Best 8 Stock Research Tools in 2025

By Emily Fenton

Updated April 2, 2025

Introduction

Stock research tools are rapidly transforming. The speed at which the investment world now operates requires investors to thoroughly understand their market and focus area. This includes having access to real-time and relevant updates about the topics, companies and industries that matter to them.

Economic fluctuations and volatile markets, as well, have made it crucial for investors to get quick, relevant updates in their niche focus area and industry.

The tools and platforms in this guide are designed to support your stock research needs by providing data and news on various asset classes—stocks, mutual funds, exchange-traded funds (ETFs), stock options and more.

By integrating a tool like Visualping into their workflow, portfolio managers and analysts can monitor granular developments, from anywhere on the internet -- including the original web sources that publish them first. This can include price changes, press releases, climate and weather events, product stock and regulatory changes, for instance.

With the right combination of stock research tools, you can detect the market-moving events you need to deeply understand your industry and focus area, and make informed investment decisions.

Best 8 Stock Research Tools in 2025

Visualping

Visualping is a versatile stock market research solution that notifies you of changes on any web pages. For stock analysts, that means it can monitor stock prices, news updates, and other critical financial data with ease.

Best for

- Portfolio Managers and Research Analysts looking to supplement their market research with a versatile web monitoring tool that can extract the exact granular web data their investment hypothesis requires.

- Particularly compatible with fundamental analysis and event driven investing strategies

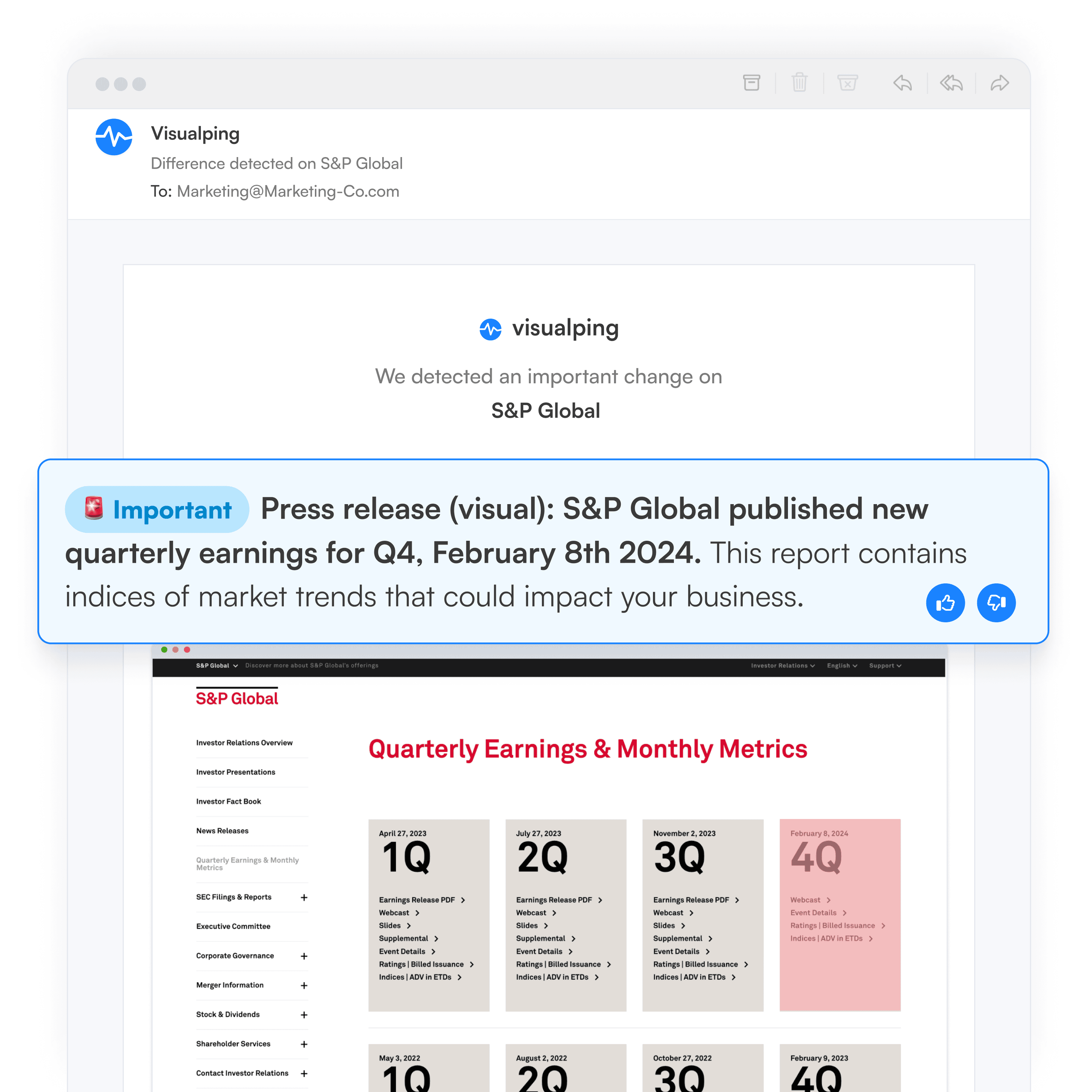

When an update occurs, you get an email alert that includes an AI-generated summary of the change, distilled in two to three lines. The alert also includes a screenshot of the page, with the changes highlighted.

In terms of what you can track, from its database of over a hundred thousand web sources, Visualping’s team imports a custom set of web sources that match your criteria – such as the financial data you’re after, related to your focus area and industry.

As a website change monitoring tool, you can also add your own web sources. Visualping’s team will set up the monitoring for you.

Top Features

-

Limitless content scope: You can monitor any public web source for updates. Be the only one to monitor the pages key to your investment thesis.

-

Real-time alerts: get notified of a change two minutes after it occurs online.

-

Cut through the noise with AI: Only get notified of updates that match your custom criteria, such as certain keywords or financial data, so you’re not sifting through irrelevant alerts.

-

Integrations: Visualping extracts data from web pages as information changes, facilitating direct integrations with your models.

Bloomberg Terminal

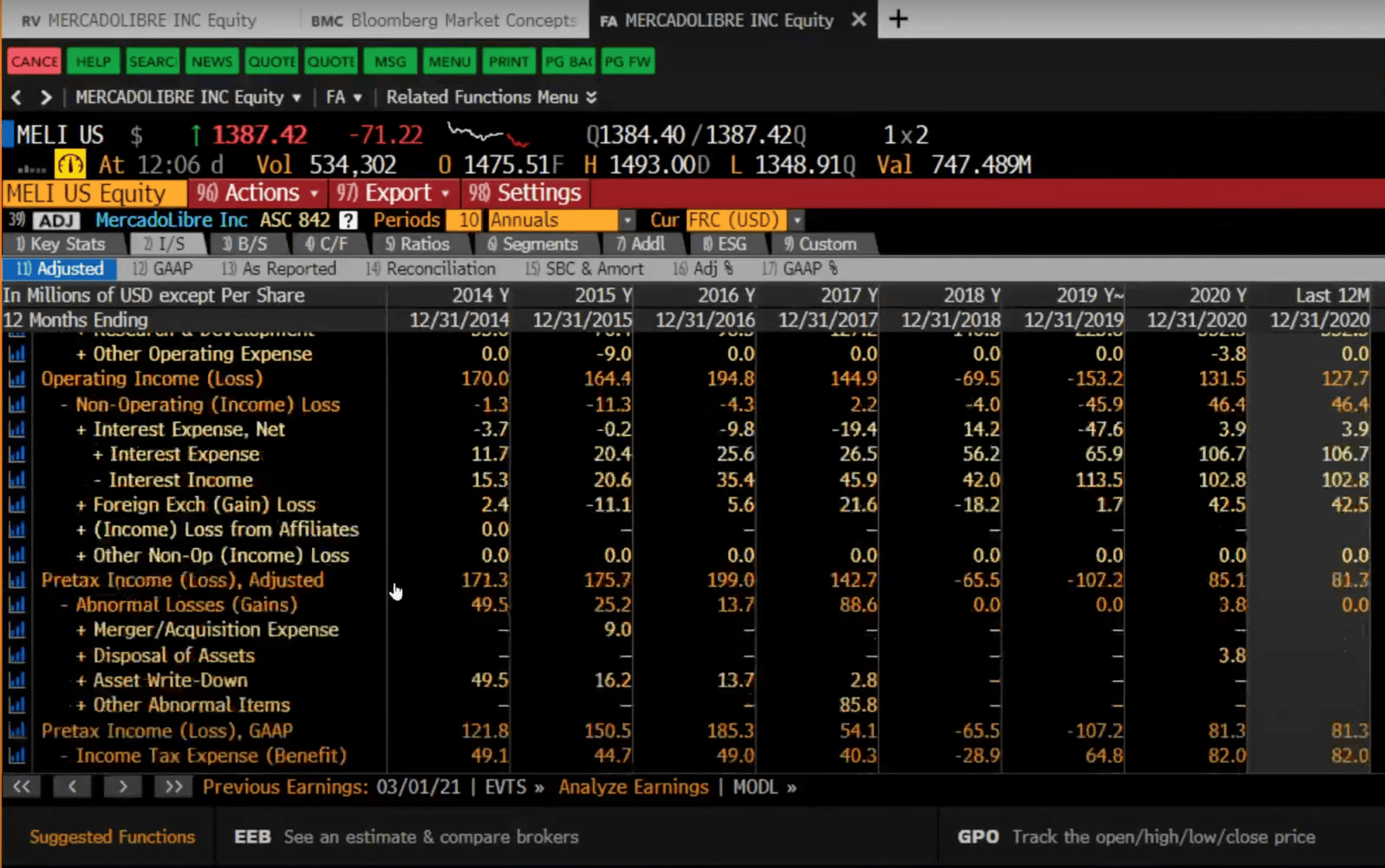

The Bloomberg Terminal is a comprehensive financial data platform offering real-time market data, news, analytics, and research tools.

Best for

- Providing access to global market information, including financials, pricing data, company profiles, and economic indicators.

Its analytics tools help portfolio managers and analysts model investment strategies, track stock performance, and analyze trends. The Terminal also includes advanced charting tools, customizable alerts, and sentiment analysis, essential for timely decision-making in fast-paced hedge fund environments.

See popular Bloomberg terminal alternatives here.

Refinitiv Workspace (formerly Thomson Reuters Eikon)

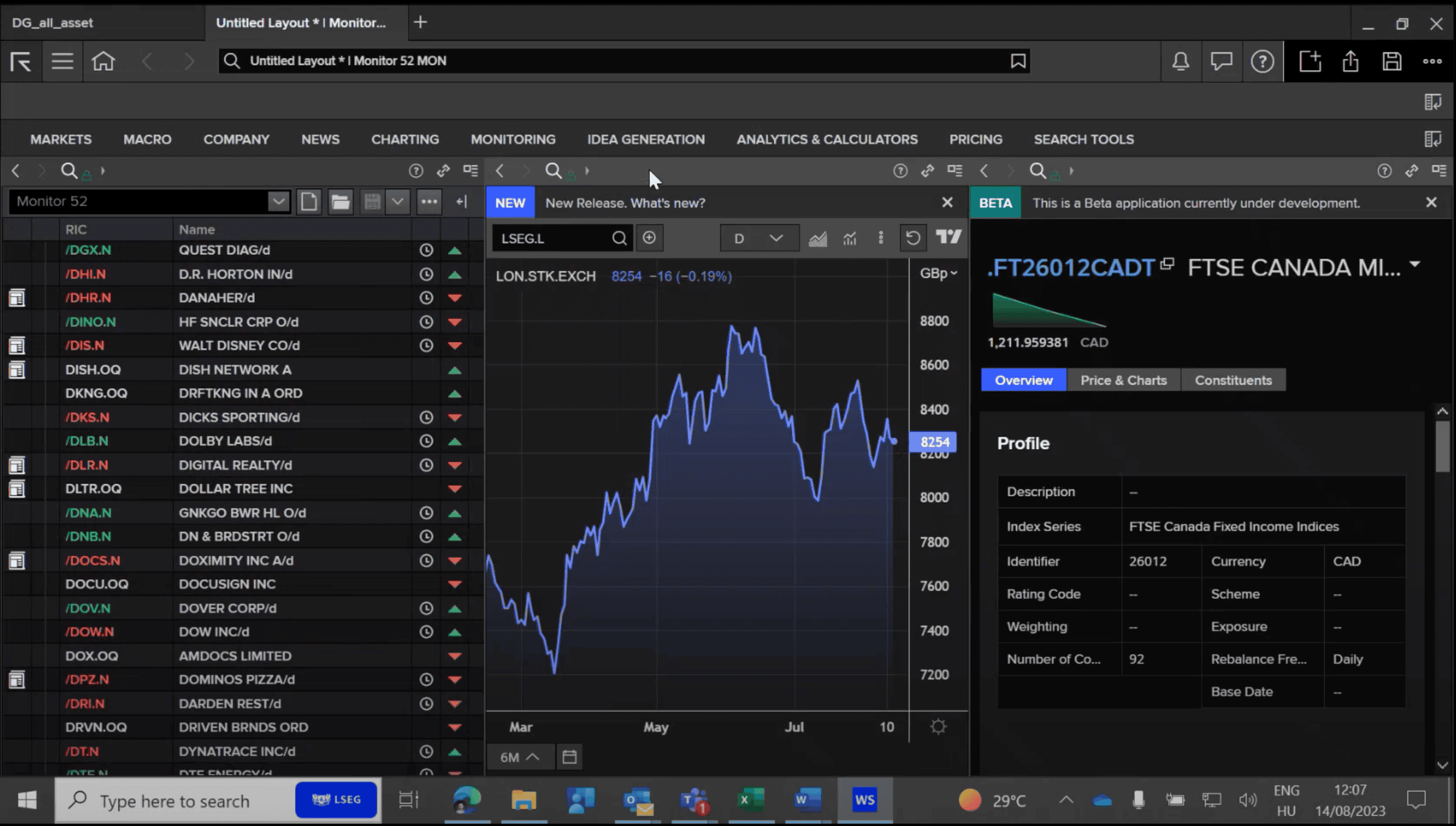

Refinitiv Workspace is a data platform offering news, data, analytics, and trading tools for financial professionals.

Best for

- Providing in-depth financial data, analyst reports, and company financials.

It includes AI-driven insights, economic indicators, and customizable screening tools. Portfolio managers can track market-moving news and sentiment, and gain access to extensive historical data to inform future predictions. Its machine learning tools are particularly useful for identifying emerging trends in equity markets.

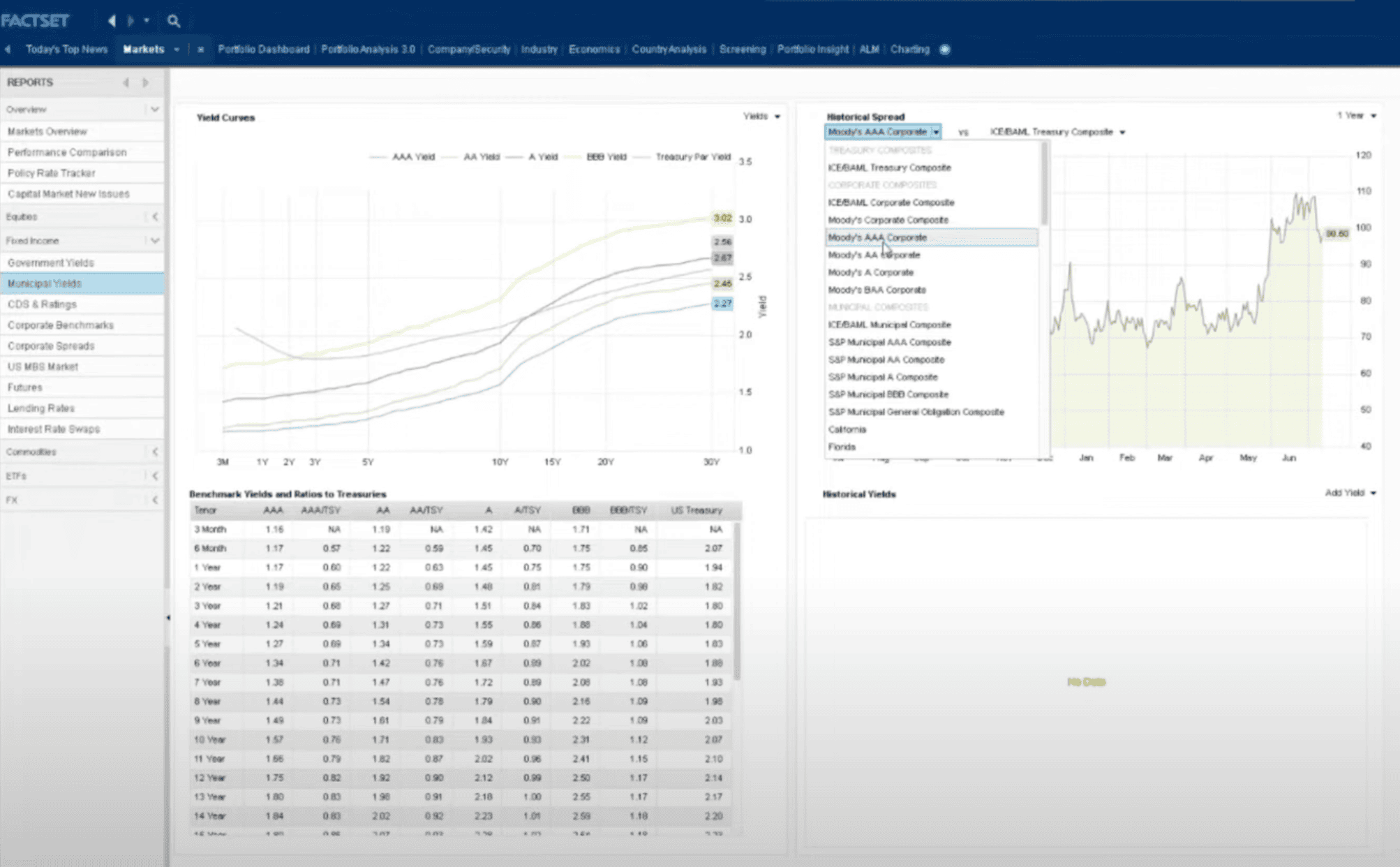

FactSet

FactSet is a financial data and analytics platform that integrates data from various sources and provides tools for financial modeling, portfolio management, and risk analysis.

Best for

- Combining financial data with robust analytics tools, allowing analysts to build sophisticated models, monitor real-time stock performance, and access comprehensive company financials and sectoral data.

Its customization options help hedge funds streamline research workflows, and its screening tools are invaluable for identifying potential investment opportunities across diverse asset classes.

S&P Capital IQ

S&P Capital IQ is a financial intelligence platform that provides detailed financial and market data, including credit ratings and quantitative research.

Best for

- Deep analysis of public and private companies, with access to proprietary data and tools for financial modeling, valuations, and risk assessments.

For hedge funds, its ability to analyze a company’s fundamentals, compare performance metrics, and model different scenarios makes it indispensable in making more informed, data-driven stock investment decisions.

Sentieo

Sentieo is a financial research platform that combines financial data, documents, and AI-driven analytics into a single interface.

Best for

- Allowing portfolio managers to search through earnings call transcripts, SEC filings, and other financial documents to quickly spot trends, sentiment, and red flags.

With its deep document search capabilities and visual analysis tools, analysts can gain insights from unstructured data, enhancing decision-making in stock selection and risk management.

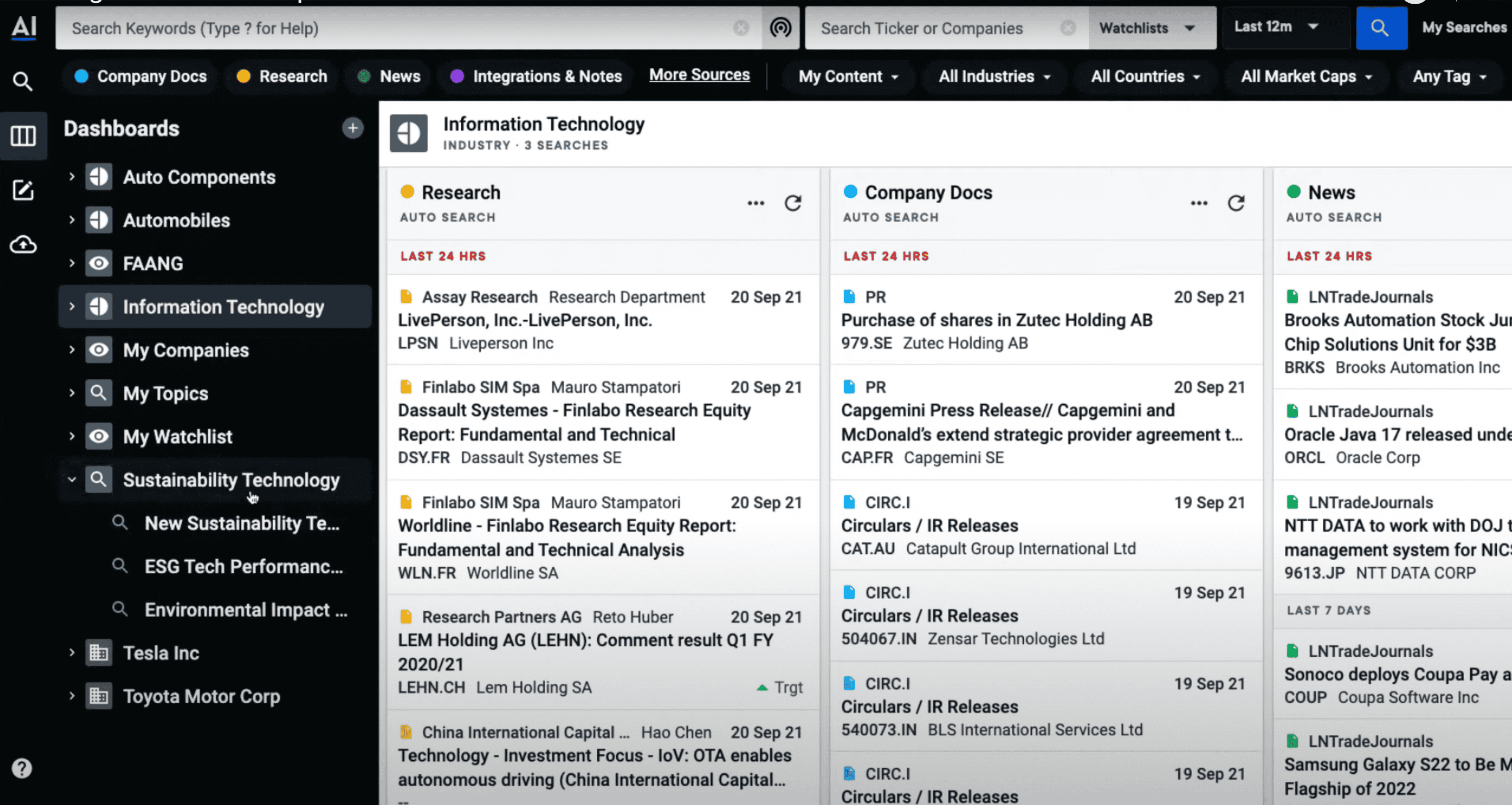

AlphaSense

AlphaSense is sn AI-powered search engine for financial documents that provides real-time access to earnings calls, SEC filings, and other market-moving content.

Best for

- Delivering insights from millions of documents, including earnings reports, investor presentations, and analyst reports.

For hedge funds, it enables quick identification of trends, sentiment shifts, and key events that could affect stock prices. Its sentiment analysis and alert systems make it valuable for predicting market movements.

QuantConnect

QuantConnect is an algorithmic trading and quantitative research platform that provides backtesting, data analysis, and strategy development tools.

Best for

- Helping portfolio managers develop, test, and deploy quantitative trading strategies.

With access to a wealth of historical data across asset classes and its robust backtesting engine, hedge fund analysts can rigorously test stock-picking strategies and optimize models for better predictive accuracy in equity markets. It’s especially valuable for research analysts using data-driven approaches.

Final Thoughts

In 2025, harnessing effective stock research tools like Visualping is critical. With market dynamics constantly evolving, leveraging technology to stay informed will give you the upper hand. Visualping helps take the guesswork out of stock analysis, allowing you to focus on what truly matters—making wise investment choices. Don’t miss out on the chance to enhance your stock research experience; explore Visualping today, and watch your investment knowledge soar!

So, if you’re serious about optimizing your stock research, check out Visualping's pricing here. Or, get in touch today.

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.