Top 7 AI Investment Research Tools for Modern Portfolio Management

By Eric Do Couto

Updated September 29, 2025

Top AI Investment Research Tools: Features, Pricing, and Real-World Workflows

Investors don’t just need dashboards, they also need signals they can trust. The best AI investment research tools combine verifiable data, fast retrieval (LLMs/vector search), and continuous monitoring of the places alpha leaks first: SEC/EDGAR, IR pages, earnings decks/transcripts, product & pricing pages, and regulatory portals.

This guide compares top tools, when to use each, and how to pair them with Visualping to catch critical changes before they hit the feeds.

Key benefits include:

- Real-time market pattern recognition

- Automated financial data processing

- Enhanced decision-making speed

- Strategic adjustment capabilities

We surveyed these tools by their overall functionality, top features, and what they’re best for. Explore and update your toolset with the top 7 AI tools for investment research.

The Shortlist: Best AI Tools for Investment Research

| Tool | Best For | Standout AI Feature | Data Coverage | Pricing Snapshot | Monitoring Fit (with Visualping) |

|---|---|---|---|---|---|

| Visualping | Event-driven & fundamental workflows that rely on original web sources (IR, filings, pricing pages, decks) | AI “Important Alerts” that summarize what changed and why it matters; screenshot diffs | Any public web page: IR, SEC/EDGAR, press rooms, pricing, regulatory portals | Free tier; Team/Enterprise available | Use Visualping as the pre-news change layer; route alerts to Slack/Email/HubSpot/Zapier/n8n for triage |

| Sentieo (AlphaSense) | Equity/fundamental research across filings, transcripts, decks | NLP across documents; smart extraction of tables; unified research workspace | SEC filings, earnings calls, research libraries | Enterprise; contact sales | Pair with Visualping monitoring of IR/filing indices to catch updates before they appear in platform feeds |

| FinChat.io | Conversational queries on fundamentals for public companies | Chat interface with guardrails; verified data answers | S&P Market Intelligence + filings/transcripts | Freemium; paid tiers | Feed Visualping diffs (pricing/IR/press) into chat context for verifiable change events |

| Dataminr | Real-time public-signal detection (news/social/open web) for macro/event traders | Stream processing + alerting on emerging events | High-velocity news, social, public sources | Enterprise; contact sales | Use Visualping to monitor company-specific web pages that won’t surface via social/news streams |

| GPT-5 PRO (model) | Power-users building custom research copilots, modeling, retrieval | Advanced reasoning + long context; tool use | Model-agnostic; connects to your data/tools | API; platform tiers | Combine Visualping’s ground-truth diffs with GPT-5 to draft memos backed by source citations/screenshots |

| Kavout | Quant/factor ideas; predictive scoring & screens | ML-based equity scoring; backtests & screeners | Equity market data, technicals | Plans vary; contact sales | Use Visualping to flag product/pricing/IR changes as event features alongside factor signals |

| Bloomberg Terminal | Institutional workflows needing unmatched market coverage | AI-assisted analytics layered on the Terminal stack | Global multi-asset data + news + analytics | Enterprise; per-seat | Visualping can alert teams to off-Terminal web changes (IR/pricing/regs) that inform Terminal workflows |

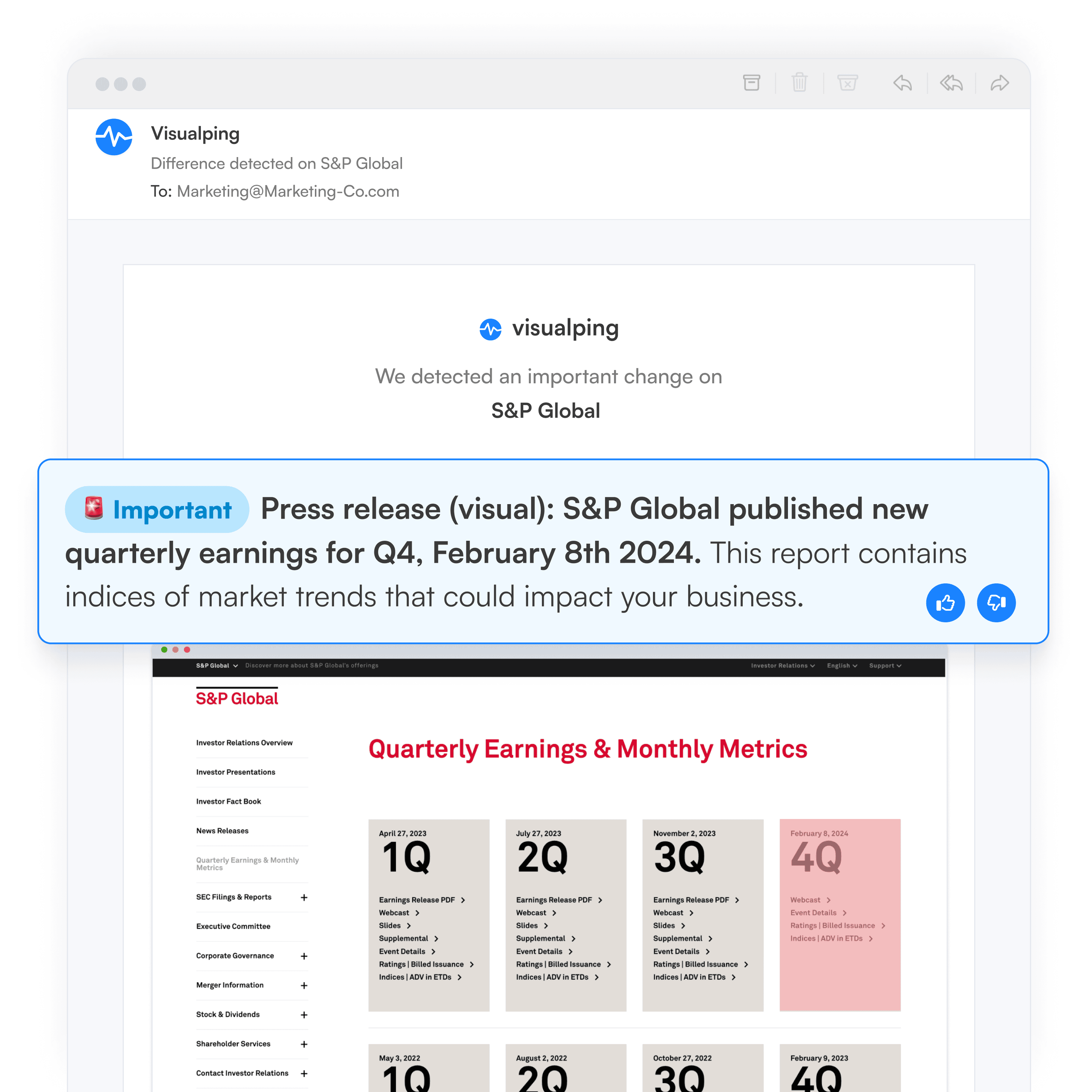

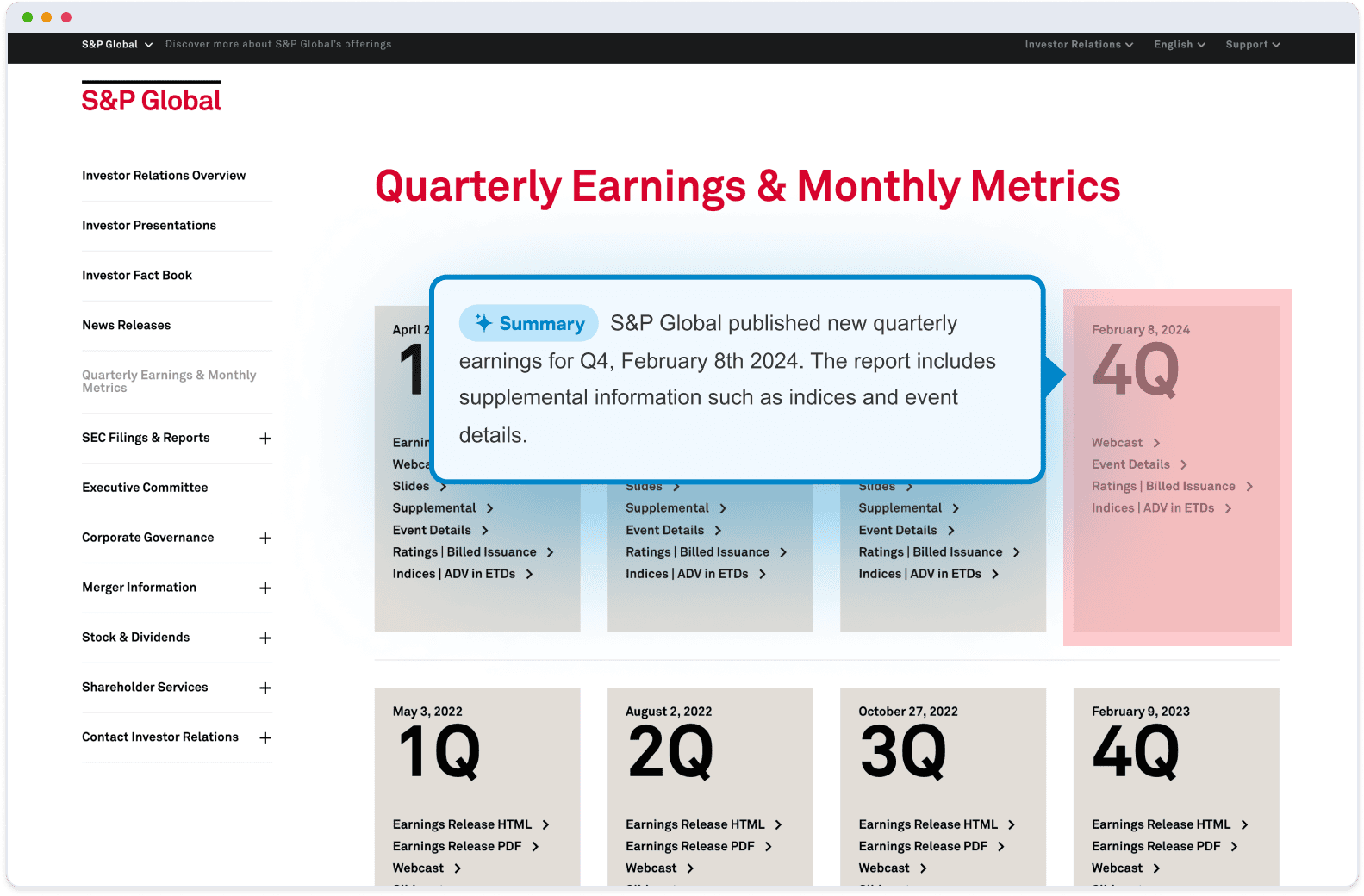

Visualping for Investment Research: Monitor Sources Before the News Hits

Ideal Use Cases

-

Track IR pages, press rooms, 10-K/Q/8-K indexes, prospectus supplements, earnings call decks, product/pricing pages, supplier pages, and regulatory portals.

-

Important Alerts: AI explains what changed and why it matters—no thresholds to tune; just tell the AI what to watch for.

-

Structured outputs: push diffs + AI summaries to Slack, Email, HubSpot, Zapier/n8n for triage.

-

Workflows: “New risk factor in 10-K,” “Pricing tier changed,” “IR FAQ updated,” “Clinical trial status updated,” “Material contract added.”

Primary Users:

- Investment analysts tracking company information

- Portfolio managers monitoring market data sources

- Researchers following economic indicators and trends

The tool excels when investors need granular web data from particular sources that matter to their investment decisions. It captures updates from press releases, executive team changes, shareholder information, and economic data pages across the internet.

Key Capabilities

Visualping offers several core features that make it valuable for investment monitoring:

Content Monitoring Range

- Tracks any public webpage across the internet

- Monitors company-specific pages and market data sources

- Covers press releases, pricing information, and stock data

- Watches regulatory filings and economic indicators

Alert System

- Delivers notifications within two minutes of detected changes

- Provides AI-generated summaries of updates in 2-3 lines

- Includes screenshots with highlighted modifications

- Filters alerts based on user intent, using AI to understand what's important on a page. Ex; a user can instruct Visualping to send an alert only when a new Insider transaction occurs

Advanced Functionality

- Smart filtering reduces irrelevant notifications through AI

- Custom criteria matching for specific financial data or keywords

- Direct integrations with existing models and workflows

- Data extraction capabilities as information updates occur

The platform eliminates manual checking of multiple websites by automating the monitoring process. Users receive concise email alerts that include both visual evidence and AI-powered summaries of what changed, allowing them to quickly assess the relevance of each update to their investment thesis.

Sentieo

Sentieo serves as an AI-powered financial research platform that integrates research capabilities, data analysis, and document management into a single system. The platform enables investment professionals to monitor companies, examine market patterns, and process financial information for comprehensive analysis.

This financial intelligence platform was founded in 2015 and has become part of AlphaSense. It focuses specifically on serving the investment management industry through advanced artificial intelligence tools and workflow optimization features.

Ideal Use Cases

Portfolio Management Applications: Investment managers utilize the platform to examine earnings transcripts, company filings, and regulatory documents. This allows them to identify market trends, assess investor sentiment, and detect potential warning signs across their holdings.

Equity Research Enhancement: Financial analysts leverage the system's document analysis capabilities and visualization tools to extract insights from unstructured data sources. This strengthens their ability to make informed decisions regarding stock selection and risk assessment during due diligence processes.

Key Capabilities

Smart Document Analysis: The platform employs natural language processing and machine learning algorithms to search through extensive document libraries. Users can quickly locate relevant information within SEC filings, earnings call transcripts, and research reports.

| Feature | Function |

|---|---|

| Data Extraction Tool | Automatically identifies and structures financial tables from complex documents |

| Unified Workspace | Combines document storage, annotation capabilities, and team collaboration features |

| Export Functions | Enables seamless data transfer for additional analysis and modeling tasks |

The comprehensive research workflow tools help streamline the investment research process through cloud-based accessibility and modern interface design.

FinChat.io

FinChat.io operates as an AI-powered investment research platform that delivers financial data analysis through conversational interfaces. The platform connects to S&P Market Intelligence databases to provide comprehensive market information. This ChatGPT-powered chat assistant focuses specifically on investor needs and delivers verified data for publicly listed companies.

Ideal Users

Investment analysts benefit from the platform's automated data processing capabilities. The system accelerates financial report analysis and identifies market opportunities through machine learning algorithms.

Quantitative researchers utilize the platform's computational tools for building predictive models. Advanced algorithms support algorithmic trading strategy development and complex financial modeling tasks.

Research professionals leverage natural language processing features to extract insights from earnings reports and regulatory filings. The automated content analysis reduces manual research time while maintaining analytical depth.

Key Capabilities

Automated Financial Analysis processes large datasets using machine learning technology. The system identifies patterns and generates investment insights from complex financial information.

Document Processing Technology extracts critical data from SEC filings, earnings reports, and financial statements. Natural language processing converts unstructured text into actionable intelligence.

Market Sentiment Tracking monitors news sources and market commentary to assess investor behavior patterns. The sentiment analysis tools help predict market movements and investor reactions to financial events.

Dataminr

Dataminr's AI platform transforms how investment professionals analyze market conditions by processing massive volumes of social media posts, news articles, and public information streams. The platform delivers immediate notifications when significant events occur that could impact financial markets.

Ideal Users

Quantitative Analysts leverage the platform's market analysis capabilities to enhance their trading models with current event data and trend information. This real-time analytics approach helps them build more accurate predictive algorithms.

Chief Investment Officers gain comprehensive market visibility through the platform's broad data coverage. They can make strategic portfolio decisions using immediate information about developing situations and emerging risks.

Investment Analysts utilize the platform's event monitoring tools to identify opportunities before competitors. The system helps them track breaking developments that could influence stock prices or sector performance.

Core Capabilities

- Immediate Event Monitoring: The AI system scans public information sources to spot early indicators of major developments like political changes or breaking financial news

- Market Mood Analysis: The platform evaluates investor attitudes by examining social media discussions and news coverage patterns

- Risk Detection Tools: Advanced algorithms identify potential threats to investment portfolios, enabling proactive strategy adjustments

- Custom Alert System: Users receive personalized notifications based on their specific investment interests and risk parameters

GPT-5

GPT-5 has arrived as a powerful tool that could reshape how investment research gets done. The latest AI model from OpenAI brings advanced reasoning abilities that go far beyond simple data summarization. GPT-5 can analyze complex financial patterns, build detailed financial models, and spot investment opportunities that human analysts might miss.

Investment professionals are already testing GPT-5 on real trading workflows. The AI can pull data from multiple sources like SEC filings and financial databases to create three-statement models. It builds upside and downside scenarios while showing how it reached each conclusion.

This technology shift affects both individual investors and large financial firms. Small funds can now access research depth that was once only available to big institutions. The question for investors becomes how to position themselves as AI transforms Wall Street's research landscape.

GPT-5 Capabilities and Impact on Investment Research

GPT-5 introduces advanced reasoning capabilities and expanded context windows that directly address longstanding challenges in financial analysis. The model demonstrates improved performance in enterprise applications while offering better integration with existing financial tools and platforms.

Key Features of GPT-5 for Financial Analysis

GPT-5 delivers significant improvements in financial modeling and data analysis capabilities. The AI model introduces expanded context windows and more powerful coding capabilities that enable deeper analysis of complex financial datasets.

The model excels at multi-variable analysis. GPT-5 cuts through noise to find key business drivers such as unit volumes, pricing, and macro trends. This capability allows analysts to identify critical factors affecting investment performance more efficiently.

Enterprise integration represents a major advancement. OpenAI designed GPT-5 with stronger focus on business analysis tasks. During demonstrations, the model connected to Gmail, Calendar, and Contacts to generate integrated dashboards with optimization calculations.

The AI handles complex financial tasks including:

- Revenue and margin analysis

- Cost structure optimization

- Investment analysis and ROI calculations

- Financial risk assessment

Microsoft has embedded GPT-5 across its business platforms. The model now powers Microsoft 365 Copilot and Azure AI Foundry, bringing advanced reasoning to existing enterprise workflows.

Comparison of GPT-5 With Previous AI Models

GPT-5 shows marked improvements over GPT-4 in reasoning and logic handling. File management platform Box reported that earlier AI models failed advanced tasks due to poor logic capabilities, while GPT-5 successfully completed complex enterprise analysis.

The new model offers enhanced speed and accuracy. Unlike previous iterations that required users to choose between different model versions, GPT-5 automatically decides when to apply deeper reasoning versus fast responses.

Safety and transparency received significant upgrades. The model reduces unsupported claims and speculative answers that affected earlier versions. This improvement proves crucial for investment research where accuracy directly impacts financial decisions.

Performance differences become apparent in coding tasks. GPT-5 demonstrates superior code quality compared to GPT-4, enabling more reliable automated analysis tools for financial applications.

The model's integration approach differs substantially from competitors like Anthropic's Claude or Google's AI offerings. OpenAI focuses on seamless embedding within existing business tools rather than standalone applications.

Performance Benchmarks and Real-World Adoption

GPT-5 shows significant gains in benchmarks testing instruction following and tool use capabilities. These improvements directly translate to better performance in financial analysis tasks requiring precise execution of complex instructions.

Real-world adoption accelerated rapidly after launch. OpenAI reports approaching 700 million weekly active ChatGPT users, with GPT-5 available across Free, Plus, Pro, and Team tiers.

The model offers three API versions for developers: GPT-5, GPT-5 Mini, and GPT-5 Nano. These options help balance performance requirements with cost considerations for different investment research applications.

Despite advances, OpenAI CEO Sam Altman clarified that GPT-5 does not achieve Artificial General Intelligence (AGI). The model still requires human oversight for critical investment decisions.

Early adopters report companies integrating GPT-5's advanced capabilities are positioned for significant competitive advantages. Investment firms using the technology gain faster analysis capabilities and deeper insights from complex financial data.

Kavout

Kavout combines artificial intelligence with machine learning to help investors make smarter investment decisions through advanced data analysis. The platform uses its unique scoring system to evaluate stocks and provides comprehensive tools for portfolio management and market analysis.

Ideal Users

Investment professionals benefit from Kavout's machine learning capabilities for identifying promising opportunities in equity markets. Portfolio managers can use the platform's optimization tools to build diversified investment strategies with detailed risk assessment features.

Quantitative analysts find value in the platform's ability to process complex datasets and apply advanced algorithms to enhance their trading models. The system works well for professionals who need data-driven insights to support their investment research and decision-making processes.

Primary Tools

| Feature | Description |

|---|---|

| Machine Learning Analysis | Uses advanced algorithms to process market data and generate stock recommendations |

| Portfolio Management Suite | Offers tools for building factor-based portfolios with risk analysis and optimization suggestions |

| Predictive Scoring System | Provides equity ratings from 1 to 9 based on technical analysis and market trends |

The platform includes backtesting tools and a comprehensive stock screener that incorporates predictive analytics. Users can access trade ideas through real-time signals while utilizing trend analysis features for better market timing decisions.

Bloomberg Terminal

The Bloomberg Terminal stands as the most powerful tool for financial professionals who require immediate access to market intelligence. This comprehensive platform delivers critical data and analytical capabilities that financial professionals and institutional investors depend on for making strategic decisions. The system incorporates AI-powered analytics and research tools that enhance traditional financial analysis methods.

Ideal Users

The platform serves portfolio managers and analysts who need comprehensive global market access. It provides essential financial metrics including company profiles, pricing information, and economic indicators across multiple asset classes.

Institutional investors benefit from the Terminal's sophisticated modeling capabilities for investment strategy development. The system enables users to monitor stock performance and identify market trends effectively.

The platform supports risk management activities through advanced charting functions and customizable alert systems. These features prove essential for professionals operating in fast-moving financial environments.

Key Capabilities

Real-Time Data Access: The Terminal delivers immediate market information across all asset classes with exclusive news feeds and analytics that support quick decision-making.

Financial Analysis Tools: Users access powerful modeling and charting capabilities, plus quantitative analysis functions. The Excel integration allows custom reporting and analytics.

Communication Systems: Built-in messaging enables direct professional networking, while alert systems notify users of significant market events and changes.

Trade Execution: The platform facilitates seamless transaction processing integrated with comprehensive market analysis.

Investors who adopt AI-powered investment research tools will gain significant advantages in today's rapidly changing markets. These technologies enable faster decision-making and more accurate analysis than traditional methods.

Key benefits include:

- Enhanced market pattern recognition

- Real-time data processing capabilities

- Improved risk assessment accuracy

The financial industry continues to transform through artificial intelligence integration. Those who embrace these innovations position themselves for greater success in competitive investment environments.

Frequently Asked Questions

What is an AI investment research tool?

Software that combines high-quality financial/market data with LLMs, retrieval, and monitoring to surface verifiable signals, summarize filings/transcripts, and accelerate diligence.

Which tools fit fundamental vs. quant vs. PM workflows?

Fundamental: transcript/filings search platforms + Visualping for IR/filing/pricing change alerts.

Quant: data platforms with backtesting & factor models; feed Visualping alerts into your data pipeline for event flags.

PM: dashboard + alerting; use Visualping for pre-news changes (pricing pages, IR FAQs, product updates).

How do I prevent hallucinations?

Favor tools with citations and source links; keep Visualping’s raw page diffs as ground truth in audits.

Can I automate alerts in my AI investment research tools stack?

Yes—send Visualping alerts to Slack/Email/HubSpot/Zapier/n8n with AI summaries for triage and tagging.

Which No-Cost AI Tools Work Best for Stock Analysis?

Several free AI tools provide valuable investment research capabilities. While they may have limitations compared to premium platforms, they offer significant value for cost-conscious investors.

Recommended Free AI Tools:

- Website Change Detection and Alert tools like Visualping offer real-time alerts on critical pages with AI-powered summarizations for quick analysis

- Basic portfolio tracking apps with automated analysis

- Market screeners using AI-driven filters

- Sentiment analysis tools for social media and news

Free tools typically offer limited features or require registration. They may include advertising or restrict the number of daily searches. Despite these limitations, they provide access to AI-powered insights without subscription fees.

Many free platforms serve as entry points to more advanced paid versions. They allow investors to test AI capabilities before committing to premium subscriptions.

Interested in learning more about how Visualping's AI web monitoring can help with your investment research process? Contact us today.

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Eric Do Couto

Eric Do Couto is the Head of Marketing at Visualping and has over a decade of experience building data automation workflows across various industries, including Finance, Accounting, Education, and Food Safety.