Top 8 Investment Research Tools in 2025

By Emily Fenton

Updated January 24, 2025

Introduction

Investment research is the process of analyzing financial markets, companies, and macroeconomic trends to identify opportunities for generating alpha. This involves data analysts and portfolio managers combining their expertise with deep dives into company fundamentals, industry dynamics, and quantitative modeling. The goal is to make informed, data-driven investment decisions that align with the fund’s strategy and objectives.

With the sheer breadth of data now publicly available today, in order to stay competitive, investors real-time updates on the granular, precise information they need about the companies, markets and industries relevant to their hypothesis.

Investment and stock research tools are essential in capturing this data, and conducting the stock market research effectively and efficiently.

Below are the top 8 investment research tools to use in 2025, including an overview of the tool, what it’s best for, and their top features, so you can determine whether and how it can supplement your current investment research process.

Top 8 Investment Research Tools in 2025

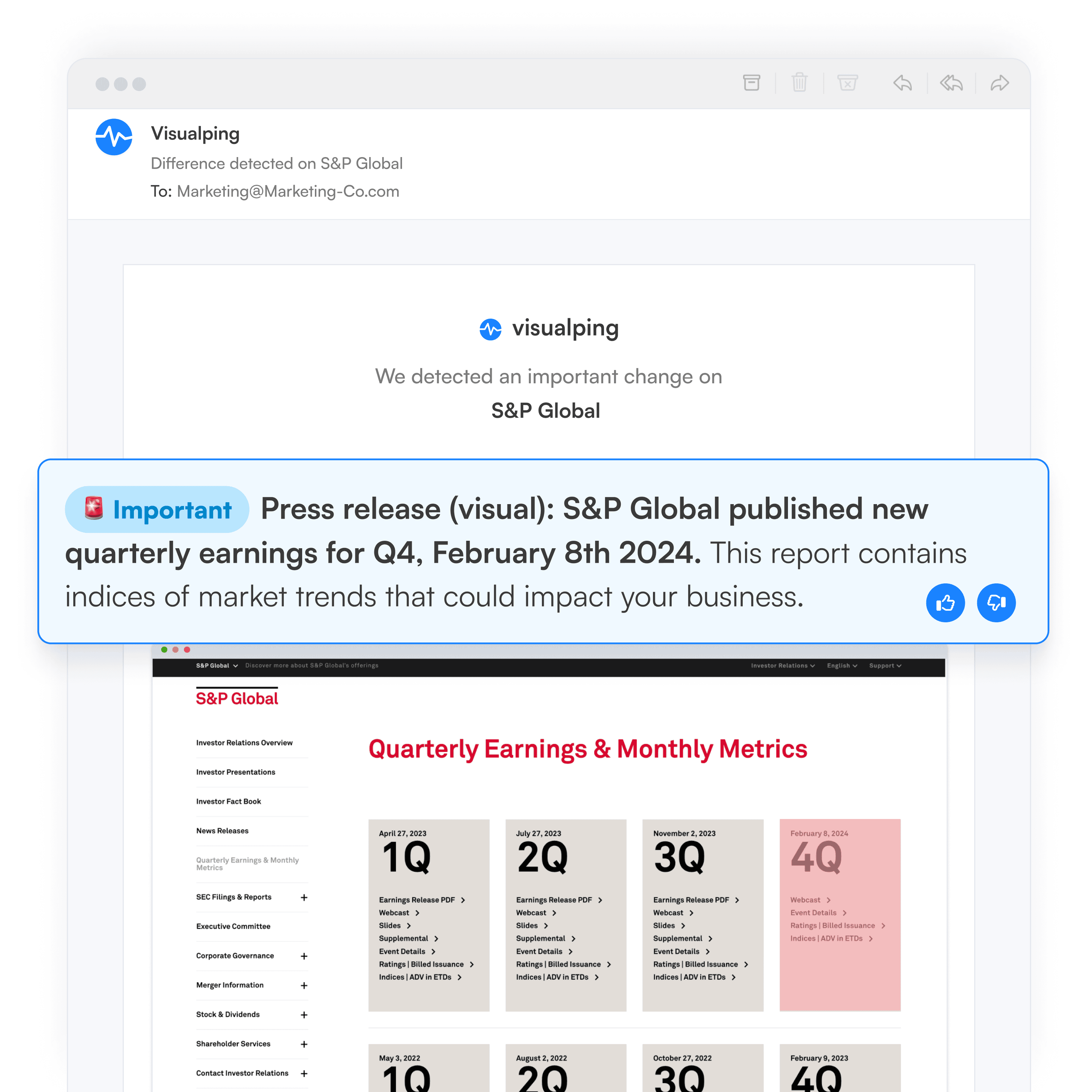

Visualping

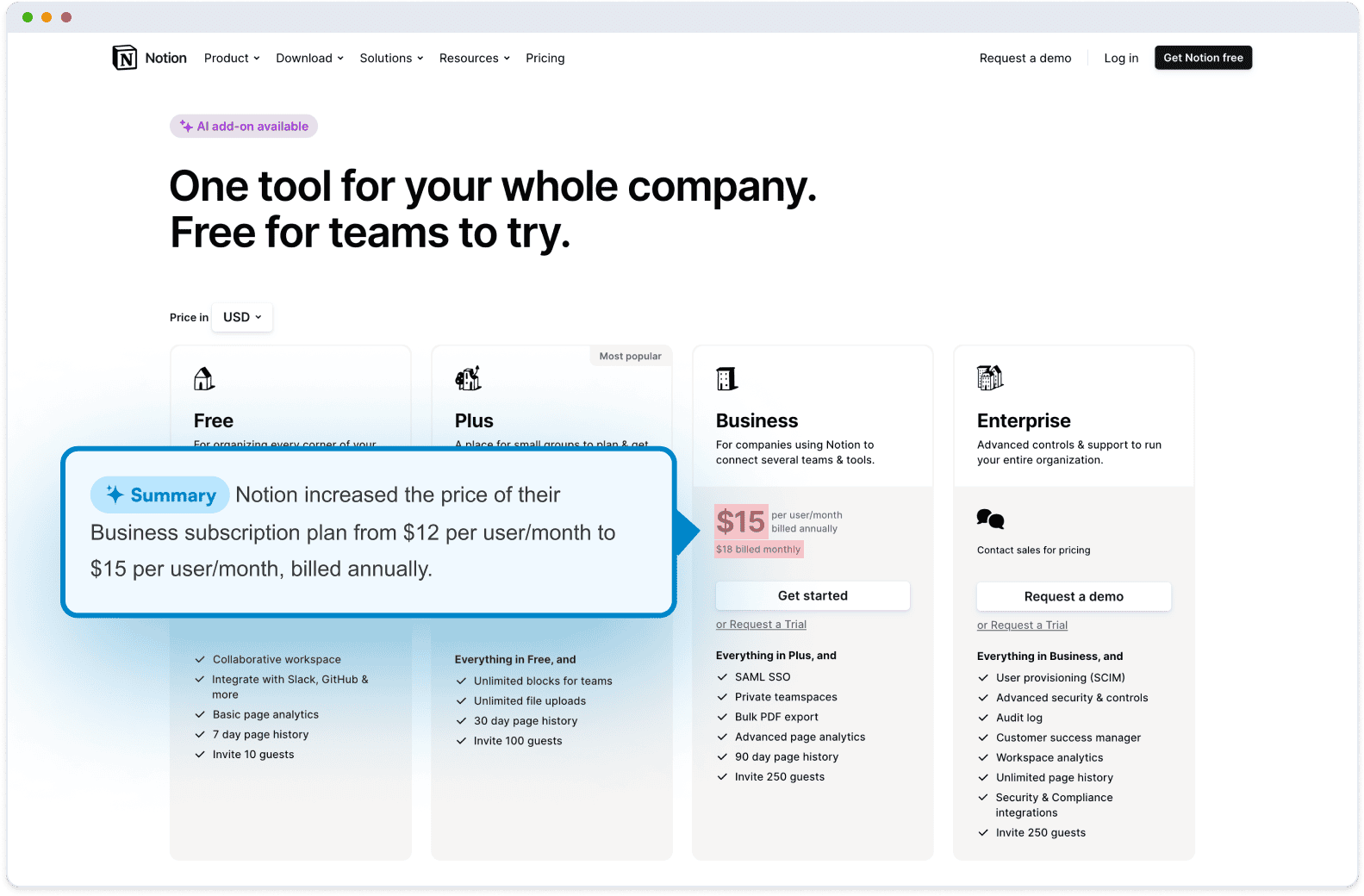

Visualping is a website change monitoring tool that can be used as a versatile investment research solution. It monitors and notifies you of changes on any web pages on the internet.

For researchers, data analysts and fund managers, it can track updates to product prices from anywhere on the internet, as well as press releases, news, stock and shareholder data, and any information relevant to their subject area and investment thesis.

Best for

- Researchers, analysts and fund managers looking to supplement their market research with a versatile web monitoring tool that can extract the exact granular web data their investment hypothesis requires.

- Particularly compatible with fundamental analysis and event driven investing strategies.

When an update occurs, you get an email alert that includes an AI-generated summary of the change, distilled in two to three lines. The alert also includes a screenshot of the page, with the changes highlighted.

In terms of what you can track, from its database of over a hundred thousand web sources, Visualping’s team imports a custom set of web sources that match your criteria – such as the financial data you’re after, related to your focus area and industry.

You can also add your own web sources. Visualping’s team will set up the monitoring for you.

Top Features

-

Limitless content scope: You can monitor any public web source for updates. Be the only one to monitor the pages key to your investment thesis.

-

Real-time alerts: get notified of a change two minutes after it occurs online.

-

Cut through the noise with AI: Only get notified of updates that match your custom criteria, such as certain keywords or financial data, so you’re not sifting through irrelevant alerts.

-

Integrations: Visualping extracts data from web pages as information changes, facilitating direct integrations with your models.

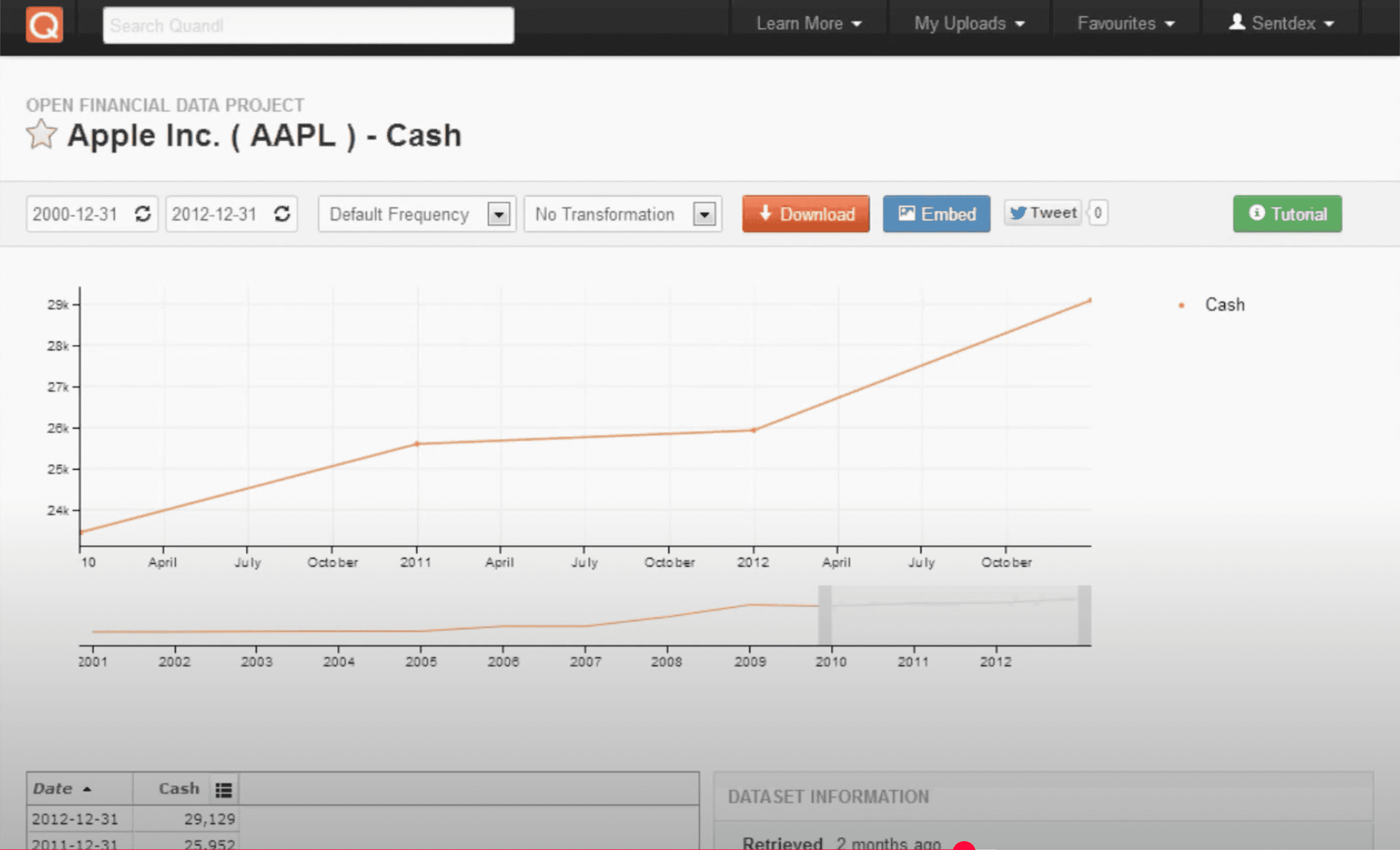

Quandl

Quandl is a premier platform for accessing a wide range of alternative and financial data, particularly useful for hedge funds that leverage alternative data for investment strategies. It offers datasets spanning from macroeconomic indicators and commodity prices to financial reports and equity market data, making it an invaluable resource for quantitative analysts and data scientists who need both traditional and non-traditional data for modeling and forecasting.

Best for

- Quantitative analysts, data scientists, and researchers focused on developing predictive models or using alternative data.

*Ideal for teams within hedge funds that focus on systematic trading strategies or data-driven research.

Top features

-

Alternative data: Extensive datasets that include commodities, macroeconomic indicators, and other non-traditional data sources.

-

Flexible API: Allows seamless integration with data science workflows, including Python, R, and Excel.

-

Data aggregation: Access to multiple data providers in one place, facilitating comparative analysis and cross-market insights.

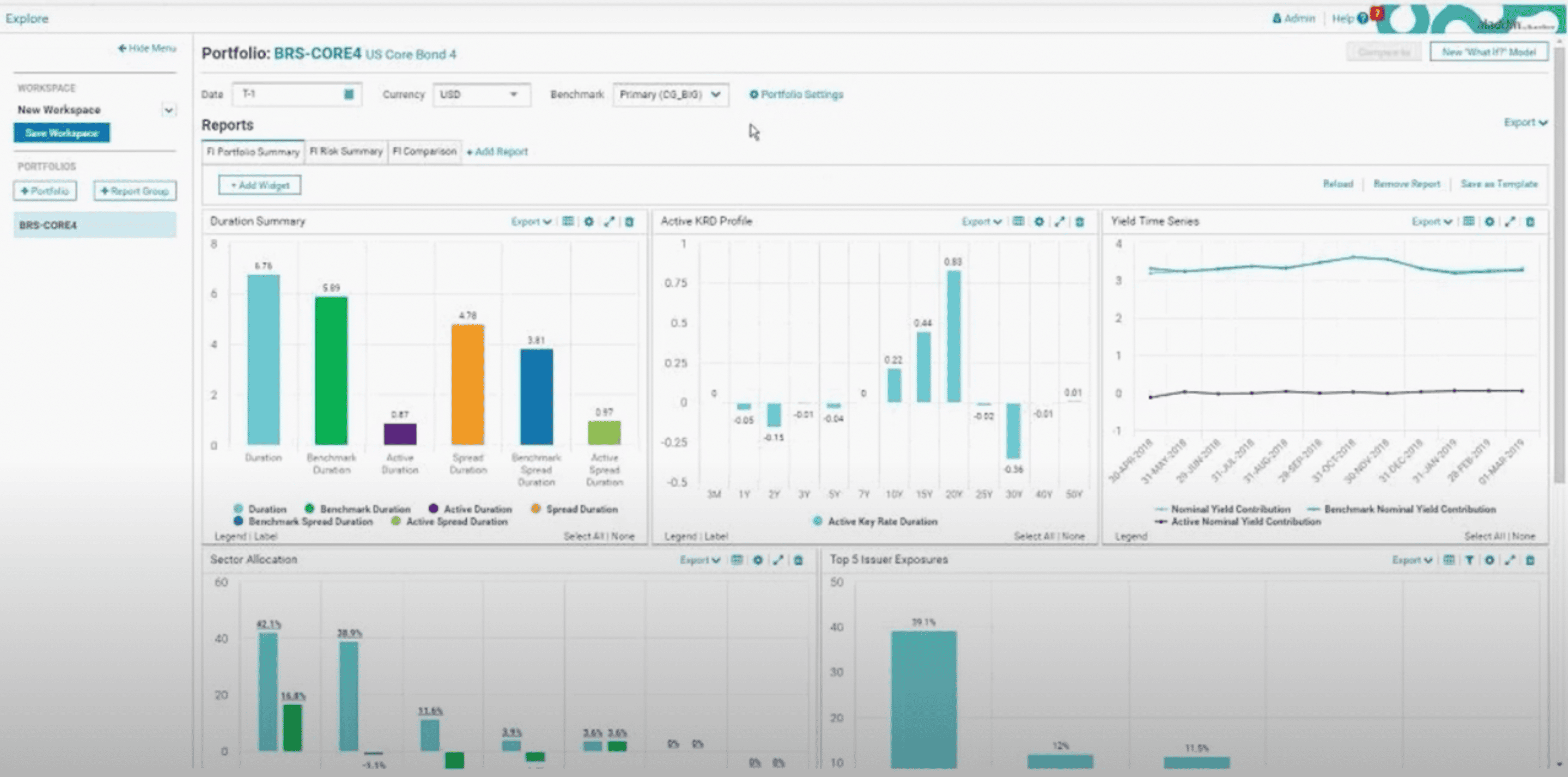

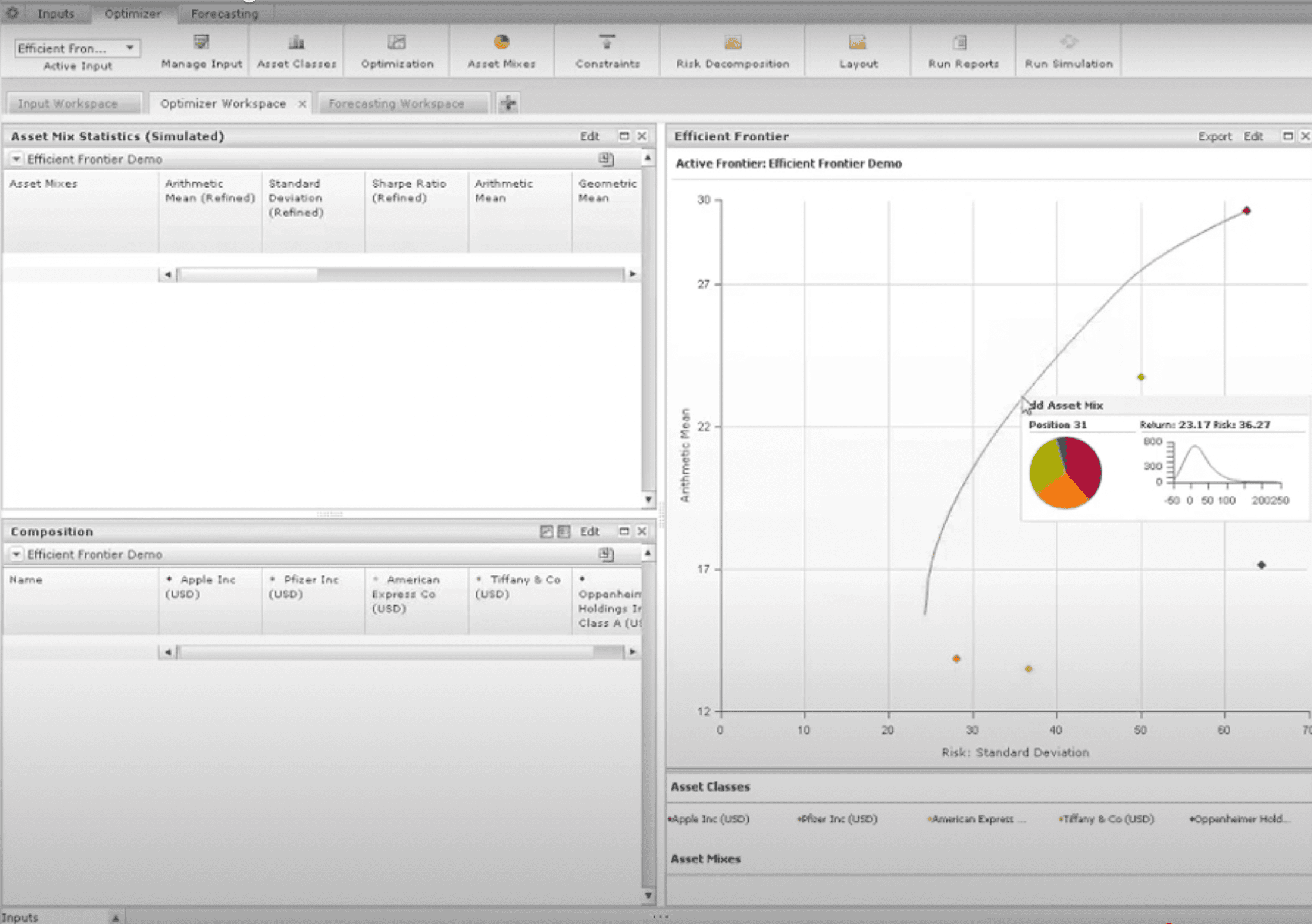

Aladdin by BlackRock

Aladdin is a comprehensive risk management and portfolio management platform widely used by institutional investors and hedge funds. It integrates financial data, advanced analytics, and powerful risk modeling tools into a unified system, enabling fund managers to make better-informed decisions while managing portfolios, assessing risk, and optimizing strategies.

Best for

Portfolio managers, risk analysts, and investment managers working within hedge funds. Primarily used by teams focused on risk-adjusted returns, asset allocation, and portfolio optimization.

Top features

Risk management: Advanced tools for assessing and managing portfolio risks, including stress testing and scenario analysis.

Portfolio optimization: Algorithms that assist in balancing risk and return through optimal asset allocation.

Integration of real-time data: Access to real-time market data, analytics, and trading platforms for timely decision-making.

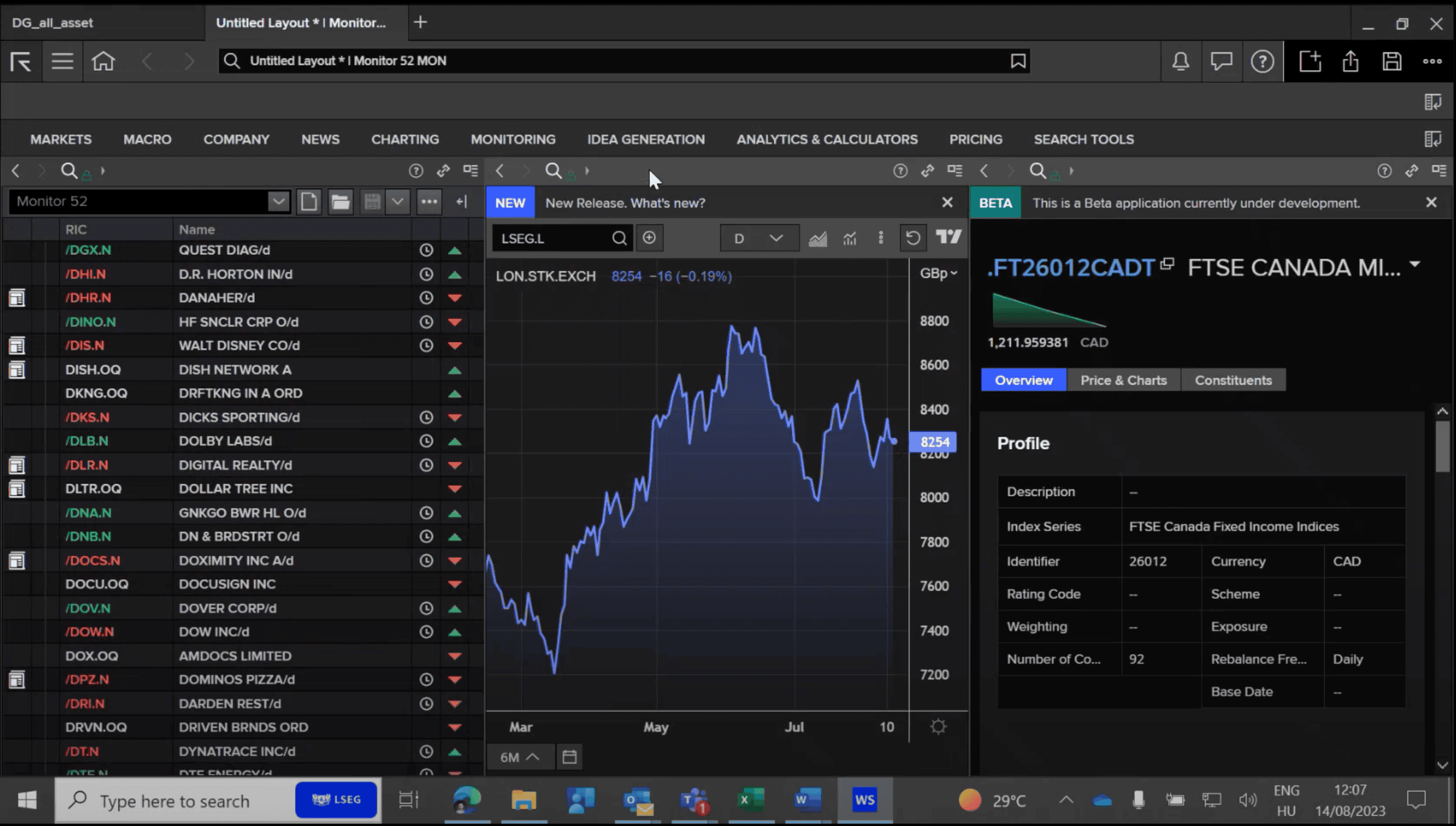

Refinitiv Workspace (formerly Thomson Reuters Eikon)

Refinitiv Workspace is a data platform offering news, data, analytics, and trading tools for financial professionals.

It includes AI-driven insights, economic indicators, and customizable screening tools. Portfolio managers can track market-moving news and sentiment, and gain access to extensive historical data to inform future predictions. Its machine learning tools are particularly useful for identifying emerging trends in equity markets.

Best for

Providing in-depth financial data, analyst reports, and company financials.

Top Features

Comprehensive Market Data & News: Provides real-time access to global financial markets, including equity, fixed income, and commodities data, as well as macroeconomic indicators and breaking news.

Advanced Analytics and Modeling: Offers powerful tools for financial modeling, technical analysis, and quantitative research, enabling users to perform in-depth scenario analysis and stress testing.

Portfolio Management & Risk Analytics: Helps portfolio managers track performance, manage risk, and assess portfolio exposure across asset classes, integrating real-time market data with custom risk models.

Xpressfeed

Xpressfeed is a financial data delivery platform that allows hedge funds to receive customized financial data feeds across various asset classes. It is designed for investors who require large volumes of real-time and historical financial data in a format that can be seamlessly integrated into portfolio management systems and quantitative models.

Best for

Data analysts, quantitative researchers, and technology teams focused on data integration, financial modeling, and systematic research. Xpressfeed is ideal for teams that prioritize large-scale data management and automated reporting for trading and portfolio analysis.

Top Features

-

Customizable data feeds: Tailor data feeds to specific research needs, including market data, corporate earnings, and macroeconomic statistics.

-

Real-time data integration: Integration with internal systems for real-time data streaming and analysis.

-

Scalable infrastructure: Ability to handle large volumes of data, which is essential for hedge funds with high-frequency trading or big data needs.

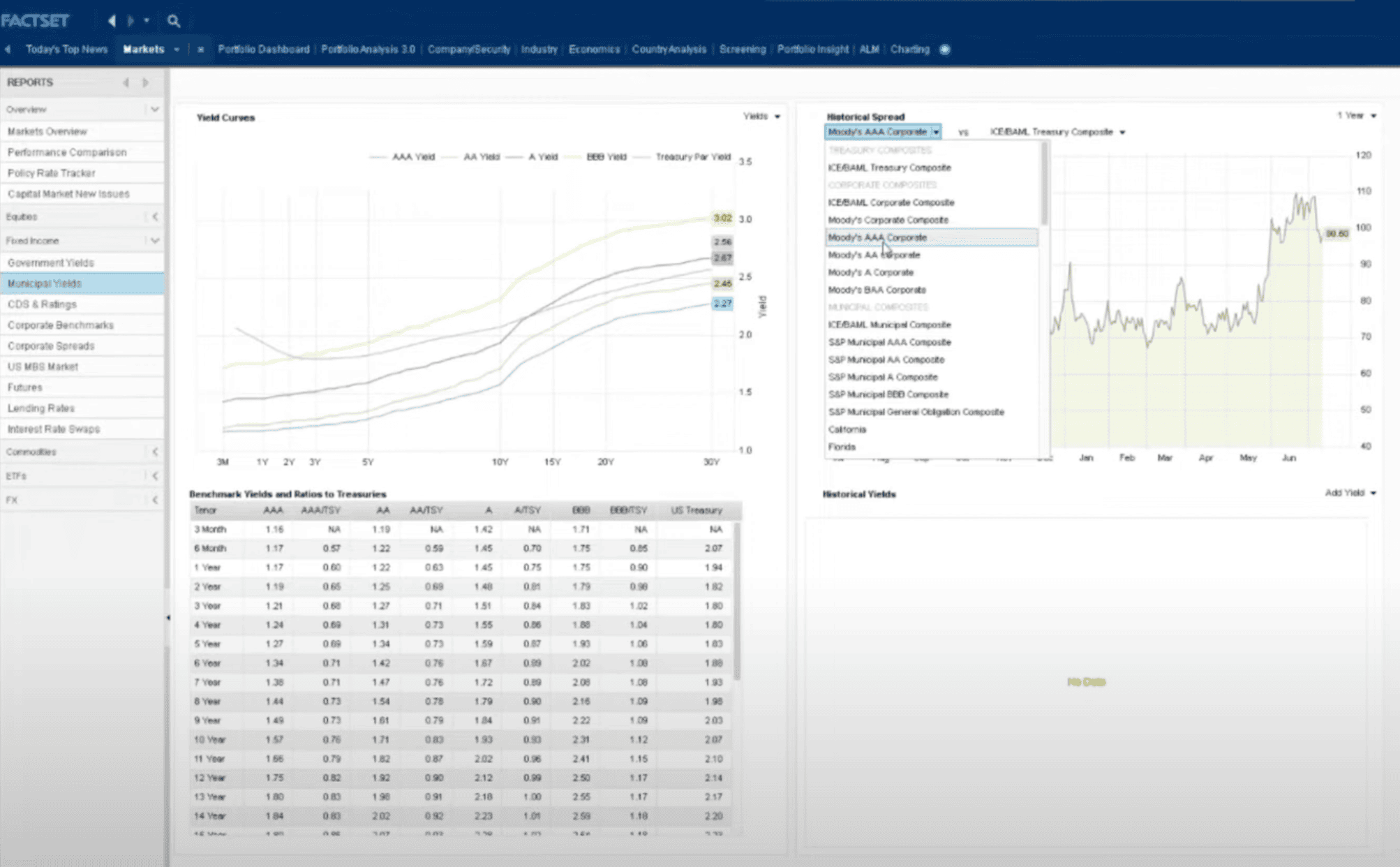

FactSet

FactSet is a financial data and analytics platform that integrates data from various sources and provides tools for financial modeling, portfolio management, and risk analysis.

Its customization options help hedge funds streamline research workflows, and its screening tools are invaluable for identifying potential investment opportunities across diverse asset classes.

Best for

Combining financial data with robust analytics tools, allowing analysts to build sophisticated models, monitor real-time stock performance, and access comprehensive company financials and sectoral data.

Top Features

-

Integrated Financial Data & Analytics: Delivers a unified platform with access to global market data, financial statements, earnings estimates, and economic indicators, all with customizable data feeds.

-

Research & Screening Tools: Includes advanced search and screening capabilities to quickly identify investment opportunities based on specific criteria, as well as deep research tools for equity, fixed income, and alternative assets.

-

Portfolio & Risk Management: Offers robust portfolio management tools for analyzing portfolio performance, tracking risk metrics, and optimizing asset allocations using advanced risk models and stress testing.

MorningStar Direct

Morningstar Direct is a comprehensive investment research platform used by hedge funds to analyze equities, mutual funds, ETFs, and other assets. It offers in-depth data, performance analytics, and fundamentals of various investment products, enabling fund managers and analysts to make data-driven decisions on asset selection, portfolio construction, and performance evaluation.

Best for

Portfolio managers, research analysts, and fund managers working in traditional and alternative asset management teams. Ideal for those focused on fund selection, asset allocation, and performance attribution for both individual stocks and multi-asset portfolios.

Top features

-

Comprehensive fund data: Extensive data on mutual funds, ETFs, and other investment products.

-

Performance attribution: Tools to analyze and break down the performance of portfolios, including risk-adjusted returns.

-

Investment screening: Screening capabilities to identify investment opportunities based on a wide range of financial metrics and qualitative factors.

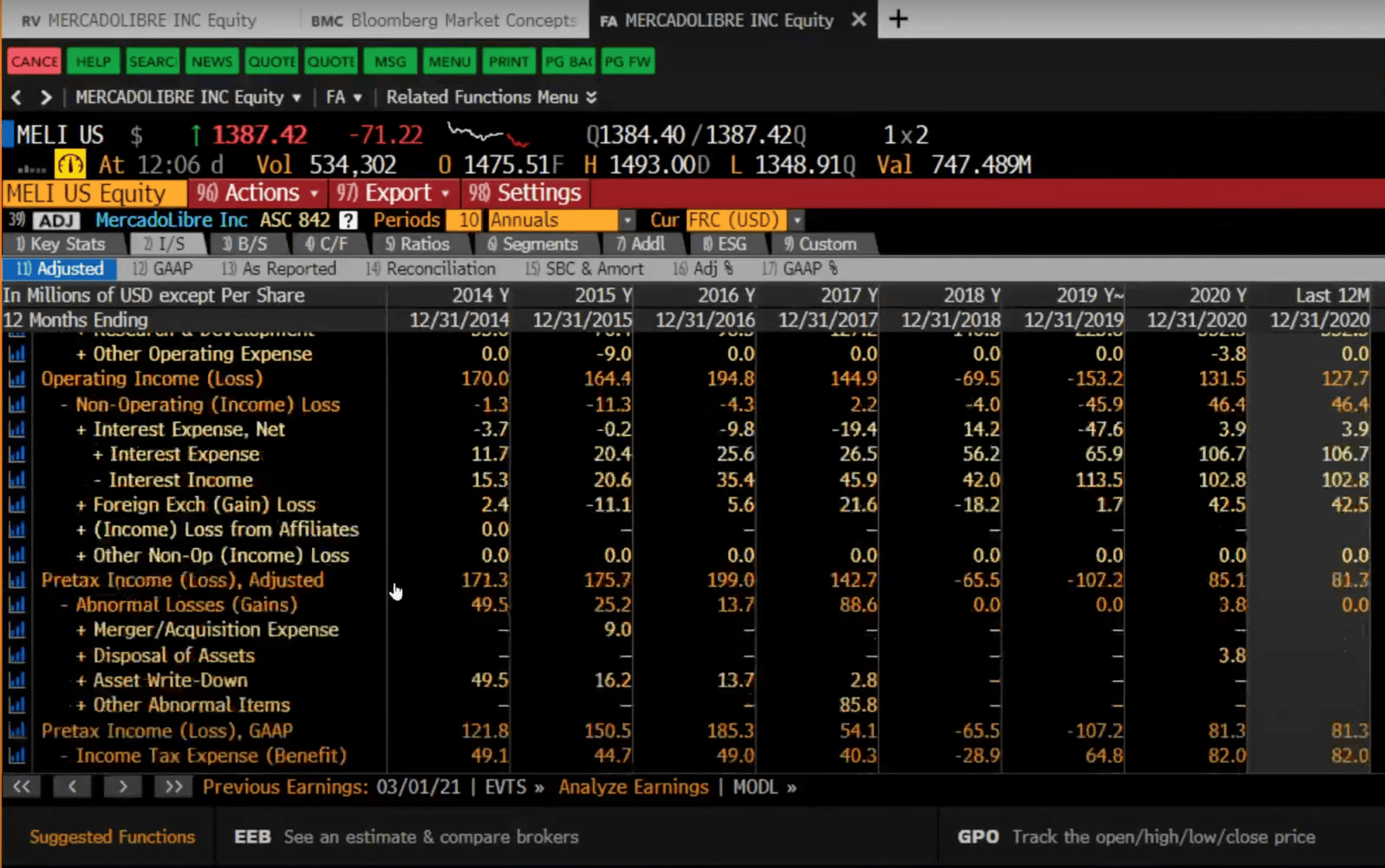

Bloomberg Terminal

The Bloomberg Terminal is a comprehensive financial data platform offering real-time market data, news, analytics, and research tools.

Its analytics tools help portfolio managers and analysts model investment strategies, track stock performance, and analyze trends. The Terminal also includes advanced charting tools, customizable alerts, and sentiment analysis, essential for timely decision-making in fast-paced hedge fund environments.

See popular Bloomberg terminal alternatives here.

Best for

Providing access to global market information, including financials, pricing data, company profiles, and economic indicators.

Top features

-

Real-Time Market Data & News: Provides unmatched access to real-time market data across all asset classes, including exclusive news, analytics, and data feeds that are critical for timely decision-making.

-

Advanced Financial Analysis & Tools: Equipped with powerful tools for in-depth financial modeling, charting, and quantitative analysis, including Bloomberg Excel Add-In for custom analytics and reporting.

-

Integrated Communication & Collaboration Features: Includes Bloomberg Messaging (Instant Bloomberg or IB), which allows users to communicate directly with industry professionals, as well as custom alerts and notifications for market events and changes.

Final Thoughts

With the breadth of data in today's investment world, leveraging investment tools to stay on top of the particular information you need efficiently and effectively, is crucial. Visualping automatically sends you web data alerts, from the particular sources relevant to your subject area or research hypothesis, helping you save time, while thoroughly understanding the markets, companies and industries trend you need you need to know. Contact us today to find out more about how Visualping can help you generate alpha.

So, if you’re serious about optimizing your stock research, check out Visualping's pricing here. Or, get in touch today.

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.