Best Bloomberg Terminal Alternatives in 2025

By Emily Fenton

Updated April 5, 2025

Introduction

Widely used by portfolio managers (PMs), analysts and traders at hedge funds, the Bloomberg Terminal is one of the oldest and most established market research and analysis platforms. Its role in the financial services industry is pivotal, offering access to a vast array of market information, economic indicators, and in-depth company analysis.

But market research shouldn't start and end with Bloomberg. PMs and Analysts need to differentiate themselves by having access to information that others don't. This means diving deep and having a thorough grasp on the shifts and latest updates in their market or focus area -- often, by getting change alerts from the original web sources that publish these updates.

For example, by integrating a stock research tool, like Visualping into their workflow, portfolio managers and analysts can monitor granular developments, from the original web sources – like price changes, press releases, climate and weather events, product stock and changing regulations updates – before it hits Bloomberg.

Read on for our list of the best Bloomberg Terminal alternatives in 2025.

Best Bloomberg Terminal Alternatives 2025

Visualping

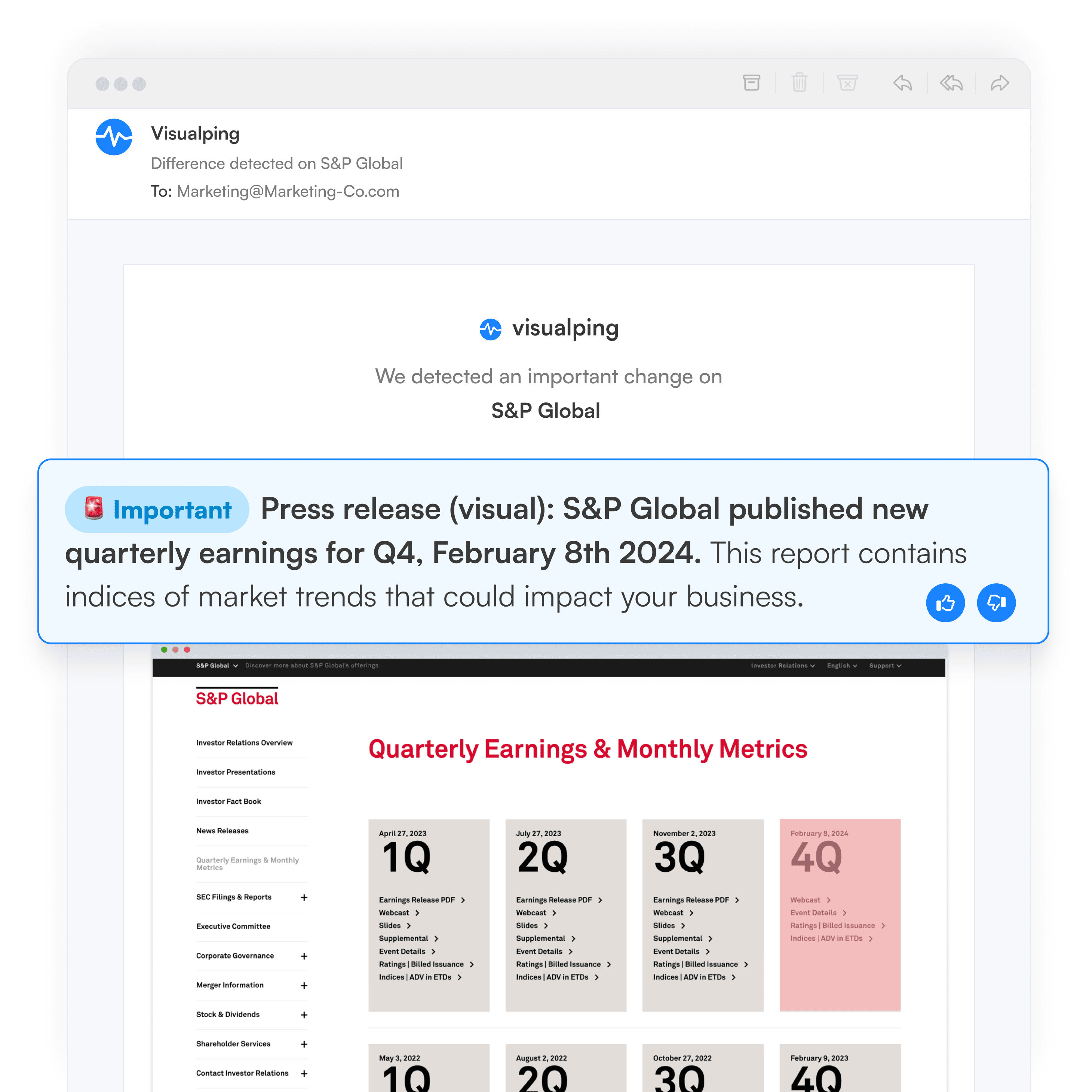

When it comes to stock market research and financial decision-making, relevant, timely data is everything. Visualping is a market research platform that will notify you of changes from any web page on the internet – including the original web source – so you can detect market-moving signal, before it hits Bloomberg.

Best for

- Portfolio Managers and Research Analysts looking to supplement their research processes with a versatile web monitoring tool that can extract the exact granular web data their investment hypothesis requires.

- Particularly compatible with fundamental analysis and event driven investing strategies.

When an update occurs on a web page you're tracking, you get an email alert that includes an AI-generatefd summary of the change, distilled in two to three lines. The alert also includes a screenshot of the page, with the changes highlighted.

In terms of what you can track, from its database of over a hundred thousand web sources, Visualping’s team imports a custom set of web sources that match your criteria – such as the financial data you’re after, related to your focus area and industry.

But as a website change monitoring tool, you can also add your own web sources. Visualping’s team will set up the monitoring for you.

Top Features

-

Limitless content scope: You can monitor any public web source for updates. Be the only one to monitor the pages key to your investment thesis.

-

Real-time alerts: get notified of a change two minutes after it occurs online.

-

Cut through the noise with AI: Only get notified of updates that match your custom criteria, such as certain keywords or financial data, so you’re not sifting through irrelevant alerts.

-

Integrations: Visualping extracts data from web pages as information changes, facilitating direct integrations with your models.

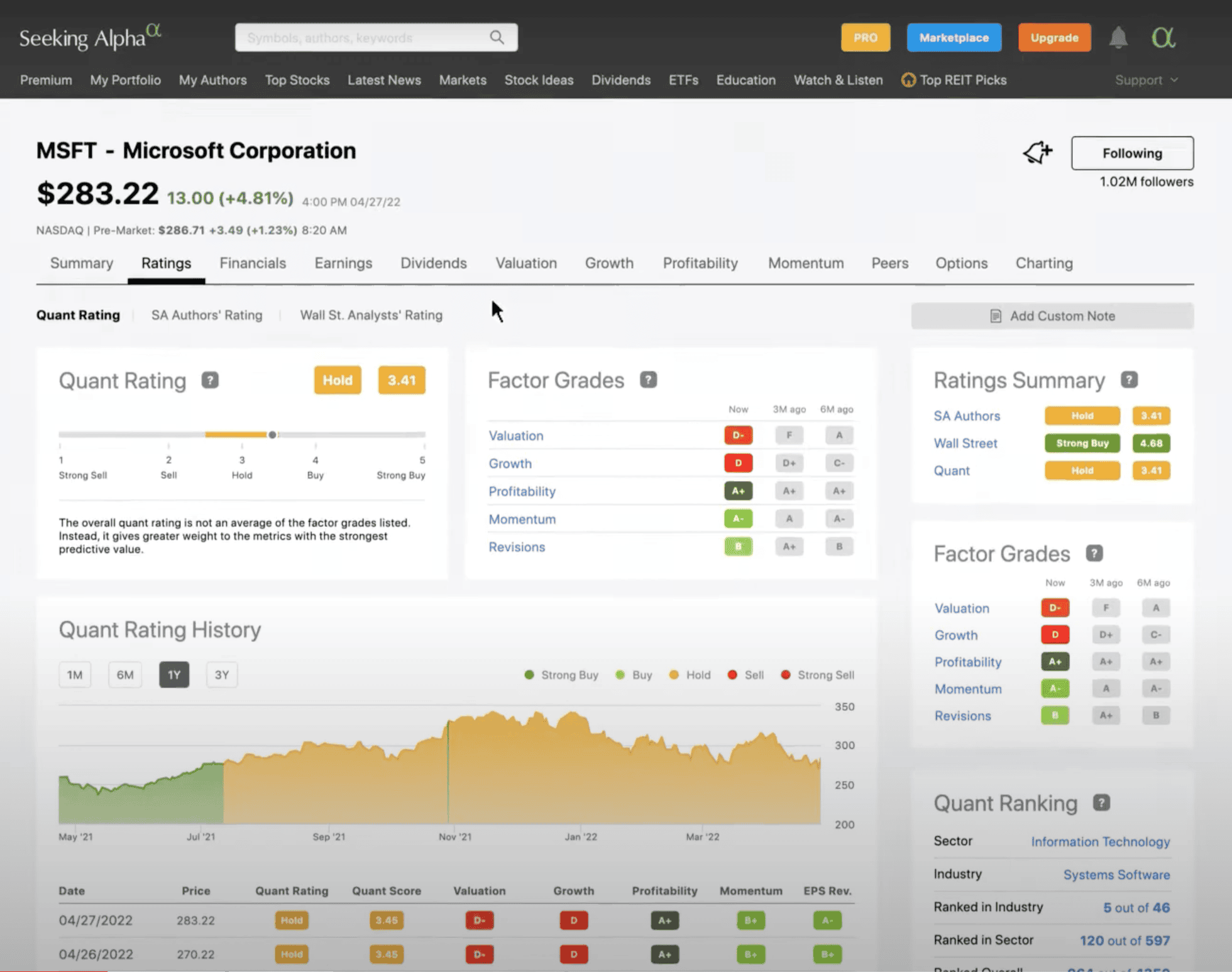

Seeking Alpha

Seeking Alpha is a crowdsourced platform where investors can access articles, research, and earnings call transcripts from both professionals and amateurs. Its diverse range of opinions on specific stocks and sectors helps users stay informed about market sentiment and trends. The platform's customizable watchlists and alerts for news related to specific companies make it a valuable resource for targeted industry updates.

Yahoo Finance

Yahoo Finance offers comprehensive financial news, real-time data, and market analysis. Its user-friendly interface allows users to follow specific stocks, indices, or sectors and receive personalized news alerts. The site provides access to earnings reports and analyst opinions, making it an accessible alternative for those who want timely updates without the complexities of Bloomberg.

Morningstar Direct

Morningstar Direct specializes in investment research, particularly focusing on mutual funds and ETFs. It provides extensive data on fund performance, holdings, and sector analysis. The platform’s robust reporting tools and insights on market trends make it ideal for investment professionals looking to track developments in the fund industry and beyond.

Morningstar Direct specializes in investment research, particularly focusing on mutual funds and ETFs. It provides extensive data on fund performance, holdings, and sector analysis. The platform’s robust reporting tools and insights on market trends make it ideal for investment professionals looking to track developments in the fund industry and beyond.

Refinitiv Eikon

Refinitiv Eikon is a comprehensive financial analysis platform that delivers real-time news, market data, and analytics. With a strong emphasis on breaking news and events affecting global markets, Eikon allows users to filter news by industry or region. Its intuitive interface and customizable dashboards help analysts quickly find relevant information, making it a powerful alternative to Bloomberg.

TradeWeb Markets

TradeWeb is a leading electronic marketplace for fixed income, derivatives, and ETFs. It offers real-time pricing, news feeds, and market analysis tailored to specific asset classes. Its focus on transparency and connectivity allows portfolio managers to stay updated on market-moving events that impact trading decisions, providing a solid alternative for those focusing on trading execution.

FactSet

FactSet provides extensive financial data, analytics, and real-time news feeds. Users can create customized alerts based on specific criteria, ensuring they receive updates pertinent to their investment focus. Its integration of data and research tools allows for thorough analysis, making it a strong contender for those who want deep insights without the high costs associated with Bloomberg.

S&P Capital IQ

S&P Capital IQ delivers detailed financial data, market intelligence, and industry research. Its powerful search capabilities and tailored news alerts keep analysts informed about relevant events in their sectors. The platform’s emphasis on credit ratings and detailed company reports enhances the ability to track market movements, serving as a reliable alternative to Bloomberg for comprehensive research needs.

Glassdoor

Glassdoor provides insights into company performance through employee reviews, salary information, and organizational culture. By monitoring employee sentiment and company reputation, analysts can gauge potential risks or advantages in investment decisions. This qualitative data offers a different perspective compared to traditional financial platforms, making it a unique complement to conventional market analysis tools.

These tools and services collectively enable investment professionals to stay updated on news and market events relevant to their specific areas of interest, ensuring informed decision-making without relying solely on Bloomberg.

Final Note

To wrap things up, exploring alternatives to the Bloomberg Terminal is more important than ever in 2025. The financial data landscape is evolving, and tools like Visualping are key to helping you navigate it effectively. Check out Visualping's pricing here. Or, get in touch today.

By providing timely updates and essential information, Visualping can make a real difference in your investment decisions. So, why not consider embracing alternatives that fit your financial needs? Dive into the world of Visualping, and you might just find the valuable resource you’ve been looking for!

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.