Top Equity Research Tools for Analysts in 2025

By Emily Fenton

Updated January 29, 2025

Introduction

The liaison between buy-side and sell-side firms, equity research is the process of analyzing stocks and other equity securities to uncover investment opportunities that align with the fund’s strategy.

Whether for long, short, or event-driven investing, you’re doing in-depth stock market research. Equity research analysts usually specialize in a small group of companies, in a specific industry or geographic area, and need to develop high-level expertise to make accurate and informed recommendations.

This involves monitoring market data, relevant events and news reports to update your research up-to-date, and inform your views.

And, to do that efficiently and effectively, you need to find the right equity and investment research tools that will complement your research process, and help you garner specialised industry insight in your focus area.

The list below, of the top 8 equity research tools to go deep in your vertical, include an overview of what the tool is best for, their top features, and pricing.

Top Equity Research Tools to Go Deep in Your Vertical 2025

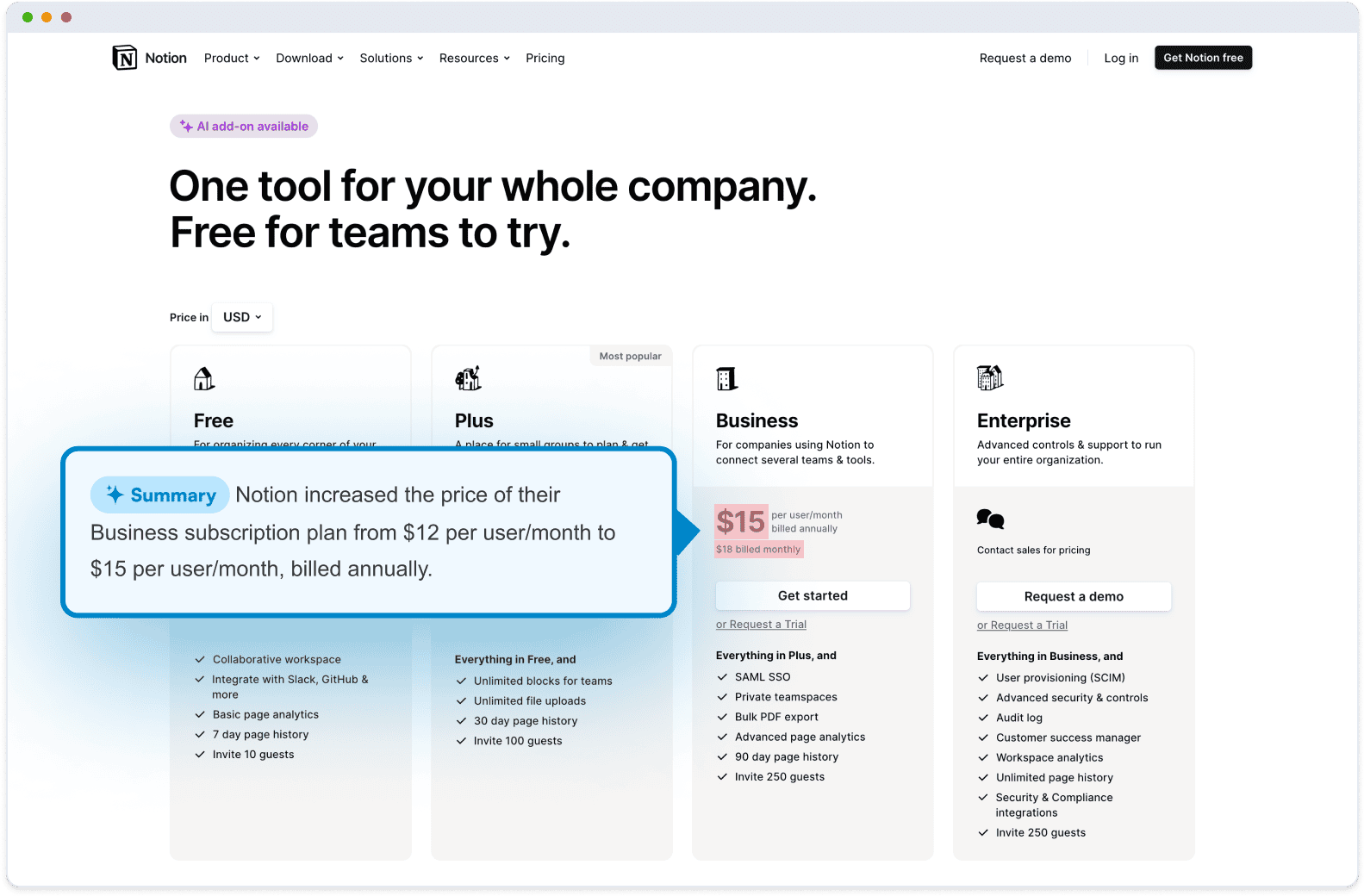

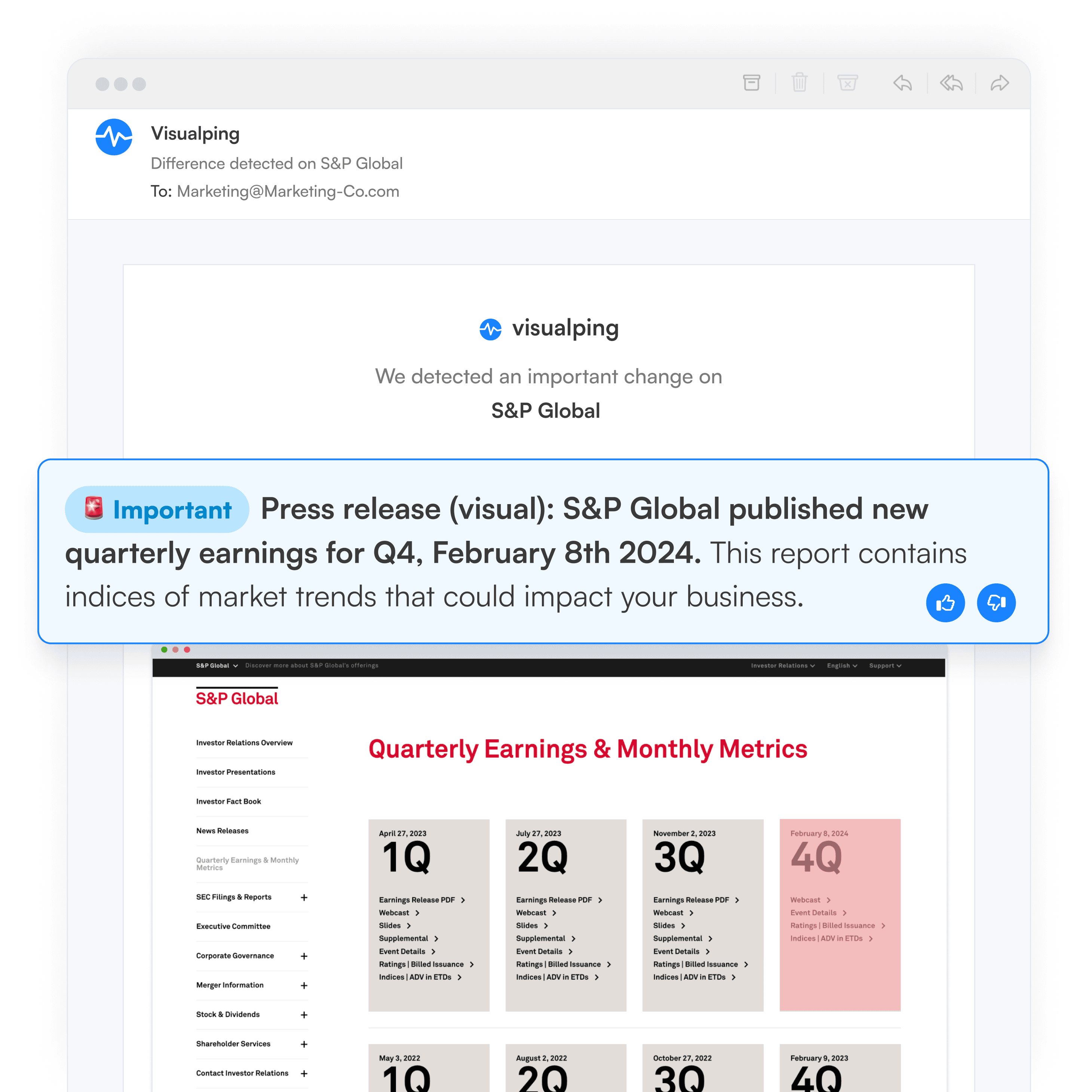

Visualping

Visualping is a website change monitoring software that can be used as a versatile equity research tool. It monitors and notifies you of web changes, from any pages you want online.

For equity researchers and analysts, it can track updates to web sources relevant to a handful of companies or markets, so you can go super deep in understanding what’s going on.

From product prices, executive team pages, press releases, news, and stock and shareholder data, you can get automatically notified of the granular changes you need to own your subject area.

Best for

- Equity researchers, associates and analysts looking to supplement their equity research with granular web data from specific web sources of interest.

- Particularly compatible with fundamental analysis and events-driven strategies.

When an update occurs, you get an email alert that includes an AI-generated summary of the change, distilled in two to three lines. The alert also includes a screenshot of the page, with the changes highlighted.

In terms of what you can track, from its database of over a hundred thousand web sources, Visualping’s team imports a custom set of web sources that match your criteria – such as the financial data you’re after, related to your focus area and industry.

You can also add your own web sources. Visualping’s team will set up the monitoring for you.

Top Features

- Limitless content scope: You can monitor any public web source for updates. Be the only one to monitor the pages key to your investment thesis.

- Real-time alerts: get notified of a change two minutes after it occurs online.

- Cut through the noise with AI: Only get notified of updates that match your custom criteria, such as certain keywords or financial data, so you’re not sifting through irrelevant alerts.

- Integrations: Visualping extracts data from web pages as information changes, facilitating direct integrations with your models.

Pricing

Business plans, include real-time monitoring, popular integrations (Like Google Sheets and Slack), and bulk monitoring.

Business plans start at $100/month.

But, for customized AI alerts, dedicated service and bulk dataset upload, you can get a Solutions plan for $3,000. Get in touch to discuss the best plan that works for you.

Quodd

Quodd provides real-time market data, financial information, and news, with a strong emphasis on equities. The platform is designed for investment professionals who need to monitor multiple markets and track changes in real time, with tools for historical analysis, financial modeling, and news aggregation.

Best for

- Hedge fund analysts who need real-time price and volume data across multiple exchanges.

- Portfolio managers looking to track the impact of global events on their investments.

Top Features

- Real-Time Market Data: Instant access to equity prices, indices, and market trends across global exchanges.

- Advanced Charting & Analytics: Robust tools for technical analysis and data visualization.

- Custom Alerts: Set custom alerts for stock price changes or news developments.

Pricing

Pricing is flexible, generally starting at $12,000–$18,000 per year, depending on the number of users and data packages selected.

Morningstar Direct

Morningstar Direct is a leading stock research tool that provides extensive data on mutual funds, stocks, ETFs, and alternative investments. It is known for its in-depth analysis of investment portfolios, risk management tools, and qualitative data on managers and strategies.

Best for

- Ideal for portfolio managers who need detailed data and performance metrics on asset classes, especially for long-term, strategic investments.

- Data analysts focused on fund performance and asset allocation.

Top Features

- Investment Performance Analytics: Detailed metrics and reports for analyzing portfolio returns and risk.

- Fund Data & Research: Comprehensive research on mutual funds, ETFs, and other managed investments.

- Risk & Scenario Analysis: Tools to assess portfolio risk and run scenario analysis based on market conditions.

Pricing

Pricing starts around $10,000 per year for individual users, with more advanced features and data sets available at a higher price point.

YCharts

YCharts is a financial research platform that specializes in providing powerful data visualization tools and comprehensive market analytics. It is particularly popular among financial advisors and analysts for its user-friendly interface and its ability to generate clean, detailed reports with ease.

Best for

- Great for data analysts and portfolio managers who prioritize data visualization.

- Its clear and easily customizable charts are ideal for quickly presenting complex financial data.

Top Features

- Customizable Dashboards: Create personalized dashboards to track the metrics that matter most.

- Advanced Charting: Use its robust charting tools to visually analyze trends and performance.

- Fundamentals and Valuation Tools: Access key valuation metrics like P/E ratios, DCF, and other financials.

Pricing

Pricing starts at around $600 per month, with plans scaling based on the number of users and features required.

FactSet

FactSet provides a comprehensive financial data platform used for investment analysis and portfolio management. With a wide range of tools covering equity, fixed income, and alternative assets, it aggregates data from a variety of sources to deliver detailed insights. FactSet’s powerful data visualization and analytics capabilities enable in-depth financial modeling and research across multiple asset classes.

Best for

- Best suited for equity research, financial modeling, and portfolio management.

- Data analysts benefit from its deep datasets and analytics.

- Portfolio managers use it to manage portfolios, conduct risk assessments, and monitor market trends.

Top Features

- Integrated Data Sets: Access to global equity data, financials, macroeconomic trends, and alternative data sources. Portfolio Management Tools: Comprehensive tools for portfolio construction, risk analysis, and performance evaluation.

- Custom Analytics & Reporting: Ability to customize reports and analyses to specific investment strategies or themes.

Pricing

Pricing is typically subscription-based and varies depending on the number of users and level of data required, ranging from $12,000 to $20,000 per user annually.

Koyfin

Koyfin is a relatively newer tool that has gained popularity for offering free access to high-quality financial data, advanced charting, and analytics. Its strength lies in providing easy access to global financial data, economic indicators, and fundamental analysis tools.

Best for

- Ideal for data analysts and smaller hedge funds or independent researchers looking for cost-effective yet powerful financial tools, particularly for global equity and macroeconomic analysis.

Top Features

- Global Equity Data: Access to a wide array of international financial data and performance metrics.

- Advanced Charting: Visualize company financials with interactive charts, including technical indicators.

- Economic Data and Indicators: Access to macroeconomic data and indicators to support broader market analysis.

Pricing

Koyfin offers a free version, with a premium version available starting at $100 per month.

Bloomberg Terminal

The Bloomberg Terminal is a powerful financial data and analytics platform that provides real-time market data, news, and analytics for equities, fixed income, commodities, derivatives, and more. It is widely regarded as one of the most comprehensive tools for professional investors, with in-depth financial reporting and access to global markets. The terminal integrates news feeds, historical data, and financial modeling tools in one platform, supporting portfolio management, research, and trading decisions.

Best for

- Ideal for both data analysts who need accurate and timely information, and portfolio managers who need to track investments and market conditions in real-time.

- Widely used for macroeconomic analysis, company financials, and sector insights.

Top Features

- Real-Time Market Data: Instant access to up-to-the-minute market prices, news, and trading data.

- Customizable Financial Models: Users can create and adapt detailed financial models, including DCF, relative valuation, and other methodologies.

- Advanced Analytics: Sophisticated charting and technical analysis tools for both macroeconomic and microeconomic research.

Pricing

Bloomberg Terminal is priced at approximately $20,000–$25,000 per user annually, with additional costs for specialized data feeds or extended functionalities. The pricing can vary based on the region and package.

Check out some popular Bloomberg Terminal Alternatives.

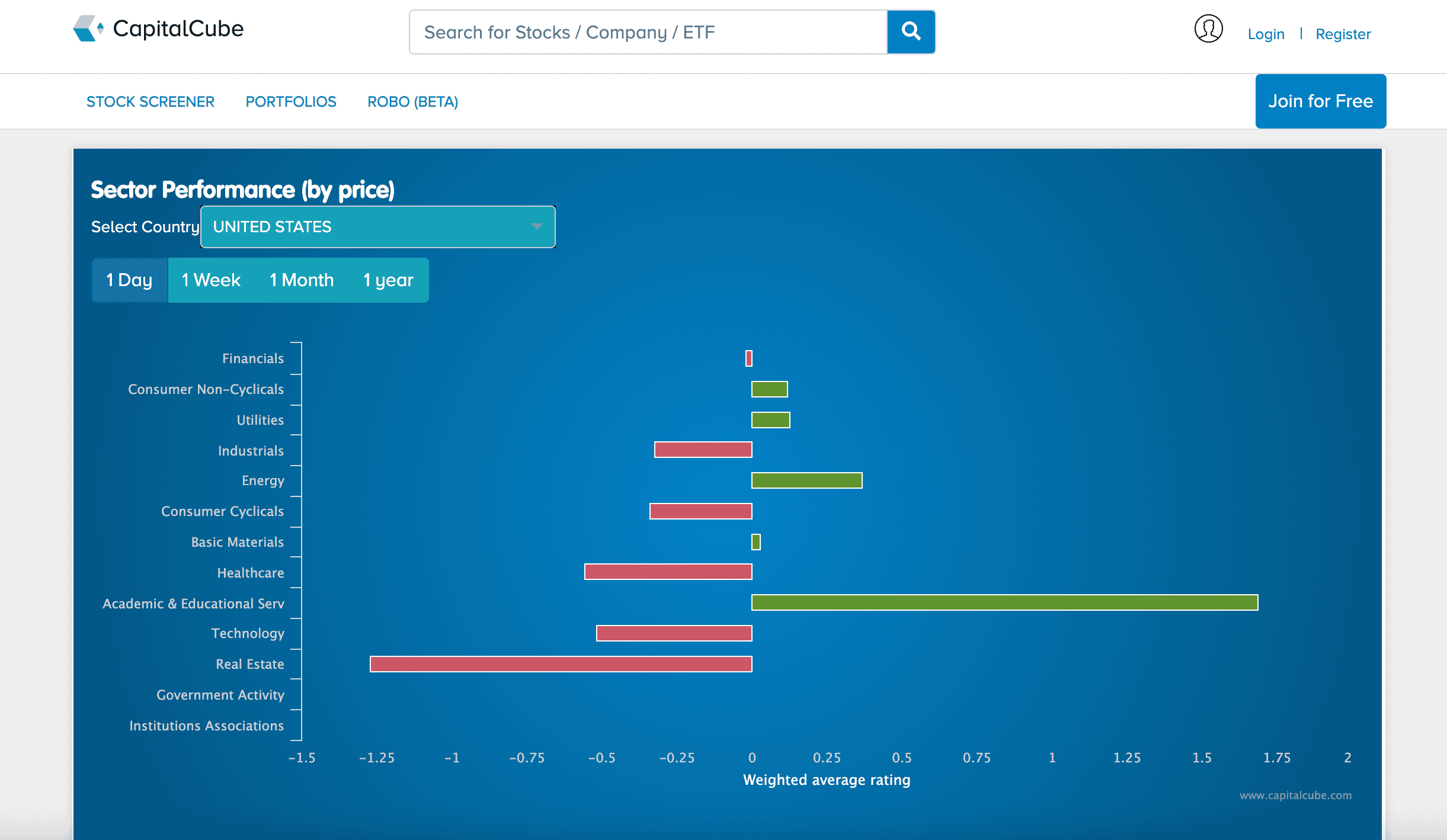

CapitalCube

CapitalCube offers an advanced data analytics platform that specializes in analyzing the financial performance and valuation of publicly traded companies. It uses a combination of machine learning and financial modeling techniques to provide high-level insights, which is particularly useful for automated equity analysis.

Best for

CapitalCube is well-suited for analysts who need to conduct automated fundamental analysis and generate stock ratings and insights based on financial metrics. Its platform can save time on manual analysis by providing ready-to-use models and reports.

Top Features

- Automated Financial Analysis: Leverages machine learning to automate financial analysis and rating generation.

- Valuation Models: Provides pre-built models for valuation, including DCF and multiples-based approaches.

- Comprehensive Metrics: Includes a wide range of metrics for evaluating companies’ financial health and valuation.

Pricing

CapitalCube offers a tiered pricing model starting at around $15,000 annually, depending on the number of users and data access needs.

Conclusion

To go extremely deep into an industry vertical, and learn about a couple of companies extremely well, you need the right equity research tools to help you get there.

Try out any one of these tools to help make your equity research more effective and efficient, so you can generate alpha with data-driven, high-conviction investment decisions.

Contact us today to find out more about how Visualping can help make your equity research more efficient and effective.

Want to uncover leading market signals?

Monitor any web source online, and get notified of market-moving events, with Visualping.

Emily Fenton

Emily is the Product Marketing Manager at Visualping. She has a degree in English Literature and a Masters in Management. When she’s not researching and writing about all things Visualping, she loves exploring new restaurants, playing guitar and petting her cats.