side-by-side change reports to review many updates that occurred over time – in one glance.

Track Any Data Source on the Web

Rather than limiting your data to what’s available on common news and financial analysis sources, website trackers allow you to monitor alternative data from any web source on the internet.

Visualping even has a keyword alerts feature, so you only get notified when certain keywords and phrases are added or removed from the page.

What are some examples of the top web sources you can track to build your own data feeds, and make informed investment decisions?

Top 10 Web Sources to Track to Drive Better Investments

Identify Market-Moving Events with Web Change Data

From macro industry trends to specific event-driven opportunities, here’s a look at some of the top web sources to monitor to more easily generate alpha.

Of course, while the below web sources are categorized by corporate performance and equity research, regulatory risk and compliance, and general information tracking and market trends, these web sources can't be clearly defined in any which category -- the nature of the kind of insights you can generate are completely dependent on your individual research process and investment hypothesis.

Corporate Performance and Equity Research

1. Price & Stock Patterns

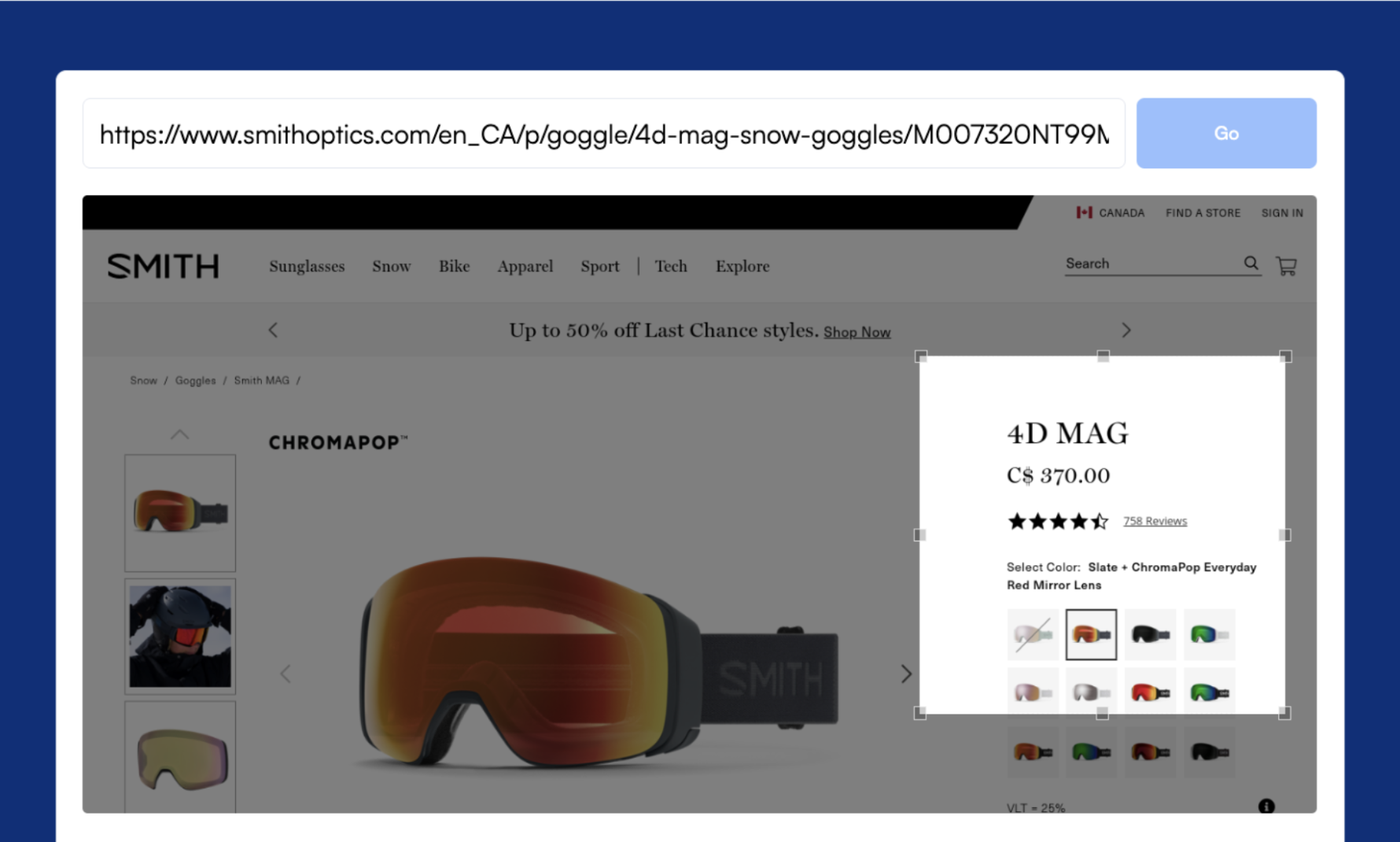

One of the many ways you can understand the fundamentals of specific companies is to track their pricing and stock changes over time, which is why analysts and portfolio managers tend to use Visualping as a price tracker. Pricing and stock patterns can help you estimate the sales volume of certain products, and estimate whether the eCommerce retailer will meet their quarterly targets. As well as getting a sense of corporate performance, you can gauge consumer trends over time, too.

<center>Track pricing and stock updates from any eCommerce product page for insights about corporate performance, and consumer and market trends.</center>

<center>Track pricing and stock updates from any eCommerce product page for insights about corporate performance, and consumer and market trends.</center>

2. Consensus & Analyst Pages

Hedge funds often use Visualping to collect data from specific companies’ consensus and analyst pages. You can automatically compile the updates into a structured format, such as in Google Sheets, with Visualping’s Google Sheets integration. This allows you to more easily assess a company’s performance overtime – and even compare it to competitors.

<center>Monitor consensus and analyst pages to keep an eye on the fundamentals of your specific portfolio companies, or potential investment projects.</center>

<center>Monitor consensus and analyst pages to keep an eye on the fundamentals of your specific portfolio companies, or potential investment projects.</center>

3. Geographic Presence

New markets are a sign of growth. Understanding whether or not a company is expanding, the extent to which a company is expanding, and where can tell you a lot about how a company is doing, and the potential for future plans. Visualping has both a textual and visual monitoring option, the latter of which lets you capture web page pixels, making monitoring maps, images and visual changes easy.

4. Executive Team Pages

Another way to keep an eye on corporate performance is to monitor the executive team changes on your portfolio company’s websites. Whether a company is hiring can tell you a lot about the state of the business.

5. Financial Statements and Balance Sheets

Website tracking tools can be used to notify you every time a company publishes any one of its financial statements and balance sheets online, sparing you from rechecking whether or not it’s become available.

Regulatory Compliance and Risk

6. Government and Regulatory Agencies

Website tracking can help investors mitigate risk by staying on top of the latest policy changes and regulatory requirements that can affect their portfolio and investment decisions. Visualping is commonly used by investment managers – even law firms and compliance teams – for regulatory intelligence and compliance -- to track government websites to stay ahead of upcoming regulations.

General Information Gathering and Market Trends

7. News and Press Releases

<center>Get relevant news alerts as soon as they're published.</center>

<center>Get relevant news alerts as soon as they're published.</center>

Tracking your favorite financial news outlets is a great way to stay on top of the latest headlines and get a sense of market trends more generally. Use Visualping’s keyword alerts feature to only get notified of certain keywords and phrases, for tailored news alerts on the exact topics you’re interested in.

8. Other Investment Firms

Keeping an eye on other investment firms can be a source of competitive intelligence, as well as a way to evaluate potential new investments. Monitor everything from other investment firm’s blog posts, press releases, team changes and portfolio pages to keep track of all the deals and moves that you care about.

9. Acquisition Opportunities

Monitor marketplaces that list small businesses for sale to discover buying opportunities, or use Visualping to watch target companies more closely.

10. Search Results

Search engine results can tell you a lot about industry trends more generally. A noticeable rise in news and press releases about a specific company, for example, can tell you a lot about the narrative surrounding a particular brand of interest. You can leverage Visualping as a search engine monitoring tool -- to strategically gauge shifts in public perception, news, and industry trends in your focus area.

Uncover Leading Market Signals with Web Change Data

Pulling alternative data to make informed investment decisions can be tricky without the right tools that let you catch exactly what you need, when you need it.

With real-time data monitoring and alerts, Visualping allows you to take advantage of events-driven opportunities – before they hit the news. Or, elevate your pipeline by building your own exclusive dataset, from any niche web source.

Don’t hesitate to contact us for more information, or to get started on our 14-day free trial.

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.